Think Microgrid, a coalition that serves as a unified voice for the microgrid industry, said microgrids can play a critical role in the U.S. energy picture. The organization recently completed a study of microgrid deployment in each state in its State Scorecard 2023. Unfortunately, it found that no state is performing well with microgrid deployment, and the report offers recommended pathways to improvement.

Microgrids are groups of distributed energy resources, such as solar modules on a home, connected to a battery system, that can disconnect from the grid and operate independently during a power outage. The U.S. Department of Energy has a vision that 30% to 50% of electricity generation will come from distributed resources by 2035, with microgrids playing a key role in the transition. However, getting there is not without challenges, as noted in the Think Microgrid study.

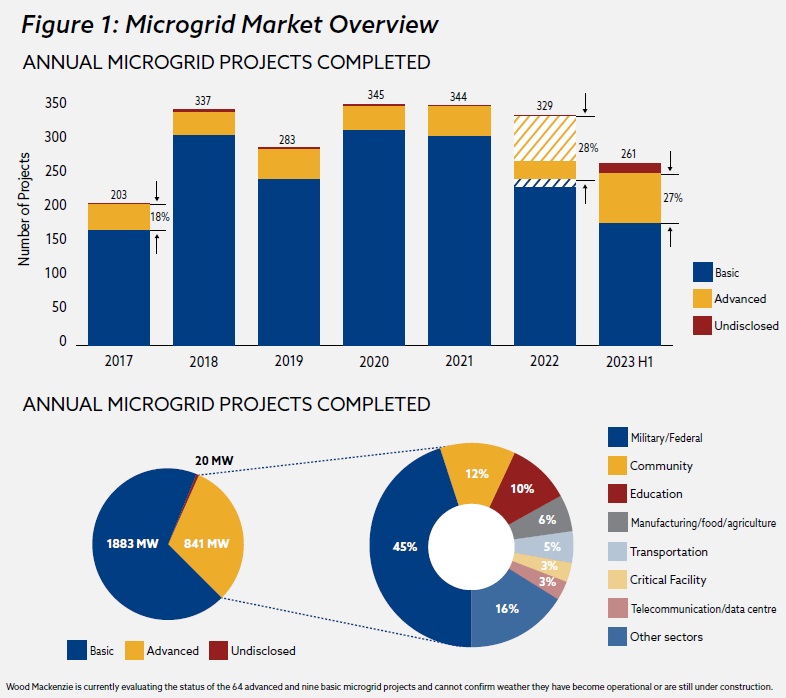

The U.S. microgrid market reached 10 GW in the third quarter of 2022, with more than 7 GW in operation and the rest in planning or construction stages, according to analysis from Wood Mackenzie’s Grid Edge Service.

Think Microgrid gained early insight from an upcoming annual report from Wood Mackenzie, which indicates that annual growth in microgrids is expected to be close to 20%. The drivers include increasing demand for resilience, federal incentives, favorable state policies and expanding corporate commitments to environmental social good (ESG) investment goals.

Wood Mackenzie analysis finds that the most significant barrier to deploying microgrids are state laws that prohibit private or community-owned electric infrastructure across property lines. Secondarily, Wood Mackenzie identifies a lack of tariffs or other market pathways designed for multi-customer microgrids.

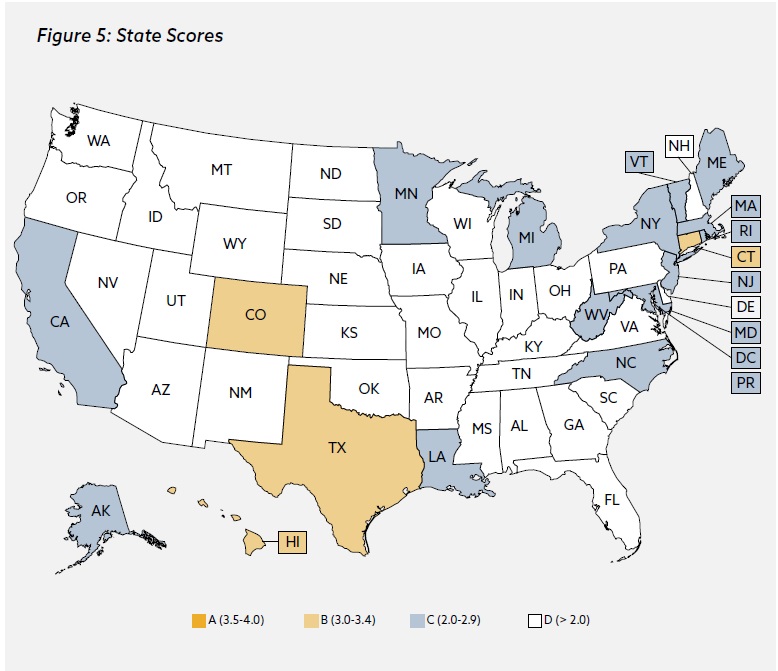

To assess each state, the study considered the policy and market conditions in across five critical dimensions: deployment, regulation, resilience, market access and equity. The result is that only a few states received even a B and many received a C or D.

While some states received an A for activity in specific categories, there is no state that where Think Microgrid believed an overall A is warranted, and this reflects in the policy landscape. While some states have innovated in certain categories, “barriers still inhibit advancement towards commercialization,” according to the report authors.

Deployment

No state earned the highest score; however, Hawaii, Texas, Colo. and Conn. all earned a received B grades for deployment.

Deployment scores are based on overall capacity deployed compared to electricity consumed in that state. Note that a state with high overall capacity and diverse projects deployed scores higher because it indicates a broad range of projects serving various customer and grid needs, according to report authors.

Policy

No state earned the highest score in policy; however, the same four states earned a B.

Think Microgrid looked at microgrid programs and incentives, tariffs to facilitate interconnection and services compensation between microgrids and distribution utilities, as well as reforms to regulatory processes or state law to incentivize or remove barriers to microgrid development. The report indicates that successful microgrid policies support “an ecosystem robustly incorporating private, utility ratepayer, and public sector capital”. What they found was that most state policies including incentives, programs and tariffs support ratepayer-recovered, utility-owned projects.

Resilience

Texas achieved the rare top score for resilience, with Hawaii, Colo. and Conn. each earning a B in this category.

Think Microgrid looked at regulatory activity, legislation, and state planning activities related to electric grid resilience, as well as engaged in collaborative activities with energy regulators and energy offices.

To achieve a high score, state policy activities must include microgrids as a targeted resilience solution.

The authors noted that effective policy allows communities to tailor microgrid configurations to local resilience needs.

Grid services

For grid services, Hawaii earned the lone top score, with Texas earning a B. Colorado and Connecticut were the lowesst in this category.

The report identifies three potential market interfaces with which microgrids can engage to receive compensation for services: wholesale markets, retail tariffs and distribution-level markets. Successful retail tariffs, the authors contend, provide compensation pathways for a range of microgrid services, including: energy exports during periods of excess generation, load-shifting during peak demand periods, resiliency services, and utility distribution investment deferral or non-wires alternatives.

Equity

In the equity category, Colorado and Connecticut rose to the top. Hawaii had th next highest score, with Texas trailing behind.

Community microgrids can provide benefits to all residents, including resilience, clean air, workforce development, and economic development to vulnerable communities, so the report looked at how well the states prioritize such equity. This is accomplished by identifying and/or mapping vulnerable communities and actively seeking to stimulate investment in those areas.

The reports note that states approach equity differently, with some establishing equity laws that provide mandates, carveouts or directives for infrastructure that supports low-income, outage-vulnerable, rural, and tribal community resiliency and economic well-being. Some states offer state or regulator-approved programs that incentivize or fund projects in specific communities. And yet another approach is when state agency programs support communities with funding or technical assistance to capture federal funding for microgrids. The report authors gave high scores to states that take a coordinated approach.

The State Scorecard 2023 scores the states while also identifying practical next steps available at all levels of government and community engagement. The authors recommend that legislators or utilities develop a microgrid roadmap to guide the coordinated efforts between utility commissions, energy offices, and stakeholders. The report also sees an effective roadmap as identifying opportunities where microgrids can address grid vulnerabilities and state public policy goals, and more.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

What’s a possible strategy to dramatically accelerate micro grid development look like? Maybe it’s just lots of solarized (sub)urban parking lots.

We have vast acres of valuable, ridiculously under-utilized (sub)urban land locked up in widely distributed hot asphalt parking lots, located right where most energy is being consumed, at large apartments & condos, neighborhood shopping centers, business parks & public facilities. These large heat islands can easily be shaded with solar canopies +on-site storage batteries +Vehicle-2-Grid chargers, without any new utility transmission, site acquisition, or other site improvement spending.

This is, without a doubt, the most rapidly exploitable strategy to create both widely distributed electric vehicle charging infrastructure & NetZero commercial properties, while simultaneously constructing a matrix of reliable neighborhood micro grids. And all of this can be accomplished by typical (sub)urban leased commercial property investors using IRA investment incentives, with just ordinary local building permits & no neighborhood opposition.