Analysts from Wood Mackenzie Renewables and Power, Xiaojing Sun, Molly B. Cox and Lindsay Cherry, see solar innovation continuing through the 2020s with prices continuing to fall on an even more technologically advanced product.

The analyst’s crystal ball suggests six significant themes (and they’re not all good):

- Lower levelized cost of electricity for projects

- “Solar-plus” applications

- Repowering

- Tariffs and trade tensions

- Supply chain and manufacturing innovation

- Regular and more severe criminal digital intrusions

500-watt modules with 30-year warranties

Module efficiencies will continue to increase, while the price of an individual module will stay the same. Not only will this hardware produce more power, it’ll work far longer — with predictions of 30-year module warranties, roughly the projected lifetime of gas assets.

Image: Vincent Shaw, pv magazine

The first 500-watt solar panels are just starting to hit the market, and the analysts suggest that this power level will be commonplace by mid-decade, while still costing the same as today’s standard 400-watt module, with pricing approaching $80 at 20¢/W.

That translates to a 16¢/W price on a 500-watt solar module – 20% lower than today. Pricing below 20¢/W for modules is expected from MIT and NREL.

Higher efficiencies, lower costs on balance-of-system

The analysts cited some innovations behind the gains in efficiency: “n-type bifacial modules using large wafers with improved hotspot performance and lower light- and temperature-induced degradations.” Sun noted that bifacial solar modules can provide a 5% to 15% bonus in power output with only a 2% to 3% price premium, effectively reducing balance of system cost by 3% to 7%.

With glass-on-glass bifacial modules already having partial 30-year warranties, and researchers investigating whether 50-year lifetimes are possible, how long might a solar field produce? How long might developers be able to squeeze per-kilowatt-hour cost?

Prism Solar - Glass on Glass bifacial

Advanced manufacturing and AI

Polysilicon manufacturer Tongwei, with a solar cell manufacturing roadmap that ramps to a capacity of 100 GW/year, has for years talked up its plans to pull module manufacturers into the fourth-generation of manufacturing — meaning that eventually no human will touch a solar panel until it is pulled from a pallet to be installed.

WoodMac projects that 5G technology, the internet of things and artificial intelligence will drive smart factories making not just cells and modules — but expect polysilicon, inverter and tracker costs to also benefit.

Per the analysis, these factories will weaken or even neutralize the labor cost advantage of some Asian manufacturers.

REC Silicon

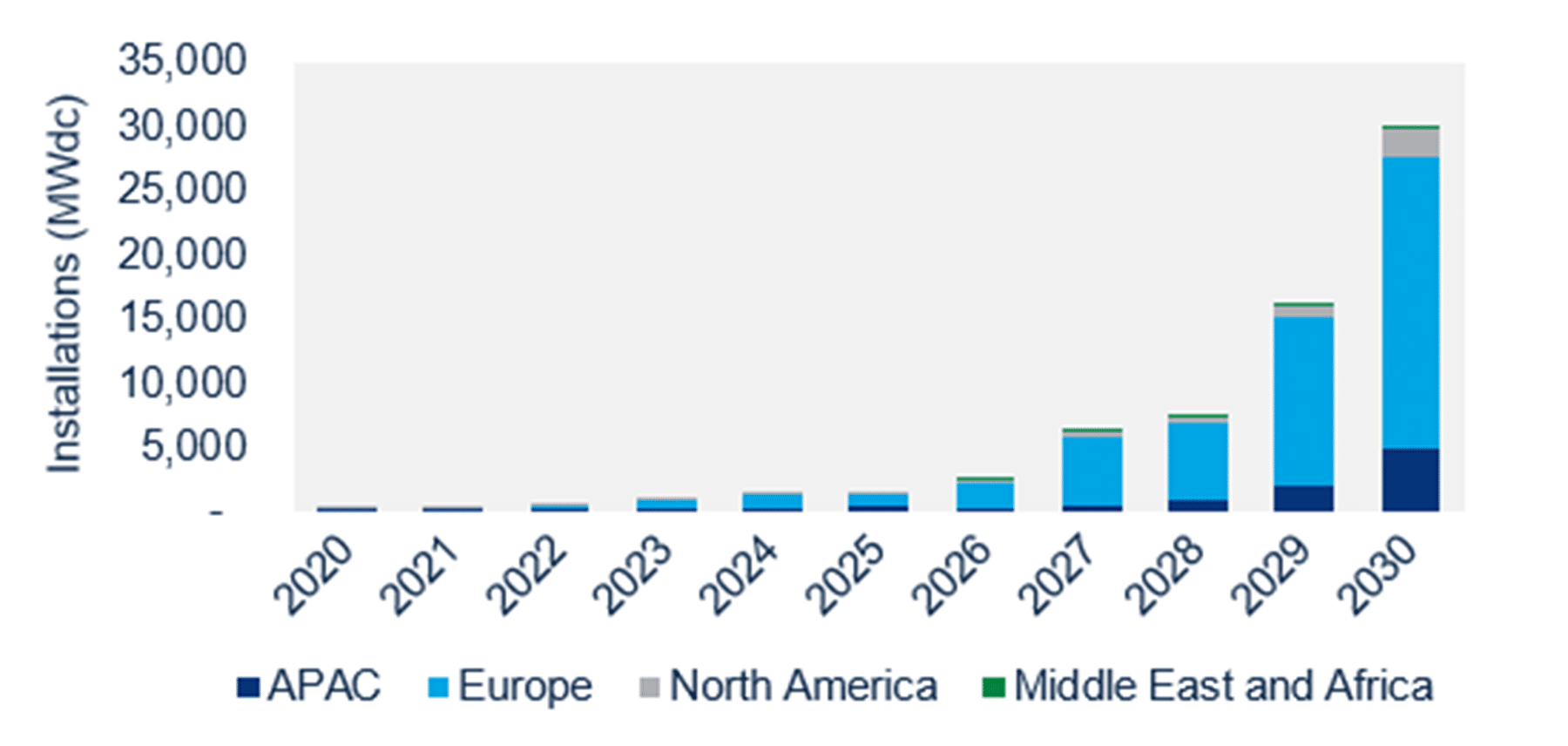

Repowering a solar plant in six years?

The new field of repowering will come on strong, and will be part of the reason we can expect to see continuing price decreases in already existing portfolios.

The repowering of solar systems allows for production of more electricity while using existing land, interconnection points and other infrastructure, leading to a lower LCOE.

NREL told pv magazine that the fall in module prices, coupled with improved power output in the same footprint had resulted in some solar asset owners repowering their facilities within their first decade, while some are doing so after six years.

Considering that some developers sign 25-year land lease agreements, with options for a second 25 years, one could imagine multiple repowering events through a solar field’s lifetime. Though, the 50-year lifetime of a glass-on-glass bifacial solar module is at odds with this logic.

WoodMac suggests up to 67 GW of solar power will be repowered through the end of the decade, equivalent to all the solar power installed in 2016. In 2030, the market is suggested as being 30 GW of the world’s potentially installed 3 TW of solar power. The U.S. is already repowering multiple gigawatts of wind power.

Software will eat the world

The analysts see 5G, internet of things, and AI assisting original plant design, monitoring, as well as repowering design. They suggest, “Intelligent system design, using software powered by data analytics coupled with real-time performance monitoring, will ensure solar systems are designed and operated to maximize energy generation and financial performance.”

Manufacturer NEXTracker has focused very sharply on the software surrounding its single axis trackers, with its TrueCapture technology able to optimize electricity generation on a per site basis amid thousands of variables. Enphase’s IQ8 will allow for off-grid solar power without the need for energy storage by instantly recognizing local load demands and meeting them with available solar-generated electricity. NextEra is mixing solar, wind power, and energy storage into a power plant “secret sauce.” which the world’s largest renewable energy company hopes to lever as a competitive edge.

It won’t all be roses though

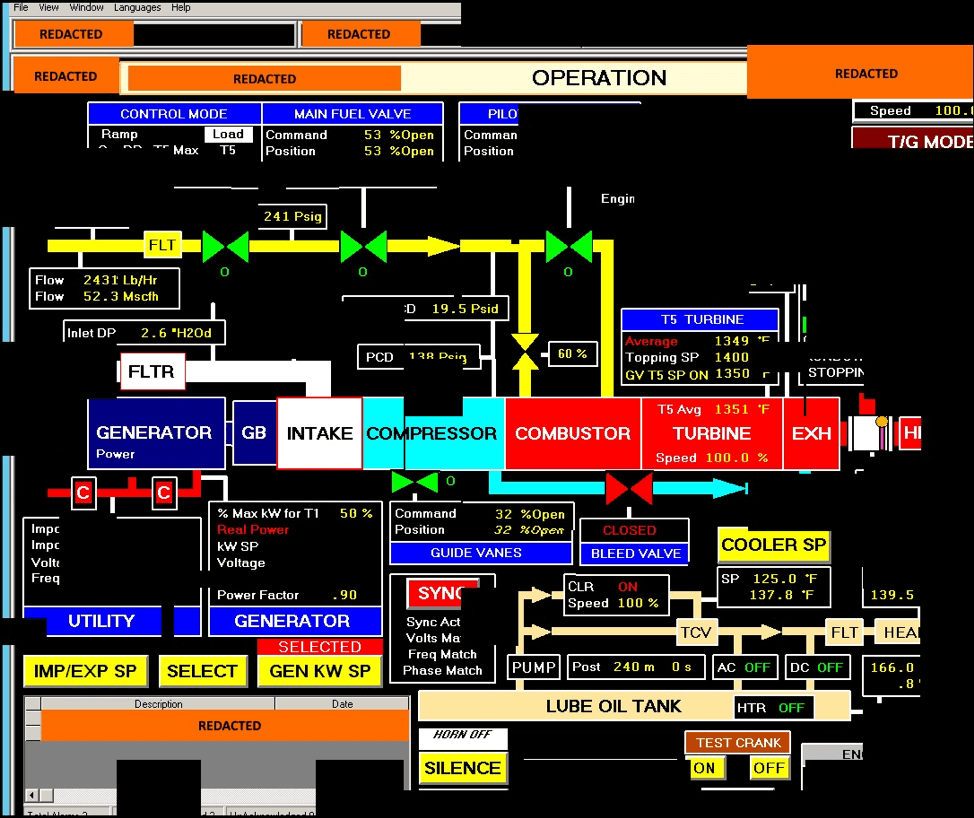

Cyber intrusions will come with connectivity – and, to a degree, it has already begun. WoodMac noted that there are no comprehensive federal cyber security standards for the power industry.

Historically, the power grid has been made with components that don’t communicate with the outside world. Our current vision for the power grid is a more interactive one, that includes grid managers in the control rooms of electric utility taking information directly from residential solar power systems. This will means hundreds of millions of potential entry points for those wishing to cause trouble.

Another way to slow the industry is politics. As the geopolitical importance of renewable energy technologies continues to increase, tensions and trade friction with national security influence will also increase.

If the U.S. were to remove all tariffs on imported solar modules today, system prices would go down by nearly 30%.

Currently, a 20% tariff is applied to all solar modules — with an eye towards China — imported into the U.S. The ongoing coronavirus response is showing another side of new energy’s global vulnerabilities.

Solar-plus

As the 800-pound gorilla in the room of solar-plus-storage has begun to flex its muscles, the solar-plus ecosystem is starting to show itself. A power grid projected to have 80% of its electricity coming from wind-plus-solar will need be coupled with at least 5.4 TWh of energy storage.

With software optimizing design and finance, robots in manufacturing, O&M from the sky, amazing batteries, and NEXTracker and NextEra using machine learning to run plants — efficiency gains will be chased in all sectors.

The result of these innovations is cheaper and more consistent solar power.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

“With glass-on-glass bifacial modules already having partial 30-year warranties, and researchers investigating whether 50-year lifetimes are possible, how long might a solar field produce? How long might developers be able to squeeze per-kilowatt-hour cost?”

Panel sealing technology is tantamount to a 50 year usable power production lifetime. It seems now since the Walmart lawsuits over panel failures and fires, that the industry will have to ferret out poor choices for back side panel sealing using plastics that will not last but a few years until they craze and crack allowing moisture entrainment and early panel failure. Will the bifacial panels be more robust?

“As the 800-pound gorilla in the room of solar-plus-storage has begun to flex its muscles, the solar-plus ecosystem is starting to show itself. A power grid projected to have 80% of its electricity coming from wind-plus-solar will need be coupled with at least 5.4 TWh of energy storage.

When one looks at electrifying Transportation country wide, that 5.4TWh may well become 16TWh to keep the “national” vehicle transportation moving day by day. Micro-grids may make it more efficient overall, but taking almost 40% of the entire energy used for transportation and making it electric will require a lot more generation with energy storage online to keep things moving.

“Currently, a 20% tariff is applied to all solar modules — with an eye towards China — imported into the U.S. The ongoing coronavirus response is showing another side of new energy’s global vulnerabilities.”

Interesting examples of how an “unhealthy” workforce is more dire than a tariff driven trade war for the supply/demand stream of products. When one “talks” of (National Security), what does it mean when a virus in one country can create product shortages affecting many counties economies around the World?