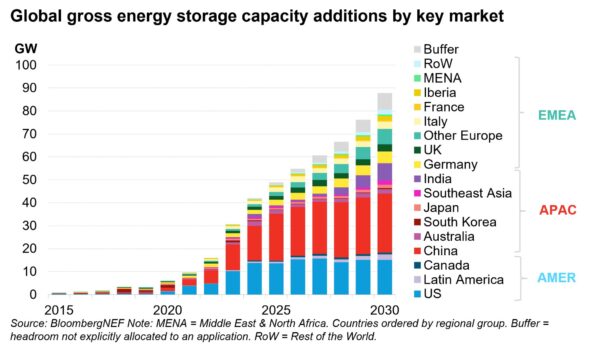

Energy storage deployments reached a new high in 2022, with 16 GW/35 GWh of new capacity projects added, up 68% from 2021, according to a report by BloombergNEF. The energy storage market is growing at a strong 23% compound annual growth rate, with annual additions projected to reach 88GW/278GWh in 2030, or 5.3 times the expected 2022 level for new installations, according to BNEF’s 1H23 energy storage outlook.

Multiple markets announced energy storage targets totaling over 130 GW by 2030. BNEF is cautious about the impact of these targets on its total forecast demand due to the lack of policy clarity and reforms. Government entities across the world have also approved millions in subsidies for storage development. These subsidies boost deployment, but highlight the underlying challenge that batteries are not yet economically attractive in most parts of the world.

China is forecast to overtake the U.S. as the largest energy storage market in megawatt terms by 2030, according to BNEF. The research group at BNEF, which consists of 19 analysts, increased its China cumulative 2030 capacity forecast by 66% to account for new provincial energy storage targets, power market reforms and industry expectations supporting significant new capacity.

In contrast, project delays continue to stymy U.S. storage deployments, based on 7.2 GW/18.4 GWh of utility-scale storage projects that were delayed in 2022 due to rising battery costs and supply-chain disruption. Despite delays, utilities continue to procure more solar and storage to displace conventional thermal assets and meet system capacity needs, according to the report.

The Americas region represents 21% of annual energy storage capacity on a GW basis by 2030. The U.S. is by far the largest market within the region, led by a pipeline of large-scale projects in California, the Southwest and Texas, the report notes.

Image: BloombergNEF

Despite project delays, a handful of long-duration storage projects have gained traction. Market reforms in Chile could pave the way for larger energy storage additions in Latin America’s nascent energy storage market. Rapidly increasing volumes of solar and wind across Chile and Brazil and underinvestment in the grid in Mexico could provide opportunities for storage, BNEF reports.

The Europe, Middle East and Africa (EMEA) region added 4.5 GW/7.1 GWh of new storage assets in 2022. Residential batteries led installations in the region, a trend that is expected to remain until 2025, as high retail electricity prices and government incentive programs in Europe support household deployments.

LFP expansion

High energy storage system costs have incentivized companies to accelerate the move toward lower-cost chemistries such as lithium iron phosphate (LFP). More Chinese battery makers are expanding LFP products overseas, BloombergNEF expects China’s share to continue growing globally until 2026 due to its lower cost, longer cycle life, and manufacturing scale.

After 2027, sodium-ion batteries may become more popular for energy storage system demand growth, the report said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.