Executives of the Indiana utility NIPSCO had assumed that “natural-gas generation would be the most cost-effective option” for new generation, but were surprised when solar and wind bids for their all-source procurement showed both to be “significantly less expensive than new gas-fired generation,” said Mike Hooper, NIPSCO senior vice president, in a webinar.

And the Colorado utility Xcel Energy found that its least-cost mix of generation resources, reflecting low renewables bids from an all-source procurement, selected “quite a bit of renewable energy instead of gas,” said Solar Program Director Bryan Jacob of the Southern Alliance for Clean Energy (SACE) in an interview.

“The end result” of all-source procurements, Jacob said, “is cleaner utility portfolios and savings for customers.”

Other utilities can “replicate these results” by using all-source procurements, says a report prepared by the consultancy Energy Innovation and SACE.

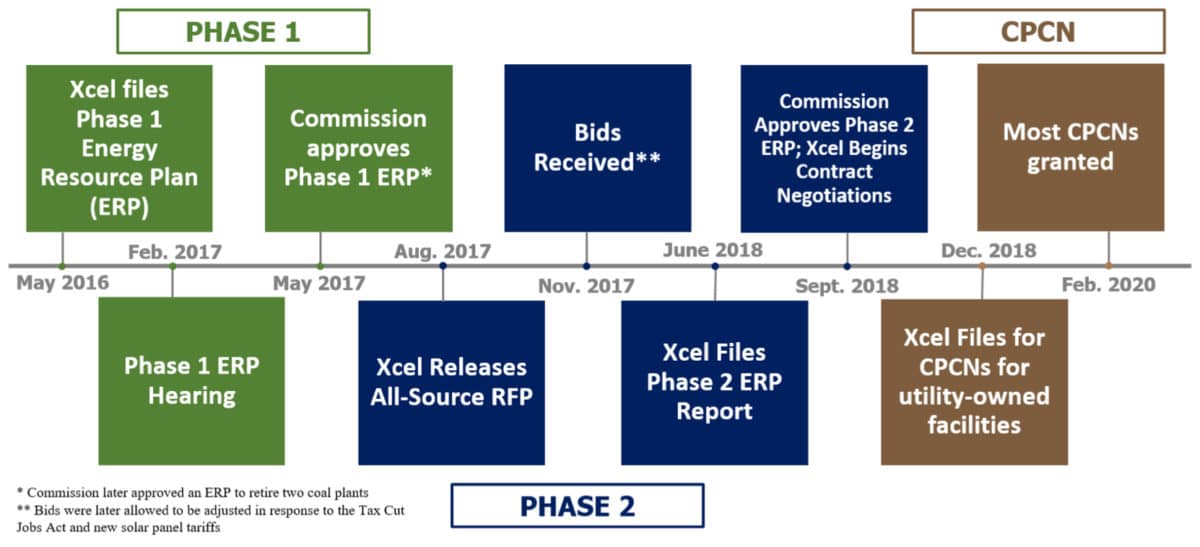

State regulators can require such procurements for vertically integrated utilities, the report says, ideally staying close to the process developed by Colorado regulators (illustrated in the image above), as that process “successfully motivated both the utility and potential bidders to engage in a competitive market process.”

“Roughly half of U.S. electricity load is served by vertically integrated utilities,” the report notes.

Southeast and beyond

SACE, which focuses on utilities in the Southeast, believes that state regulatory commissions across the region “already have the authority to require the utilities they regulate to utilize all-source procurement approaches, but they don’t presently have a legislative mandate to do so,” Jacob said in an interview. “Emphasizing to state lawmakers how these aspects of competition benefit ratepayers and the public interest is key to advancing the adoption of this approach among Southeast utilities,” he said.

The North Carolina Clean Energy Business Alliance, whose members include local and national solar firms, supports all-source procurement, said spokesperson Adam Foodman. “If we are provided an opportunity to participate in the procurement of generation resources in a fair environment,” he said, “that is going to benefit ratepayers and it’s going to benefit the state broadly, with less risk to ratepayers, and with environmental and carbon benefits.” He added that with a bid process, “private companies are bearing the risk of that very competitive environment, as opposed to ratepayers bearing the risk.”

From the perspective of solar developer Pine Gate Renewables, “where you don’t have good PURPA implementation,” said Steven Levitas, the firm’s senior vice president for strategic initiatives, “and you haven’t had competition, we’re for all-source procurements to open up the market. In places where there has been good PURPA implementation, we’ve been willing to support all-source procurement as an alternative.” PURPA is the federal law requiring utilities to purchase power from independent power producers.

All-source procurement is a near-term option for utilities in Arizona, Georgia, Kansas, Missouri, and New Mexico, which are in the process of selecting new generation or replacing existing assets, said Silvio Marcacci, communications director for Energy Innovation.

Recommendations

The report makes five detailed recommendations, based on case studies of vertically integrated utilities across the country.

Prior to an all-source procurement, the authors say that regulators should make a determination of the load forecast that must be met, and oversee the terms of the procurement, including contract terms for winning bidders. Utilities should not use procurement and contract terms to box out competition in favor of utility-owned gas units, they say.

The report includes a model bid evaluation process, and a caution that “complex bid evaluation processes can create opportunities for bias.”

Following an all-source procurement, the utility would follow the usual process of using a resource planning model that can find the least-cost resource mix. “Utility resource planning models appear to be capable of simultaneously evaluating multiple technologies against each other,” says the report.

In Xcel’s case, the utility is optimizing across three categories of resources: dispatchable resources, renewable resources, and semi-dispatchable renewable resources.

Bias toward gas

“Many utilities are in a rush to acquire new natural gas-fired capacity, and clinging onto coal-fired generation” rather than reducing costs and environmental impacts by “embracing clean alternatives,” say the report’s authors.

After examining ten utility procurements, they found “utility preferences for gas-fueled generation” that “may be at odds with economics, but are not surprising.” Utilities owned and operated about 1,900 gas units as of 2018, the authors found, and utilities’ preference for gas-fueled plants may be related to biases towards over-procurement of capacity and self-built generation, and “an organizational culture and rate design that favor gas-fueled generation.”

Also, “while utilities have generally acknowledged the value of grid services,” they said, “those values may not be recognized for new technologies in the same way that they are taken for granted from gas-fueled generation.”

Apparent bias toward gas was a factor last year as at least seven utilities used their resource plans to block solar power. Another factor was the use of high federal projections for solar costs—a problem that all-source bidding would overcome, by using actual solar bids.

Many bids, or few

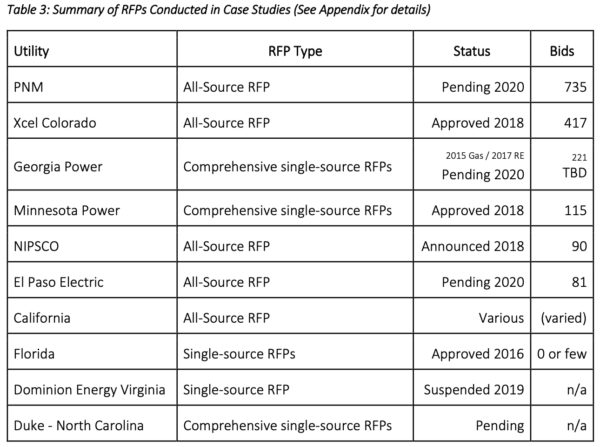

All-source procurements can yield hundreds of bids, as shown in the last column of the following table; the report discusses each of the ten utility procurements shown.

Webinar

The report’s authors are offering a webinar to discuss their findings on Thursday, April 30.

The report is titled “Making the most of the power plant market: Best practices for all-source electric generation procurement.” The ten case studies are presented in an appendix. The authors are John D. Wilson, Mike O’Boyle, Ron Lehr and Mark Detsky.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This sounds like the path to a flurry of distributed energy storage facilities and soon after, a flurry of natural gas and coal fired decommissioning’s with attendant “stranded asset” rate cases. This will drive the “case study” that probably the best “mix” is wind, solar PV and at one time or another large scale energy storage may be waiting to serve grid demands just like old fueled generation assets used to. IF the epiphany of large scale multi-hour energy storage being made available finally sinks in with the rote utilities, they will finally find the “operation” shift of the grid from fueled “spinning reserve” or “spinning demand” generation is not needed. When one can charge up a utility sized battery to handle 12 to 100 hours of energy storage, burning fuel and sitting idle waiting for a grid demand puts the resource from “spinning” to dispatchable. Old baseload generation like geothermal or most likely nuclear, could use this very large energy storage facility to keep the plant’s running at the most efficient generation point all of the time.

I really do get the “cost effectiveness” of an asset. There’s still too much rote, energy storage cost is just not there yet. The (ones) who adopt the technology early, gain the ability to not waste non-fueled generation but store it, gain the ability to use online generation more effectively or replace it with energy storage all together. Utilities make decisions every day that sometimes cost them greatly. Like keeping old gas fired generation online “for a few years more”, ends up costing their ratepayers much more, when the utility has a practice of buying multi year natural gas futures contracts in an “attempt” to stabilize electricity rates. IF the price of natural gas falls precipitously, the utility and therefore the ratepayer gets to pay more for electricity than they should.

The “practice” of “penciling out” energy storage is the paradigm these electric utilities need to overcome. Perhaps the ‘other’ question(s) should be, what do I “pencil in” to the energy storage equation that adds value and efficiency to any operation that would use an energy storage asset. I believe the Hornsdale wind farm in Australia has shown the World what an energy storage asset is truly worth, compared to running natural gas Peaker plants or continuing to operate natural gas fired heat exchange or coal fired heat exchange generation plants in the “spinning reserve” or “spinning demand” mode of wasteful operation. The very last thing any electric utility should use to meet grid demands is a fueled generation resource, (the very last resort).

It’s time to dive into analytics and systems modelling to get a handle on how much and where a distributed energy storage facility should be constructed along a particular grid infrastructure. Would it be better to have a 2GW redox energy storage facility off of an existing nuclear plant running at optimum efficiency 24/7 or is it better to distribute this 2GW of energy storage along the grid in several MW energy storage facilities?

Utilities need to get used to parameters of where, when, what energy storage technology is to be used and under what “program” to relegate the cost of construction of such facilities. Government low interest loan, grant programs, bond sales, stock offerings, at some time, smaller energy storage facilities could come about under a Capital Improvements Program (CIP).