During the summer of 2019, South Dakota electric utility Black Hills Energy conducted a targeted competitive request for proposals (RFP) for replacement solar and solar with storage projects – resulting in 133 bids and a median price of solar power at 2.4¢/kWh and solar plus storage of 3.63¢/kWh.

Now the utility notes, in a new RFP (pdf), that the surprise of these values, combined with the pending step down of the 30% investment tax credit (ITC), is driving them to seek this new capacity. The power company noted they’ve got no,

immediate need for new capacity to meet load requirements, nor does it have a need for new energy to meet the State’s RES requirements. Renewable Advantage is thus solely focused on whether the opportunistic window represented by the recent PSCo competitive solicitation and the phase-out of tax credits will permit Black Hills to significantly increase renewable and storage resources with savings to customers.

Short version – it’s all about the Benjamins. The utility states that if the bids don’t save their customers money, then they will not proceed with the procurement.

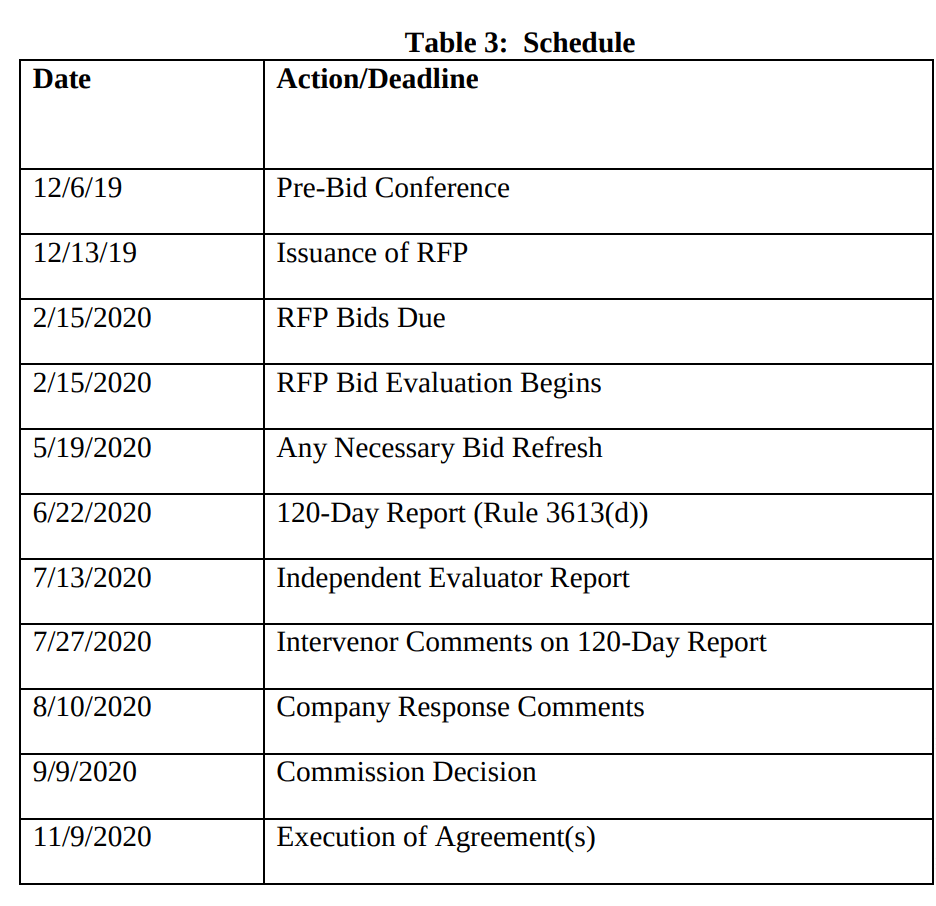

The competitive bidding process will accept four types of bids – power purchase agreements, build-transfer arrangement, power purchase agreements that include a future sale to Black Hills Energy, or – drum roll please – utility self-build. The bids are due by February 15, 2020 (above image), with projects expected to be approved by the end of 2020 and interconnected to the power grid before the end of 2022.

Due to the intermittent natures of solar and wind, the utility will give “effective load carrying capacity” (ELCC) of 23% and 19% (below image left), respectively. Adding energy storage will increase the ELCC (below image right).

The example language the company gave explained how a battery will increase the ELCC of a solar or wind facility:

For example, a 100 MW 8-hour storage device would receive a 95 MW capacity credit. If it were paired with a 100 MW solar facility, the solar facility would receive a 23 MW capacity credit. The combined capacity credit would be 118 MW. However, since that amount is greater than the eligible energy resource nameplate capacity, the capacity credit will be reduced to 100 MW.

The combination of this information leads pv magazine USA to believe the volumes of solar power installed could be up to five times larger, if no energy storage would be included, but in fact will be scaled back as the developers run their economic models to feather in financially viable volumes of energy storage.

If the projects go through, this will bring the utility to approximately 60% CO2 free electricity in their southern Colorado generation portfolio in 2023. The recently added 60-MW Busch Ranch II wind project brought the group to 30% renewables, fulfilling the requirements of Colorado’s renewable energy mandates.

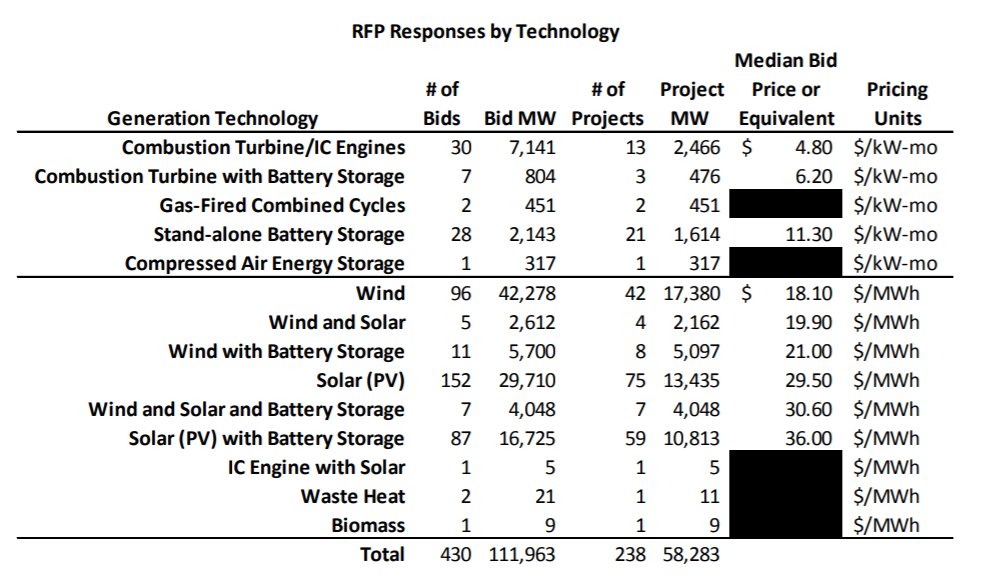

This whole RFP reminds me of the groundbreaking Colorado bids from almost two years ago now. We saw wind bids turn into wind plus battery storage bids with an increase from 1.81¢/kWh to 2.1¢/kWh – less than 0.3¢/kWh (that’s less than a third of a penny per kWh!) to add energy storage. The solar alone saw an increase from 2.95¢/kWh to 3.6¢/kWh – 0.65¢/kWh to add storage.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Definitely good. From their website it appears that Black Hills Corp (parent of Black Hills Energy) supplies electricity to four states: Colorado, Wyoming, South Dakota and Montana. Hopefully these prices will have the other three states following the cheap RE electricity generation.

Interesting, “The combination of this information leads pv magazine USA to believe the volumes of solar power installed could be up to five times larger, if no energy storage would be included, but in fact will be scaled back as the developers run their economic models to feather in financially viable volumes of energy storage.”

The recent installation of the TESLA energy storage system across the Neoen wind farm in Australia has provided some specific information about that ‘particular’ sites cost and value return for the asset. The French bank that loaned the money for the energy storage project says, they loaned $66 million for the battery. Within the first two years of operation the Energy storage system has provided $50 million in stacked ancillary services to the grid. It will be paid for before another year of service. The real test will be when some utility pulls the trigger on a solar PV and or wind generation facility with a GW or GWs of energy storage is built. With the touted economies of size model in effect, it will show what alternative energy non-fueled generation with large energy storage facilities, that can store enough energy to make intermittent generation into dispatchable generation and the adder is being able to stage on power cubes in say 10MWh blocks with the added value of almost instantaneous reaction to the demands on the grid.

Let’s face it, non-fueled generation with energy storage is superior to commodity fueled generation with the intrinsic heat and mechanical losses of the total power input into the system.

$6.5/MWh extra for storage is a far cry from above $100 estimate by NEF (Bloomberg).

Those are different numbers. The $100 kWh/ from Bloomberg in a couple of years is the cost for the hardware, whereas the $6.5/MWh is the cost of the electricity from a system with a certain amount hardware added.

Would be nice to have more data on how many storage cycles per year those pv + storage utilities are calculating.