New Use Energy introduces ruggedized 16 lb. portable solar battery bank

The battery bank contains a 550 Wh LFP battery and a 600 W pure sine wave inverter.

People on the move: Vesper Energy, Bloom Energy, ESS Tech and more

Job moves in solar, storage, cleantech, utilities and energy transition finance.

Trump: “We will not approve wind or farmer destroying solar”

U.S. President Donald Trump took to social media to express an anti-solar and wind energy stance. The President has made a series of actions to slow the growth of renewable energy in the United States, but it is expected to remain the dominant source of new-build electric generation capacity.

GreenLancer expands residential solar repair and “orphaned” system services nationwide

The company said it can repair, maintain and activate “orphaned” systems installed by businesses that are no longer operating.

Schneider Electric acquires home electrification software platform WattBuy

Schneider Electric is expected to merge WattBuy’s capabilities with its subsidiaries EnergySage and Qmerit to deliver an end-to-end customer experience for residential solar, EV integration, home electrification and more.

Anker Solix launches C1000 Gen 2, billed as the world’s fastest charging power station

The new portable power station can output a max of 2000 W with a 1024Wh capacity, and charge to full in 49 minutes.

FlexGen completes Powin acquisition, expands its battery fleet to more than 25 GWh

FlexGen’s acquisition of Powin marks a major shake-up in the US battery storage industry, as market leaders face financial pressure, policy uncertainty, and shifting supply chain dynamics. Meanwhile, long-duration storage player ESS Inc. fights for survival amid early signs of commercial traction.

Solar tax credit cliff tightens project deadlines

U.S. project developers face a shrinking timeline as federal investment and production tax credits are set to end early, and new import restrictions target Chinese components.

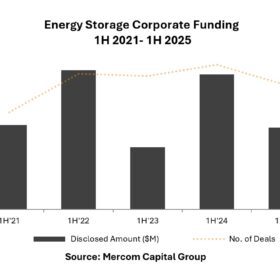

Energy storage finance fell 41%, year-to-June, despite rebound in project deals

Political uncertainty and new trade tariffs have been cited by Mercom Capital Group as dampening activity.

Turbulent times for U.S. energy storage

The OBBBA kills many of the provisions in the U.S. Inflation Reduction Act that were most impactful for the energy storage industry, and while no one is fully sure what comes next, many are bracing for turbulence, as Phoebe Skok reports.