VPP pilot programs have run for years in the United States. The market is maturing as the technology competes with centralized utility scale power plants as a low-cost alternative with benefits to the grid and end-users alike.

A VPP is a virtual aggregation of small-scale, distributed energy resources (DERs) including PV, energy storage, electric vehicle chargers, and demand-responsive devices such as water heaters, thermostats, and appliances. VPP technology has shown immediate promise in replacing natural gas “peaker plants” on grids, offering additional capacity during times of peak electricity demand.

Over the last decade, the US has spent more than $120 billion on 100 GW of new generation capacity, mainly for resource adequacy. A study by Boston-based consultancy Brattle Group estimates utilities could save $35 billion by 2033 by focusing on VPPs for peaker capacity.

“By deploying grid assets more efficiently, an aggregation of distributed resources lowers the cost of power for everybody, especially VPP participants,” says Jigar Shah, the director of the US Department of Energy (DoE) Loans Programs Office.

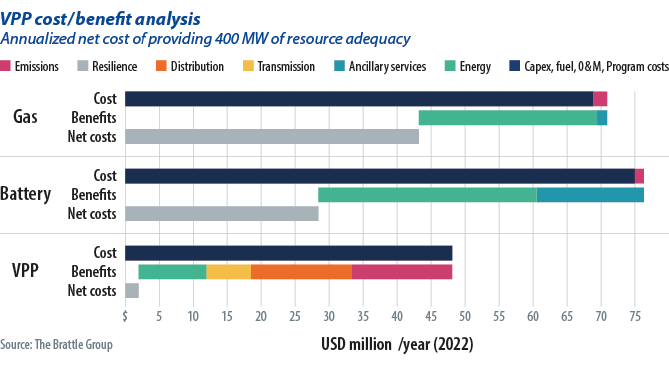

Brattle Group’s 400 MW resource adequacy study considered a utility with 1.7 million residential customers. The power company had 5.7 GW of gross peak demand and 3.6 GW of net peak demand from solar and wind resources. Its aim was to generate half its electricity from renewables by 2030. The study found VPP peaker usage would be 40% to 60% cheaper than alternatives, including gas peakers and grid-scale batteries.

Brattle Group estimated 60 GW of VPP deployment could meet US resource adequacy needs through 2033 for $15 billion to $35 billion less than the cost of alternatives. That level of VPP deployment could also provide more than $20 billion worth of emissions and resilience benefits over the decade.

“VPPs do more than provide decarbonization and grid services – they increasingly give grid operators a large scale and utility grade alternative to new generation and system buildout, through automated efficiency, capacity support, and non-wire alternatives,” says Shah.

Project Hestia

The DoE Loan Programs Office has supported VPPs, recently proposing a $3 billion conditional loan to energy-as-a-service provider Sunnova to roll out its “Project Hestia” nationwide. The plan aims to increase solar and VPP service access for disadvantaged communities that could otherwise be unable to secure residential solar loans. Sunnova will receive indirect, partially guaranteed cash flows for loans backing customer accounts.

Eligible households must use Sunnova’s energy management system, accessible via smartphones or other electronic devices. The system will recommend demand response behavior, enabling customers to reduce energy costs while helping balance the grid during peak demand.

If issued, the DoE package would support loan origination for solar, storage, and other Sunnova adaptive home technology with VPP capability. The guarantees could drive up to $5 billion in loan originations, saving on interest and reducing the weighted average cost of capital.

“Project Hestia would make possible a historic private sector investment in disadvantaged American communities and energy infrastructure,” says Sunnova CEO William J. Berger.

Market tailwinds

Shifting US market conditions are further driving VPP adoption. The $369 billion of climate and energy spending in the Inflation Reduction Act includes many requirements for serving energy communities: disadvantaged communities crucial to an equitable energy transition. Projects in designated energy communities are eligible for an additional 10% investment tax credit, supplementing the 30% base credit for renewables projects.

Other states are beginning to follow California in trimming back or removing net energy metering (NEM), a rate mechanism instrumental in launching the US residential solar market. Older NEM rates offered customers the full retail value for every kilowatt-hour of electricity fed to the grid. California’s NEM 3.0 rate essentially kills the value of exported energy and other states will follow suit. Solar installers have warned this could prompt a market based on self-consumption from batteries, with resulting grid defection doing little to help network flexibility. VPPs, however, offer grid services including demand response, peak demand shaving, and more. Customers can be incentivized to trim energy use or export power during peak grid hours, making for a nimbler network.

Resilience

VPPs also reinforce grid resilience in zones affected by climate change-related extreme weather. Residential solar installer Sunrun has been selected to deploy a 17 MW network of solar-plus-storage VPPs in Puerto Rico.

In the wake of 2017’s Hurricane Maria, the Caribbean island’s government created a framework for DERs with 2019’s Puerto Rico Energy Public Policy Act.

Sunrun will enroll Puerto Rican customers this year to begin VPP operation next year. The company says customers will bank power cost savings and be compensated for offering battery storage capacity to the grid now run by US-Canadian joint venture LUMA Energy. The 10-year VPP program enables customers to opt out, Sunrun says.

“We’re solving energy insecurity on the island by switching the model so that solar energy is generated on rooftops and stored in batteries to power each home and then shared with neighbors, creating a clean, shared-energy economy,” says Sunrun CEO Mary Powell.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I live in CA and had a Tesla rooftop PV system installed along with a Powerwall battery. Not only do I enjoy market rate return when I dump excess energy into the grid as well as an enormously reduced utility bill, I have the added peace of mind knowing I can run my household (and charge my car) in the event of a grid failure. Instead of supporting the rooftop solar industry that he previously championed, Governor Newsom has tossed in with the behemoths of centralized energy generation/distribution — PG&E, SoCal Edison, and San Diego Gas & Electric — by signing off on Net Metering 3.0. With the stroke of his pen, he diminished the return new potential rooftop owners might earn selling excess energy to their utility by 75%. If not an industry killer, it at least takes away an important incentive to go solar.

Instead, the governor and the legislature (under his thumb it would seem) are enfeebling CEQA protections to fast track the construction of giant battery energy storage systems (BESS) and siting them anywhere there is a substation. These could be virtually next door to residential areas, historic structures and landmarks, schools, in designated scenic corridors, near earthquake faults and airports, even wetlands and culturally sensitive areas, etc. You get the picture — not only inappropriate but outright dangerous and financially wasteful. There is questionable intent here beyond the appealing claim BESS facilities are a necessary technology paving the way for renewable energy. Clearly, VPPs are a proven concept that could be saving CA not just money but the conflict that is building throughout the state as a result of state government’s bullying behavior and poor decision-making.

While there is a definition of VPP, it is unclear:

“A VPP is a virtual aggregation of small-scale, distributed energy resources (DERs) including PV, energy storage, electric vehicle chargers, and demand-responsive devices such as water heaters, thermostats, and appliances. VPP technology has shown immediate promise in replacing natural gas “peaker plants” on grids, offering additional capacity during times of peak electricity demand.”

How can an electric vehicle charger be a VPP? If it is interruptible, like water heaters? If it is 2-way as Volkswagen, Ford and a few other manufacturers are beginning to develop?