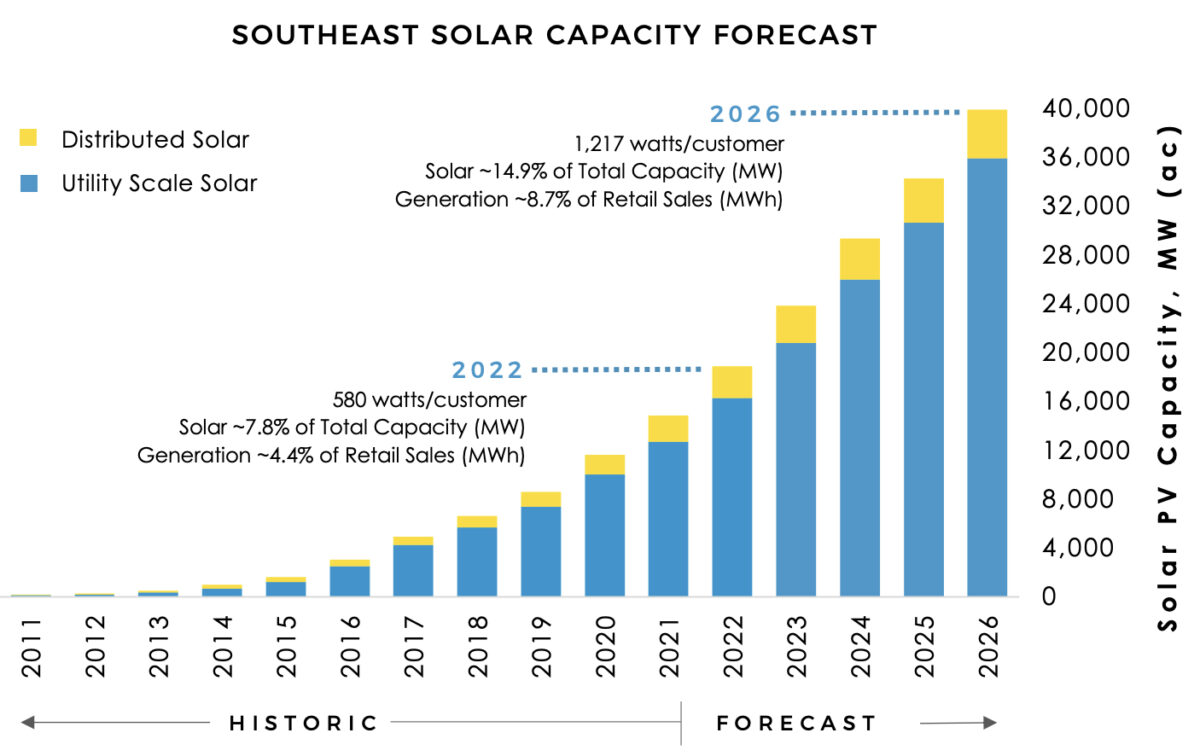

The seven-state Southeast region now has 18 GW of operating solar, providing 4.4% of generation, and is projected to reach almost 40 GW of solar by 2026. Three states in the region are projected to reach solar generation of 9% to 13% by 2026.

The Southern Alliance for Clean Energy (SACE) presented the data in its “Solar in the Southeast” report and an associated webinar.

The Southeast is almost level with the 4.7% solar generation for the U.S. as a whole, as reported by the U.S. Department of Energy. Utility-scale solar in the Southeast, both historic and forecasted, is shown in blue on the chart below, and dominates distributed solar, shown in yellow.

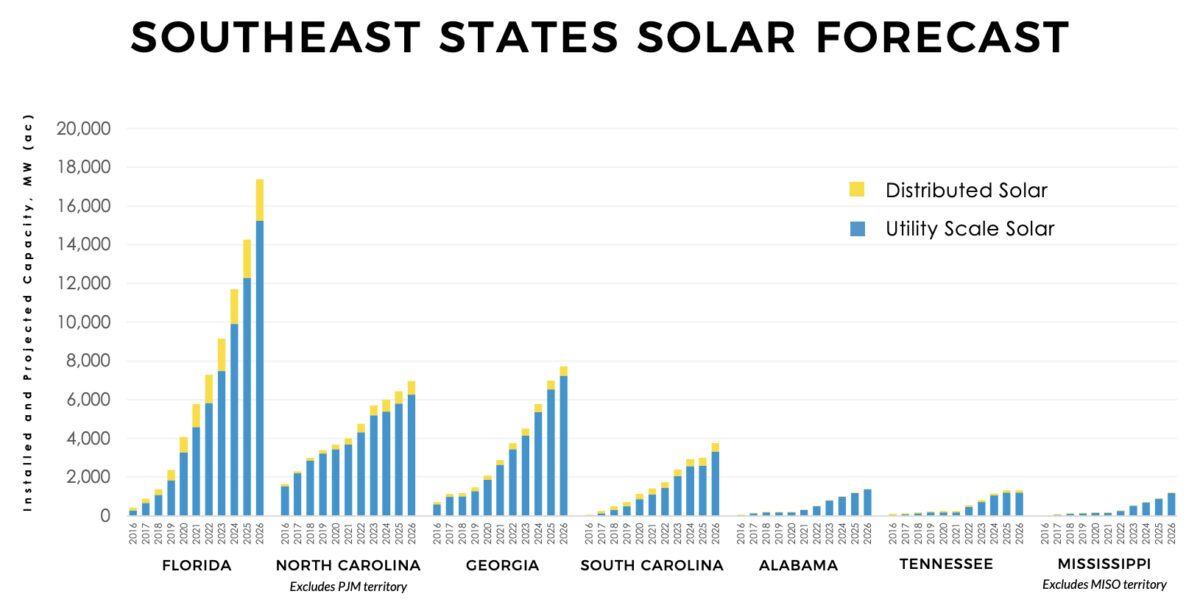

The seven-state region covered by the report consists of Tennessee, North Carolina, South Carolina, Mississippi, Alabama, Georgia and Florida.

Florida leads

Florida, South Carolina, and North Carolina are projected to reach solar generation of 13%, 10% and 9% by 2026, respectively. The growth trends and forecasts for all states are shown in the image below.

Florida’s sharp solar growth trend reflects the “Real Zero” plan of Florida utility FPL and its parent company NextEra Energy, said SACE Executive Director Stephen Smith on the webinar. FPL has “put on the table” 93 GW of solar by 2045, Smith said, representing “the most ambitious commitment to solar of any utility in our region, and we think in the country.” That plan “has completely changed what everybody thinks is possible, and I think it is going to become the norm” for solar.

The region’s best market for distributed solar is also Florida, because the state still has net metering, said SACE Solar Program Director Bryan Jacob on the webinar. Other Southeastern states do not have net metering, or at least not “true” net metering, he said. Duke Energy is instituting netting for solar customers within time of use periods, he noted, while Alabama Power “charges a penalty” to customers with solar.

“Net metering is the right policy mechanism to drive distributed solar in its infancy,” Jacob said. Countering a “cost shift” argument that says distributed solar increases costs for non-solar customers, Jacob said that won’t become an issue until “we get around 10%” solar generation, referencing a Berkeley Lab study.

Jacob said federal policies under the Inflation Reduction Act (IRA) had “turbocharged” the Southeast’s solar progress, as some utilities have already reflected the IRA’s tax credits for renewables in their resource plans, and others would do the same. Jacob said the IRA’s New ERA program, which provides the equivalent of renewable tax credits to nonprofit rural electric co-operatives, “could be the most transformational program for rural America since the Rural Electrification Act in 1936.”

Not keeping pace

Still, some Southeastern states “are not keeping pace,” said Jacob, pointing to Alabama, Tennessee, and Mississippi.

Smith explained that several Southeast utilities are not yet considering solar “as a workhorse resource.” When solar is combined with storage, “the numbers are absolutely in the money for solar going forward,” he said. “This is where planning is so important,” he said, noting that some utilities are planning to build peaking gas plants and use “assumptions around that,” or are pursuing small modular reactors. Once early investments are made in such technologies, “it’s really hard to claw some of those decisions back,” he said.

“They’re making the wrong bets,” Smith said. “We saw it with [Georgia’s nuclear plant] Vogtle, we’re going to see it again with TVA and their small modular reactors,” and with utilities that “are still building gas plants, even though we know we’ve got to move away from fossil gas. And until those utilities have that shift in leadership thinking, and properly plan, they’re going to continue to miss the mark, and customers are ultimately going to suffer.”

Jacob said customers would suffer “because the utility commissions tend to let the utilities get rate recovery for their mistakes. They’re basically making those big bets with other people’s money.”

Smith challenged the “inappropriate” planning process of Tennessee’s federal utility TVA, saying that TVA does not follow the standard practice for integrated resource plans (IRPs) of allowing outside parties to challenge planning assumptions and submit expert testimony. Instead, TVA is “self-selecting a very narrow group of players” to participate, he said, and “most of the folks that serve on the IRP review group for TVA are not technically able to deal with the detail associated with the planning assumptions.”

Looking ahead

SACE Research Director Maggie Shober said on the webinar that in the coming year Duke Energy will file its first IRPs for North Carolina and South Carolina to be aligned with the utility’s carbon plan. Shober added that transmission planning initiatives, which could enable interconnection of more solar to the grid, are being conducted by Duke Energy’s North Carolina utility, by the North Carolina Transmission Planning Collaborative, and by the Southeast Regional Transmission Planning initiative.

SACE included data on more than 400 Southeastern utilities in an appendix to its report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.