Utility-scale solar development had a depressed year in 2022, with a decrease to 13 GW of deployments across the U.S., hampered by supply chain disruption and sourcing challenges for panels.

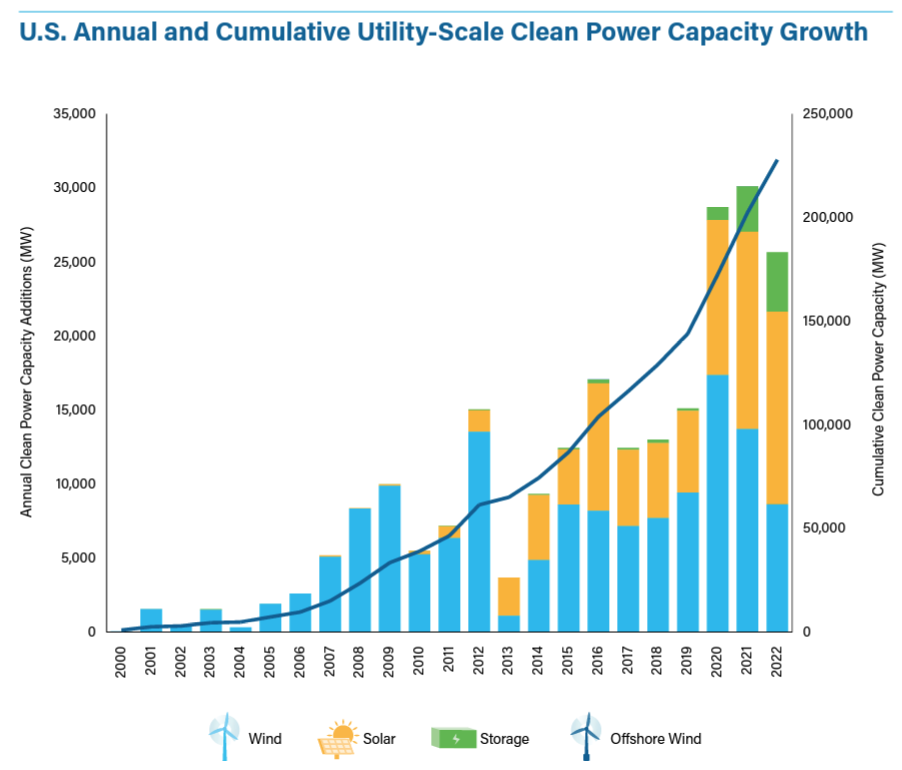

According to the 2022 American Clean Power Association (ACP) annual report, 25.5 GW of new renewable energy assets were deployed last year, the third largest years for renewables, representing 80% of all new power entering the U.S. grid. With the new additions, the U.S. generated 228 GW of solar, wind and energy storage resources, representing 15% of the power mix and powering 62 million U.S. homes.

Despite the third strongest year on record, Clean Power reported that 2022 saw a decline in deployments for the first time in five years, based on trade barriers, supply chain issues, ongoing permitting delays and regulatory challenges that resulted in a 15% slowdown in installations, largely represented in the utility solar market.

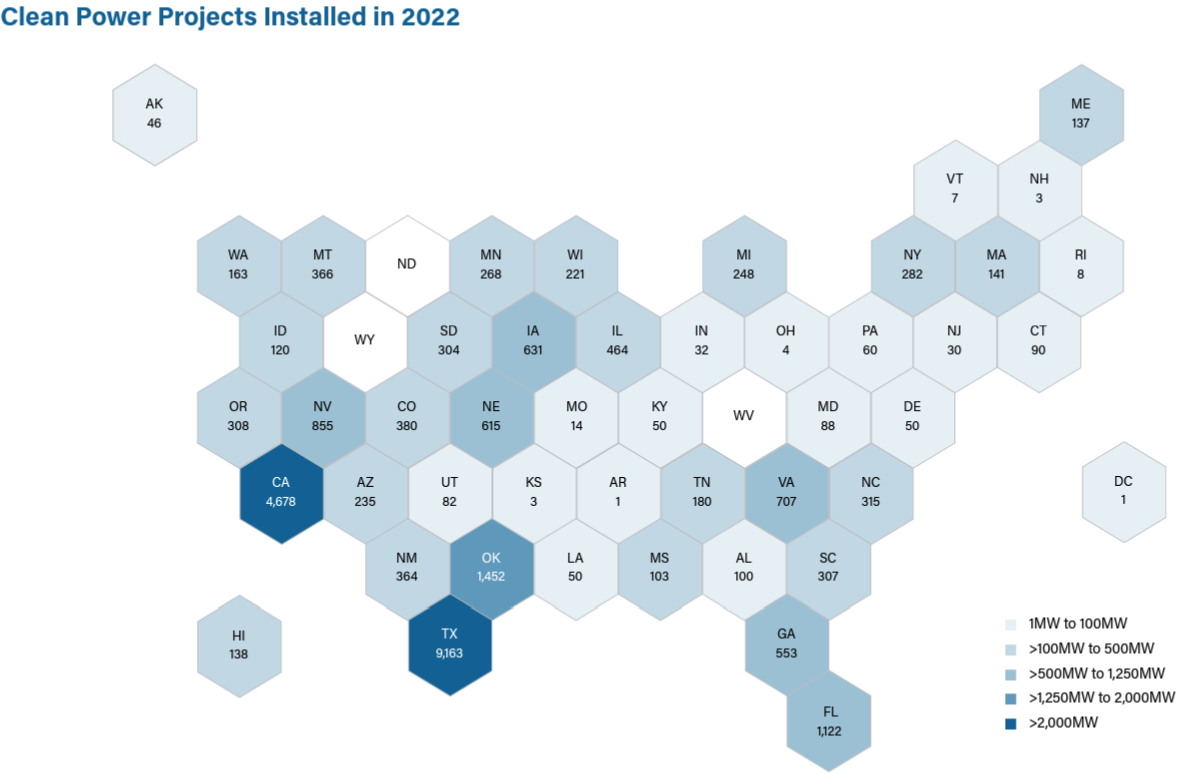

Texas and California remain the frontrunners in renewables, deploying a staggering 9.16 GW and 4.68 GW of solar, wind and storage projects in 2022, followed distantly by Oklahoma (1.45 GW wind), Florida (1.12 GW), and Nevada (855 MW), which saw gains in utility solar plus storage projects.

Clean Power notes that Texas has led the U.S. in renewable installations since 2017, and last year the Lone State state installed nearly twice as much capacity as any other state, including California.

Project delays persisted in 2022 and are a primary cause of the annual decline in installations compared to 2021. Over the last year, 66 GW of projected experienced some sort of delay, while into 2023 nearly 9 GW of delayed projects are now operational.

Solar accounts for the 68% majority of project delays, due to difficulty sourcing panels as a result of the 2022 trade restrictions tied to the import restrictions of solar panels from banned Southeast Asian countries.

Energy storage project delays were the least severe in 2022, at 14% total projects delayed, with the delayed projects primarily tied to colocation with large utility solar projects.

In 2022, energy storage projects were deployed at a strong rate, at 4 GW / 12 GWh of projects commissioned, an 80% increase in operating storage capacity year-over-year.

Since the August 2022 passage of the landmark Inflation Reduction Act, the U.S. utility-scale renewables market has announced 47 new manufacturing facilities, expansions or reopenings of existing facilities, with $151 billion of capital investment into the onshoring of 96 GW in announced new capacity manufacturing facilities.

The IRA stimulus has already created onshoring efforts with 18,000 new manufacturing jobs.

Clean Power’s assessment reveals the IRA will deliver 525 GW to 550 GW of new utility-scale renewable energy projects from 2022 through 2030, which in turn will bring $550 billion to $600 billion of new capital investments. The research shows that $500 billion of U.S. gross domestic product will be added over the decade, bringing $14 billion in GDP each year as the U.S. becomes more self-reliant in the renewables supply chain.

According to a Department of Energy report titled U.S. Energy and Employment Report 2022, the country’s solar, wind and storage markets staffed nearly 443,000 workers at year end 2021. The report shows the solar market makes up the largest share of workers with 253,052, an increase of 20,000 from 2020.

In 2021, the U.S. renewable energy market came close to matching the workforce of the fossil fuel energy market, which includes coal generation and extraction (124,143) and natural gas (322,969). The next 2023 DOE energy jobs report will be released in June 2023.

More than one-third of U.S. renewables workers are located in California (108,626), where more than one-third of the U.S. solar industry (87,200 jobs) is based. That is followed by Texas (42,188), Massachusetts (18,641), Florida (16,449) and New York (15,918).

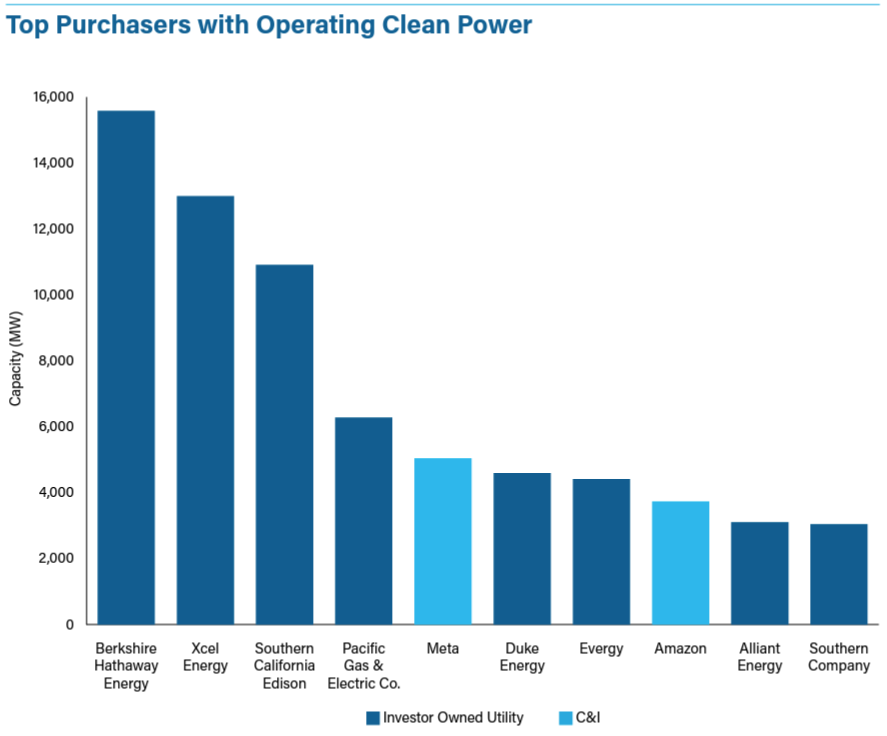

The annual Clean Power report ranks the top purchasers of renewables across the U.S., and for the first time, social media giant Meta (Facebook) edged out Duke Energy for the number 5 spot of top purchasers of renewable energy, with just shy of 5 GW of solar, wind and storage capacity powering its data center operations.

Amazon is the only other corporate renewables buyer to appear in Clean Power’s top purchasers list, while it has edged out southeast utility Southern Company and midwestern Alliant Energy with capacity nearing 4 GW from primarily wind power and some solar. Further down in the pack of corporate purchasers are Google, Microsoft, Walmart and AT&T.

American Clean Power held its annual CleanPower 2023 conference and expo earlier this week in New Orleans, La. The annual event drew more than 8,200 attendees this year plus more than 480 exhibiting companies.

The full report and press release of Clean Power’s annual report can be accessed above.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.