On December 2, 2022, the U.S. Department of Commerce made a preliminary determination that companies in Southeast Asia are avoiding U.S. tariffs imposed on solar products that originate from China. The preliminary ruling included investigations of BYD (Cambodia), Canadian Solar (Thailand), Trina Solar (Thailand), and Vina (a Vietnamese subsidiary of LONGi).

Goods found in violation could have tariffs as high as 50% to 250%, creating an untenable amount of risk for project developers.

However, in June, the Biden Administration placed a two-year moratorium tariff on solar goods. The tariff exemption applies to modules that are imported before June 6, 2024 and installed a project sites before December 2024.

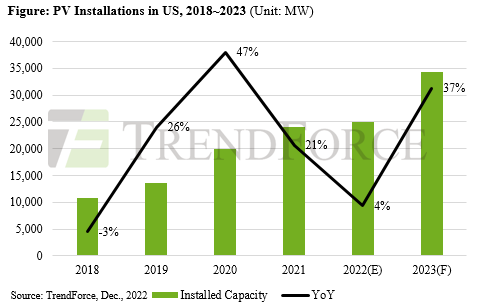

TrendForce reported that this preliminary ruling should not have a tangible effect on short-term solar deployment due to the Biden moratorium. The company forecasts that installation demand for the entire U.S. market will total around 35 GW to 40 GW for 2023.

The report continued that the U.S. lacks a complete industry chain and is at a relative disadvantage in PV module production, leaving developers more dependent on imports. TrendForce said due to relatively high labor and energy costs, there is a low chance the country will be able to cut manufacturing costs meaningfully in the near future. With the U.S. facing an election year in 2024, it is unclear whether a new administration would continue to support the Biden Administration’s support of domestic supply chains. In total, this leads TrendForce to conclude that the U.S. government will likely continue to be “open minded” about solar components imported from factories in China and other countries for the next two to three years.

UFLPA

The Energy Information Administration said about 20% of utility-scale solar projects, sized 1 MW and up, were delayed in the first half of 2022, largely due to module supply shortages related to the investigation, as well as to COVID-19 slowdowns and goods seizures from the Uyghur Forced Labor Prevention Act (UFLPA).

TrendForce said that the UFLPA should warrant more attention than the anti-circumvention investigation as a threat to short-term module supply.

The UFLPA places a “rebuttable presumption” that goods from the Xinjiang region of China, home to roughly 50% of the global polysilicon supply chain, are made with forced labor. The act places the burden of proof on buyers to show that the imported goods have no connection to forced labor whatsoever.

To be in compliance with UFLPA, companies must provide a comprehensive supply chain mapping, a complete list of all workers at a facility, and proof that workers were not subject to conditions typical of forced labor practices and are there voluntarily.

“The origins of components and materials used in PV products are not ascertained through a direct identification process. Instead, regulatory agencies often have to rely on product manufacturers and importers to provide supply chain information and sourcing certification,” said the report.

TrendForce said the subjective view of Customs and Border Protection will play a role in the flow of solar goods onto U.S. shores as well. Recently, Customs cleared a meaningful supply of JinkoSolar modules made with Wacker polysilicon for the U.S. market. While this clearing of goods was a good sign for solar module supply, there is a significant backlog of modules remaining to be cleared.

Last month, Reuters reported that over 1,000 shipments of solar energy components, valued in the hundreds of millions of dollars, have been blocked in U.S. ports under enforcement of UFLPA. ROTH Capital Partners said in August that as much as 3 GW had been held in Customs since the law was enacted. As much as 9 GW to 12 GW of solar modules could be prevented from entering U.S. markets by the end of the year, said Shen.

ROTH Capital warned that following the release of JinkoSolar goods, Customs Border Patrol may now turn its attention beyond the top solar component importers. “We could end up being in a two steps forward, one step back situation,” said ROTH Capital managing director and senior research analyst Philip Shen.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.