The energy transition has caused an upswing in interconnection costs related to network upgrades across the PJM Interconnection market, according to a new study by the Lawrence Berkeley National Laboratory. PJM is a regional transmission organization that serves 13 states and the District of Columbia.

At year-end 2021, PJM had 259 GW of new power generation and storage capacity actively seeking grid interconnection. Capacity in PJM’s queue is dominated by solar (116 GW), standalone energy storage (42 GW), solar-plus-storage systems (32 GW), and wind power (39 GW).

PJM’s queue has ballooned in recent years, with 2021’s active queue increasing by 240% compared to year-end 2019. The capacity associated with interconnection requests is nearly twice as large as PJM’s peak load in recent years (155 GW). This explosive growth of interconnection requests along with lengthy study timelines and high project withdrawal rates (423 GW) motivated the Mid-Atlantic grid operator to reform its interconnection process in 2022.

Going forward, PJM has adopted a “first-ready, first-served” approach and increased study deposits that are at risk when projects withdraw.

The PJM study culls data from more than 1,100 projects, covering 86% of new generators in the grid from 2000 to 2022. However, the Berkeley Lab notes the difficulty in finding project cost specific data, creating an information barrier for developers, regulators and policy makers.

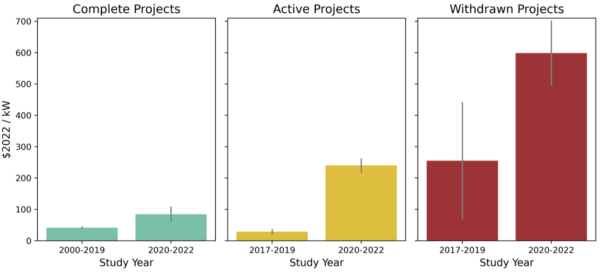

For completed projects, average costs have doubled relative to pre-pandemic costs, from $42 per kW to $84 per kW, with a median of $18 per kW to $30 per kW).

For active projects, interconnection costs have ballooned higher, from $29/kW to $240/kW between pre-pandemic costs and costs starting in 2020.

Withdrawn projects face the highest costs, averaging at $599/kW, with a median of $156/kW, which is likely a key driver for those withdrawals, the report notes.

Full access to the study can be found here.

Network upgrade cost driver

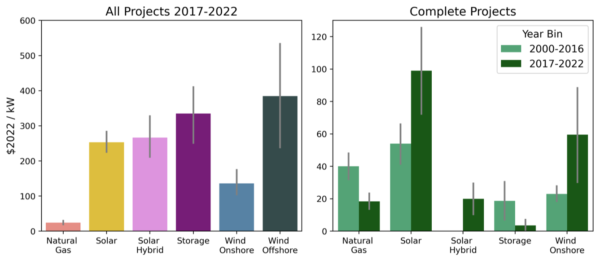

The key driver to interconnection cost increases has been network upgrade costs, Berkeley Lab finds. The average costs for upgrades beyond the substation have risen sharply since 2019, to $71/kW for complete projects, $227/kW for active projects, and $563/kW for withdrawn projects.

A small group of generators face lower network upgrade costs by choosing interconnection services as an energy source instead of a capacity resource. However, as a result project owners forfeit preferential treatment during daily high load times, cannot participate in PJM’s capacity market, and may face increased curtailment.

Among recently completed projects, interconnection costs have fallen for natural gas ($18/kW) facilities, while increasing for both solar ($99/kW) and onshore wind ($60/kW) relative to historical costs through 2016. Costs for both active and withdrawn storage and solar plus storage projects are surprisingly high ($337/kW), but complete projects are much cheaper (storage: $4/kW, solar hybrid: $20/kW).

The PJM study was funded in part under the U.S. Department of Energy’s Interconnection Innovation e-Xchange (i2X), and builds on Berkeley Lab’s previous work tracking interconnection requests and timelines.

After a recent study from October 2022 examining interconnection costs in the MISO market, the Berkeley Lab will publish future analyses on the NYISO, ISO-NE, and SPP markets in the coming months.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.