The pv magazine USA tour of solar incentives state by state last stopped in Tennessee, and now moves onto Alabama.

Nicknamed “The Heart of Dixie,” Alabama lacks the framework that Georgia, Florida and other Southern states now share for rooftop solar, while the state’s striated utility market makes for limited development of large utility-scale and corporate offtake projects.

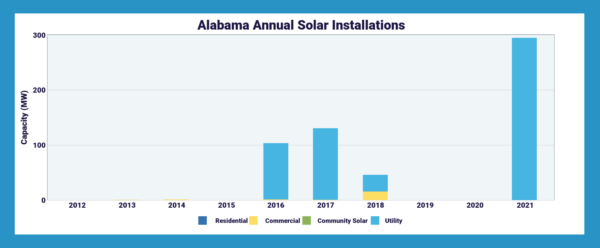

Post-pandemic, the state of Alabama has started to increase its mix of utility-scale solar development to baseload generation resources. In 2021, the state deployed 294.8 MW of utility solar projects, a value that may not seem like much, but is larger than the previous five years combined.

Solar industry advocates continue to point to the state’s regulator the Alabama Public Service Commission entrenchment with the fossil fuel industry as well as the region’s reliance on natural gas as harbingers for slow change for the residential solar and distributed energy markets in the state.

With the Tennessee Valley Authority (TVA) operating in Alabama’s northern belt, public utility Alabama Power (owned by Southern Company) operating in the Capitol region’s mid-section, and some 22 rural electric cooperatives operating elsewhere across the state, it’s difficult to not associate Alabama with a stifled or dislocated market for growth in the distributed energy marketplace.

Solar Tax Blues

Alabama’s utility regulator has a history of restraining rooftop solar for residential and commercial applications. In April, the Alabama PSC sided with Alabama Power’s increased ‘Capacity Reservation Charge’ from $5 to $5.41 per kW deployed per month, which for an average 5 kW system equates to a $25 monthly fee payable to Alabama Power for Alabamians to go solar.

The state’s utility-scale solar development rules date back to the federal PURPA legislation from 1978, and the Alabama PSC enforces a maximum 80 MW size limit for utility and commercial project development.

It’s worth noting that Alabama’s two biggest solar projects – Muscle Shoals Solar (296 MW) and Black Bear Solar (130 MW), built over the last year by Orsted and BP Lightsource – are located outside of the PSC’s jurisdiction in TVA and Alabama Municipal Electric Authority service territory, respectively.

IRA Help on the Way

Daniel Tait, executive director of Energy Alabama, a distributed energy advocacy group, said the passing of the Inflation Reduction Act (IRA) and other bipartisan legislation could create a market for behind-the-meter distributed generation (DG) activity, as well as local manufacturing opportunities in the state over the next one to two years.

For 50 kW to 1 MW systems, Tait said commercial and industrial (C&I) customers could receive a federal rebate to offset the cost of deploying rooftop solar and storage systems, which–in the absence of state rebates or cost incentives for DG systems–C&I customers can at least benefit from a partial cost recovery from federal rebates attached to the IRA.

“For DERs, many utilities are saying “we’re closed off,” rather than take slim benefits, but we hope that the IRA will open some eyes that DERs are coming no matter what,” Tait said. “I’m certainly less hopeful Alabama Power catches some religion out of it.”

Once a historic hub for the automotive parts market, Alabama saw signs of life in August with Mercedes-Benz announcing a $7 billion commitment to invest in Tuscaloosa County, Alabama. Full-scale production of the automaker’s all-electric EQS SUV model is slated to begin in late 2022 in Tuscaloosa, while Mercedes first invested in Bibb County, Alabama in 2017 to assemble EV components.

Anovion Battery Materials was one of 20 corporate recipients of federal grant funding under the Department of Energy’s $2.8 billion stipend from the 2021 Bipartisan Infrastructure Law for the sourcing of North American battery components. Chicago-based Anovion is receiving $117 million of DOE funding to produce a synthetic graphite anode material at a 35,000 ton facility in northern Alabama for use in lithium-ion EV batteries and energy storage applications.

“We are receiving an increasing number of phone calls from people asking about the IRA being a tool to explore commercial opportunities in the state,” said Tait.

Landmark Projects

Alabama’s small solar exposure is largely characterized by large-scale projects built for corporations in pursuit of environmental and social governance goals (ESG), like the Muscle Shoals Solar (295 MW) project in Muscle Shoals, Alabama for Facebook owner Meta, and Hollywood Solar (150 MW) for Google.

Both utility projects are powering the technology giants’ data centers and are located in Tennessee Valley Authority’s northern Alabama territory, which is not governed by the project limitations imposed by the state’s utility regulator.

According to SEIA, Alabama got a bump up to number 19 in the country for solar development with the installation of Muscle Shoals Solar in 2021, but has since dropped to number 31 in the United States with 577.9 MW of solar installed to date.

With 35 solar companies operating in the state, Tait and regional distributed energy advocates are hopeful that the IRA legislation will spur interest in clean energy manufacturing finding a hub in the Heart of Dixie, which in turn could spur a change in the state’s policy framework for solar installations in years to come.

The pv magazine tour of solar incentives makes its next stop in Mississippi.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.