EnergySage released its fifteenth “Solar Marketplace Intel Report”. The semiannual report looks at quotes sent in the past year to shoppers on EnergySage.com and analyzes data points to look for trends and prices in buying solar panels and batteries from solar companies in 39 states and Washington, DC.

The three key insights from this latest report, which can be downloaded for free in its entirety at energysage.com/data, include price increases, shifts in market share, and the increasing acquisition of energy storage.

Solar prices increase again

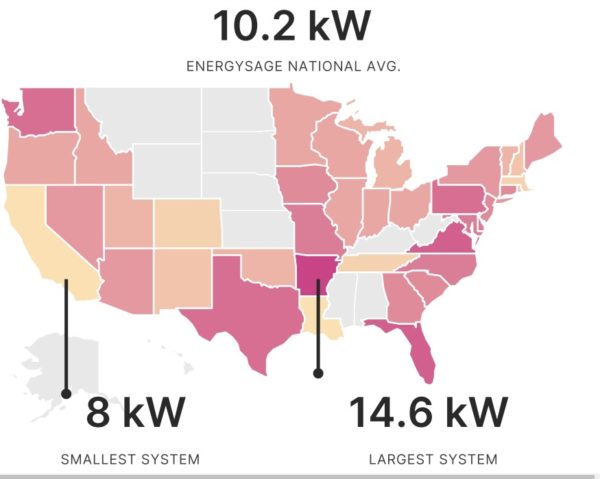

For the second half year in a row, solar prices increased on the EnergySage Marketplace, this time jumping 3.4% to $2.77 per Watt; a price not seen since 2020. Despite increasing prices, the average quoted system size remained relatively steady, dropping from 10.3 kilowatts (kW) in H2 2021 to 10.2 kW in H1 2022. As a result, the payback period increased from an average of 8.7 years to 9.1 years.

Geographically the list of the top five solar states remained the same and four of the five (excluding North Carolina) witnessed median quoted prices on EnergySage below the national median price. Pricing in California was similar to the national distribution, with most of the quotes coming in between $2.25 and $3.00/W. Texas, Florida, and Arizona all had solar pricing distributions below the national distribution– at least two-thirds of quotes were between $2.00 and $2.75/W. The highest prices were found in Minnesota at $3.64/W and the lowest were in Arizona at $2.25/W.

Looking at system sizes, the wattage of the most frequently quoted panels increased from 360/370 Watts in 2021 to 390/400 Watts in the first half of 2022. About one-third of quoted solar panels on EnergySage in the first half of 2022 were rated between 390 and 400 Watts, compared to 360 and 370 Watts in the second half of 2021. Importantly, half of the quotes in the first half of 2022 were for 390 Watt panels, up from 16% in the second half of 2021.

Shifts in market share of modules, inverters

In the first half of 2022, the top four most quoted module brands jockeyed into new positions. REC overtook Panasonic for the number one most quoted brand, and Qcells took spot number three from Silfab Solar.

Overall, market share consolidation decreased slightly as the top three panel brands dropped from a combined share of 66% of quotes in the second half of 2021 to 59% in the first half of 2022.

Size of systems range widely in different states and different parts of the country. For example, in California, average quoted system size is about 8 kW, whereas in Arkansas they are 14.55 kW. However, half of the states analyzed were within one kW of the national average for the third half-year in a row.

On the inverter front, Enphase remained the most quoted brand despite losing 4% of its market share. As for battery storage, Enphase was again the most frequently quoted option–offered in 45% of all storage quotes–while Generac’s market share grew the largest at 7% from the second half of 2021 to the first half of 2022. Within that same time period, LG Energy Solution’s Marketplace share fell 10% on EnergySage.

In the first half of 2022, the difference in pricing between panel and inverter pairings dropped. For example, the difference between quotes for Enphase inverters compared to SolarEdge inverters was only 3.4%, down from 4.2% in H2 2021. SunPower equipment continues to hold a premium price, as systems with SunPower solar panels and SunPower inverters were 33.3% more expensive than the least expensive pairing Qcells paired with a SolarEdge inverter.

Storage on the upswing, policy drives decisions

The median storage price increased by $1/kWh or 0.04%, which did not deter shoppers from buying. In the first half of 2022, a little over 17% of shoppers purchased a battery with their solar system, up 1.5% to 15.5% in the second half of 2021. The median quoted system size was 10.1 kWh in nine out of the 10 states, with the quotes ranging from about $12,000 to $16,000.

Why do solar shoppers buy storage? The single most cited reason was saving on utility rates. On a geographic basis, shoppers in Tennessee were most likely to receive a storage quote (94%), followed by Georgia (85%). Why? Neither of these states have net metering policies.

As for storage market share, EnergySage offered quotes on 20 battery storage brands in the first half of 2022. Enphase tops the charts, offered in 45% of all quotes, but Generac’s share grew the most—from 2% to 9%. This was the first time that the SolarEdge Energy Bank was featured in the data, and it accounted for 5% of the quotes. LG Energy’s share fell 10% in the same time period.

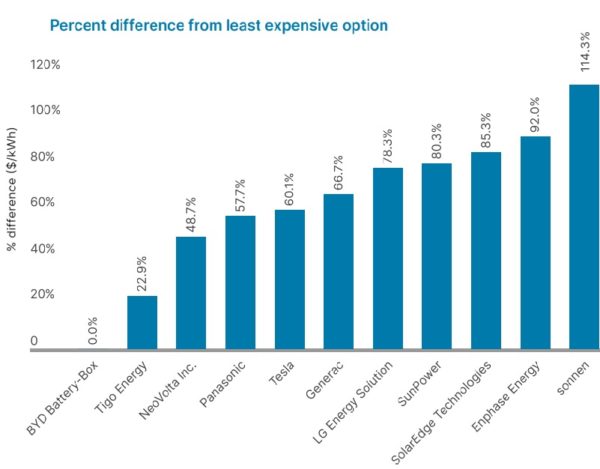

It was also noted that cost does not determine market position of storage. For example, the seven brands that were quoted below the $1,000 per kWh stored threshold in the first half of 2022 accounted for only 1.1% of the storage quotes. These brands include: BYD Battery Box, SimpliPhi Power, Homegrid Energy, Tigo Energy, FNS Power, Lion Energy and Q CELLS. On the other hand, Enphase, which received the highest number of quotes, is also the highest cost option.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

You can blame the 8Kw small size of California Solar installations on the utilities limiting the size of the solar installations to 115% of the previous year’s usage to stop customers from switching from natural Gas heating to all electric heating and cooling. If the utility has GAS listed in their name, such as “Pacific GAS and Electric” or “San Diego GAS and Electric”, you can bet they want to keep selling their overpriced natural Gas to customers. Natural gas being used in a power plant is 3 times more efficient than the natural gas being used in fan forced ducted gas furnaces in people’s homes. Any excess power you produce, from your rooftop solar, is only compensated for at 3 cents per kilo watt hour statewide and the pro-rated cost of a non-battery, grid tied system is 10 cents per kilo watt hour in homeowner costs. Solar installers have been told to never go above the 115% limit because of the low valuation the utilities give any of the excess power produced at “True-up” at the end of the year. These privately owned utilities act like middlemen utility managers so they can get huge bonuses from their sales in Natural Gas and Sold Electricity profits. Highest prices in the nation for electricity and natural Gas on a year around basis and now they want to start pricing based on demand like other states have done that will lead to $10,000.00 monthly utility bills that we have been reading about in Texas.