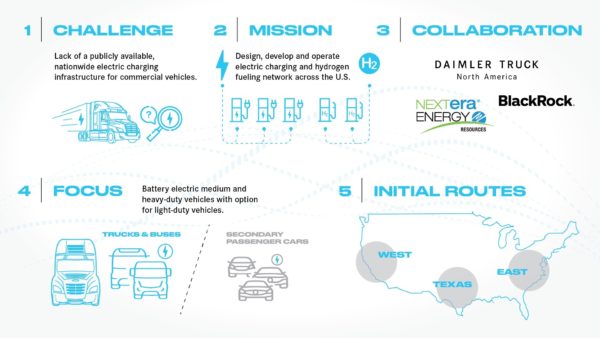

Daimler Truck North America, associated with the Mercedes-Benz brand, NextEra Energy Resources, and BlackRock Renewable Power announced the signing of a memorandum of understanding to develop a joint venture in the design, development, installation, and operation of a nationwide charging network for medium- and heavy-duty battery electric vehicles and hydrogen fuel cell vehicles.

Operations of the joint venture are expected to begin this year. Initial investment in the venture included an evenly split $650 million from the three parties.

Lack of publicly available EV charging infrastructure for commercial fleets, especially in long-haul operations, remains one of the most significant hurdles to the electrification of trucking, said Daimler. The parties shared plans to deploy a network of charging station routes along the east and west coasts and in Texas by 2026. The plans call for leveraging existing infrastructure and amenities while adding greenfield sites in anticipation of a rising customer base. The first phase of construction is planned for 2023, said Daimler.

The project will initially focus on medium- and heavy-duty battery EV, followed by hydrogen fueling stations. The sites are also planned to be accessible to light-duty passenger vehicles.

NextEra Energy Resources, a global solar and wind generator, has significant investments in EV charging infrastructure, and will bring experience in optimizing renewable energy, resiliency and grid integration. The group of three said it seeks to invest over $9.5 billion in total commitments across 350 solar and wind projects, as well as battery energy storage and charging infrastructure.

Daimler plans to begin the production of the battery electric freightliner eCascadia and eM2 in 2022-23, and additionally builds walk-in vans, school buses, and other fleet vehicles. The automaker partnered with Portland General Electric to build the nation’s first public charging site for commercial electric vehicles.

Investment manager BlackRock has over $65 billion in client commitments. Its renewables arm is one of the largest renewable power equity investment platforms globally. “The commercial transportation sector is a significant contributor to carbon emissions and we firmly believe that decarbonization of transportation will be a critical societal focus for the next decade.,” said David Giordano, head of BlackRock’s Renewable Power Group.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.