Solar analyst firm Roth Capital Partners said in a note to clients that it believes LONGi may be the next module manufacturer to be the subject of U.S. Customs and Border Protection action under a Withhold Release Order (WRO) issued in June.

“While detainment appears to have not yet happened, we believe it is imminent,” Roth said in a note obtained by pv magazine. The note said that LONGi had been informed that shipments currently on the water were expected to be detained at five ports. “Look for this to impact LONGi in a broad-based way,” the analyst’s note said.

The note said that Trina recently slowed or even stopped module flow “meaningfully” and changed terms on customers, in some cases increasing prices by around $0.10 a Watt.

On June 24, the Biden administration ordered a ban on U.S. imports from Chinese-based Hoshine Silicon Industry Co. over forced labor allegations. The U.S. Commerce Department separately restricted exports to Hoshine, three other Chinese companies, and what it said is the paramilitary Xinjiang Production and Construction Corps (XPCC), saying they were involved with the forced labor of Uyghurs and other Muslim minority groups in Xinjiang.

The three other companies added to the U.S. economic list included Xinjiang Daqo New Energy Co, a unit of Daqo New Energy Corp.; Xinjiang East Hope Nonferrous Metals Co, a unit of Shanghai-based manufacturer East Hope Group; and Xinjiang GCL New Energy Material Co., part of GCL New Energy Holdings Ltd.

Industry analysts believe that Hoshine provides around 60% of the world’s metallurgical grade silicon (MG-Si) used in the solar industry. The silicon provides feedstock material used in the polysilicon refining process.

In August, reports first emerged that CBP was detaining solar modules that they suspected contained material subject to the WRO.

In August, reports first emerged that CBP was detaining solar modules that they suspected contained material subject to the WRO.

News of possible CBP action involving another module manufacturer was not unexpected. Federal enforcement of the WRO at U.S. ports of entry has been expected to evolve over time. A challenge for the solar industry is to prove that supply chains do not contain any material sourced from the targeted suppliers. Because Beijing denies that forced labor exists within China, it has been difficult to trace suppliers as far back as the mines, which is what the WRO targeted.

Other trade challenges

The anti-circumvention tariff issue mentioned in the Roth note referred to a petition filed in August by a group known as American Solar Manufacturers Against Chinese Circumvention (A-SMACC). Through its attorneys, the group asked officials at the U.S. Department of Commerce to investigate whether imports from Malaysia, Thailand, and Vietnam were unfair. The petitions argued that Chinese companies had shifted production to those nations in recent years to avoid existing U.S. duties on solar cells and panels made in China.

In late September, the Commerce Department deferred a decision and asked the group to identify its members. In early October the group revealed its members to Commerce officials, but declined to make the names public, citing concern over possible retribution.

Falling imports

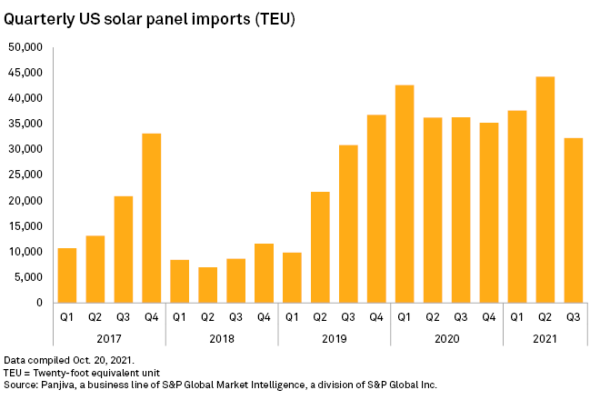

U.S. solar panel imports fell during the third quarter by around 27%, the largest single-quarter drop since 2018, according to research firm Panjiva, with analysis provided by S&P Global Market Intelligence. Total module shipments were also down 11%, compared to Q3 2020, according to S&P.

In an email to pv magazine in October, Timothy Brightbill, an attorney with the Wiley Rein law firm that represents A-SMACC, said that the decline in module imports to the U.S. during the third quarter has been “most pronounced from Malaysia” with the decline beginning in July, and accelerating in August. He said that the A-SMACC petitions were filed on August 16 and that the drop in imports appeared to correspond with the “wide reports that that Customs and Border Protection had detained major solar import shipments.”

He said that imports from Thailand and Vietnam started to fall “sharply” in June and July.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.