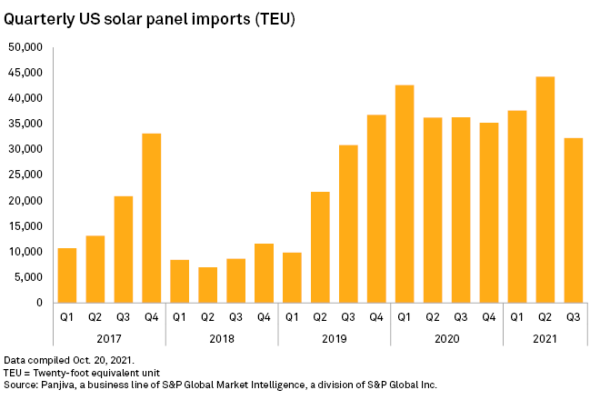

U.S. solar panel imports plunged during Q3, falling 27%, the largest single-quarter drop since 2018, according to research firm Panjiva, with analysis provided by by S&P Global Market Intelligence.

In addition to being down 27% compared to Q2 2021, total module shipments were also down 11%, compared to Q3 2020, according to S&P. Many in the industry are blaming the fall on a proposed expansion of tariffs, introduced by an anonymous group of domestic manufacturers last month.

The proposed tariffs would apply to manufacturers in Southeast Asia beyond just China, including modules that are imported from Malaysia, Vietnam and Thailand. Those countries account for 80% of all panel imports into the United States.

The report claims that the uncertainty over the tariffs is already stalling projects, as, if instituted, the tariffs could be applied retroactively to already-completed sales. The Solar Energy Industries Association (SEIA) has warned that tariffs on imported panels from three Asian countries would jeopardize nearly 30% of the solar capacity the U.S. is expected to install over the next two years.

The proposed tariffs also come at a time where it has become harder to source modules, regardless of their country of origin, due to worldwide supply chain problems and difficulties in international shipping.

These potential of these tariffs are not the only factors affecting imports, however.

More about the U.S. solar industry at our Roundtables USA!

According to Rystad Energy, a consulting firm, supply chain disruptions and shipping difficulties could threaten 56% of the utility-scale solar projects planned globally for 2022. Additionally, the effects of the Covid-19 pandemic have not passed the world over yet, and overall production has still not recovered to pre-Covid levels.

In mid-August, reports emerged that solar module shipments to the U.S. were being detained by Customs and Border Protection agents as part of an enforcement action aimed at banning the import of solar equipment containing components provided by a Chinese company suspected of using forced labor. Reports said that JinkoSolar had around 100 MW of product detained by border agents. Analysts said that Jinko may not ship hundreds of megawatts of capacity to the U.S. as long as the customs inquiry is in process.

All of the above factors could potentially derail the Biden administration’s goal of producing 45% of U.S. electricity supply from solar by 2050.

The U.S. Dept. of Energy’s Solar Futures Study, released in September, outlines the need for the U.S. to install an average of 30 GW of solar capacity per year between now and 2025, then 60 GW per year from 2025. According to SEIA’s Q4 2020 Solar Market Insight Report, domestic solar module manufacturers only have the capacity to produce about half of the domestic demand.

Earlier this week, SEIA sent a letter to U.S. Dept. of Commerce Secretary Gina Raimondo to “refute the credibility” of the so far unknown petitioners of the tariff, saying that SEIA is leading the fight against the tariff request to protect this country’s 10,000 solar companies and 231,000 solar workers from the “monied interests” behind the petition.

While the companies included in the group that began the petition, the American Solar Manufacturers Against Chinese Circumvention, have identified themselves to the U.S. Department of Commerce, their names are being kept private, in order to avoid any potential retaliation.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.