Frank van Mierlo, the CEO of 1366 Technologies, is a betting man — and he’s wagering that “the solar market will see 2 GW of tandem solar in the marketplace by the end of 2022.”

I am the skeptic on the other side of this wager for one bottle of fine champagne — although I would accept a thimbleful of the CEO’s tears in its place.

van Mierlo, chief of a kerfless silicon wafer startup, has said: “I’ve never doubted silicon. We really believed in it. The learning curve had been holding steady for 45 years – it’s a pretty predicable line. Why would that stop?”

So, when we heard van Mierlo at a recent talk saying that tandem modules made from a high-bandgap and a low-bandgap material are “the most important innovation in solar since solar was first conceived in Bell Labs in 1954,” it seemed that 1366 was pivoting to a new technology and approach.

van Mierlo makes the case

When I asked van Mierlo about this seeming shift to tandem, and voiced my concern with this technology path, the CEO suggested we embark on a small wager about tandem’s commercial future.

He believes that the solar market will see 2 GW of tandem solar in the marketplace by the end of 2022.

van Mierlo writes, “In fact, not only do I believe that multiple gigawatts of tandem will be sold before the end of 2022, I am also confident that in a decade’s time, tandem will command more than 50% of our industry’s market share.”

He continues: “Is it that I no longer believe in the long-term role of silicon?”

“No! In fact, it’s the remarkable success of silicon that now makes tandem modules the inevitable next step. With its low bandgap of 1.1 eV and its low cost, silicon is the ideal candidate for the bottom cell in a tandem configuration. In this position, a silicon bottom cell converts less than one-third the energy captured by the sun but still carries 100% of the cell cost. To make tandem work, you need the bottom cell to be extremely low cost. And, thanks to recent innovations such as the Direct Wafer furnace, we can achieve that cost target.

“It is precisely because of silicon’s dramatic learning curve that tandem will soon be a commercial reality. As module costs have declined and many installation costs remain fixed, we’ve witnessed the increased pressure for greater efficiency. This pressure will drive tandem adoption: its dramatic efficiency boost without a significant increase in module cost-per-watt will lower the installed cost of solar by producing more power for a given area.

“We know that the headroom for increasing efficiency with single-junction silicon technology is closing. It is the opportune moment for tandem modules underpinned by extremely low-cost silicon.

“Which brings us to the tandem top cell, for which there are many excellent solutions. Thanks to the massive investment in thin film R&D, there are suitable materials already on the shelf. Moreover, new perovskites bring additional promise. Oxford PV and Swift Solar both vouch that it is possible to make a stable high-bandgap perovskite, but it is much harder for perovskites to match the excellent low-bandgap performance of silicon.

“Silicon’s next contribution will be to tandem as an extremely low-cost and high-performing bottom cell.”

“I am looking forward to drinking that champagne,” taunted the CEO.

Tandem solar startups

Since its founding, 1366’s technology has been based on forming solar wafers directly, using molten silicon, instead of silicon ingots sawn into wafers. Over the last 14 years, 1366 has raised more than $100 million from investors including Breakthrough Energy Ventures, Tokuyama, North Bridge, Polaris, VantagePoint, Energy Technology Ventures, Hanwha Chemical, Ventizz Capital and Haiyin Capital.

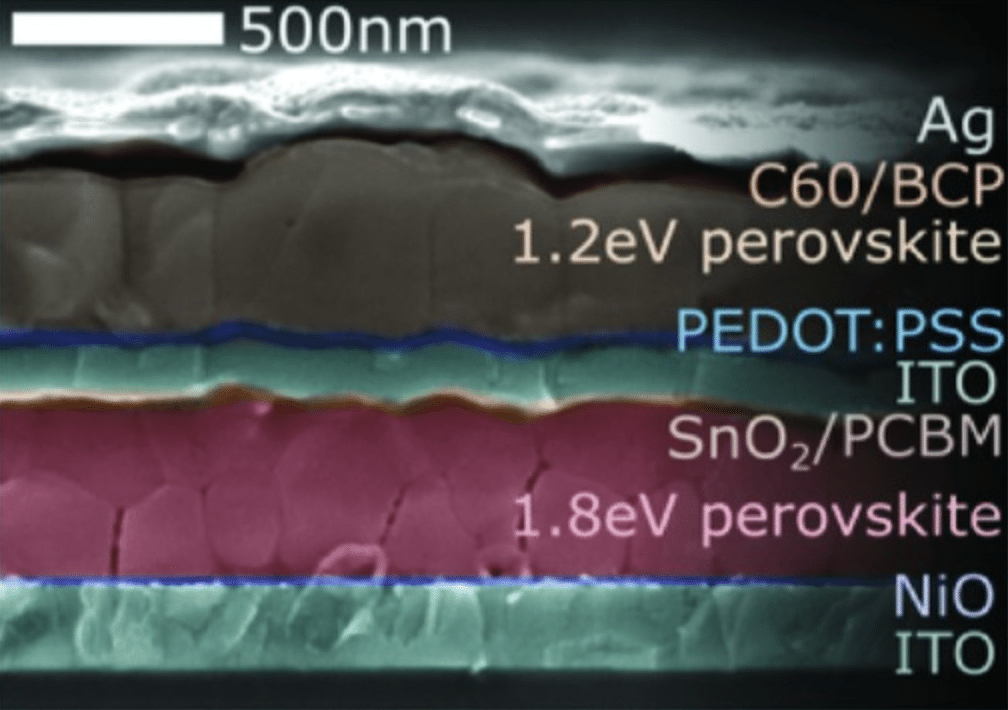

Tandem structures can be epitaxially grown monolithically on silicon or mechanically stacked. The tandem-junction cell architectures have potential efficiency gains because of the different wavelength ranges and bandgaps of silicon and other materials.

Tandem solar startups include:

- Oxford PV has raised more than $140 million to develop perovskite-on-silicon tandem solar cells and modules. Meyer Burger has partnered with the startup to develop equipment and has also taken an equity stake in the firm.

- Swift Solar stacks perovskite solar cells to make tandem cells. The company can put these layers on flexible substrates and foils.

- Tandem PV aims to monolithically print thin-film perovskites on a glass panel and mechanically stack it on top of silicon cells.

- Other perovskite solar technology developers include Saule Technology and HPT.

I win this bet

As we’ve reported, commercial crystalline silicon is forecast to reach efficiencies of 22%-24% by the end of the decade, and possibly 25% if interdigitated back-contact (IBC) heterojunction products get to market.

NREL studies find that reaching cost reductions in photovoltaics beyond the 6¢/kWh SunShot 2020 goal will mean that cell efficiency must be increased beyond the Shockley–Queisser limit of 29.4% for a single p-n junction. Other researchers have found that PV modules made with tandem solar cells will have to show efficiencies of 30% and offer the same lifetime and degradation rate as standard crystalline panels if manufacturers want to hit commercial production.

That said, I win this bet because:

- Reliability: Silicon is the most studied element in the periodic table, and the globe will deploy more than 100 GW of the stuff in PV applications this year. We know its failure modes and its long term behavior. Other potential tandem materials such as perovskites or CIGS exhibit different and relatively unstudied failure modes and degradation paths. It will take years to gain confidence in the long-term reliability of a new materials system or tandem combination. Even if we understand each materials system separately — what happens when they are mingled in these 30-year assets in increasingly hostile environments?

- Developers, banks, underwriters: A solar project is an investment tool that turns photons into kilowatt-hours and dollars — and the extremely risk-adverse financial community does not tolerate new, unproven technologies. Greater risk in any aspect of a solar project translates to nervous underwriters, a higher cost of capital and an uncompetitive project.

- History is on my side: The road is littered with the remains of hundreds of solar aspirants, all keen to commercialize some alternative to straight-up crystalline silicon — amorphous silicon, CIGS, CdTe, or GaAs. Not one company, other than First Solar, has been able to succeed commercially in this effort.

- Time is on my side: Yes, it is.

I will toast your health with my victory champagne in Dec 2022.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It does seem like having 2GW of tandem by EOY2022 is a long shot, but I hope you lose….

Champagne? What happened to betting a bottle of scotch or bourbon? Or even a PBR.

There is some friendly wager website that I can’t remember the name of…

Champagne not my drug of choice.

What is efficiency of tandem

For efficiency discussion also see my talk:

https://www.ted.com/talks/frank_van_mierlo_a_photon_walks_into_a_bar

The Shockley-Queisser limit for a silicon based tandem is 45%. The practical limit for tandem modules is 30% against a practical limit for single junction modules of 24%. Today most high quality modules in the market have an efficiency of 21 to- 22% .