GlassPoint, a venture capital-funded startup that targeted solar enhanced oil recovery (EOR), has gone into liquidation, according to an email obtained by pv magazine.

Glasspoint received more than $130 million in venture capital from Oman’s sovereign wealth fund, along with the venture arm of Royal Dutch Shell and a syndicate of venture firms: RockPort Capital, Nth Power and Chrysalix Energy. Anna Halpern-Lande led the Glasspoint deal for Shell. Shell Venture’s CIO Robert Linck is on the board, as is Chrysalix’ Richard MacKellar.

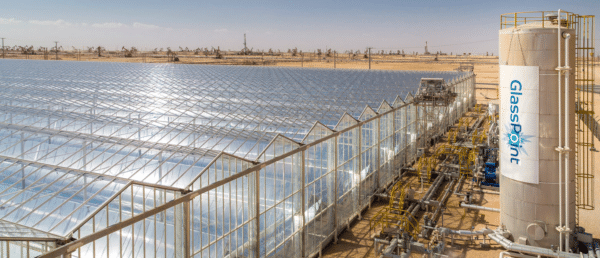

In 2015, Petroleum Development Oman, the largest producer of oil and gas in Oman, and GlassPoint announced a $600 million deal for the 1,021-megawatt “Miraah” project to coax viscous oil from Oman’s Amal oil field.

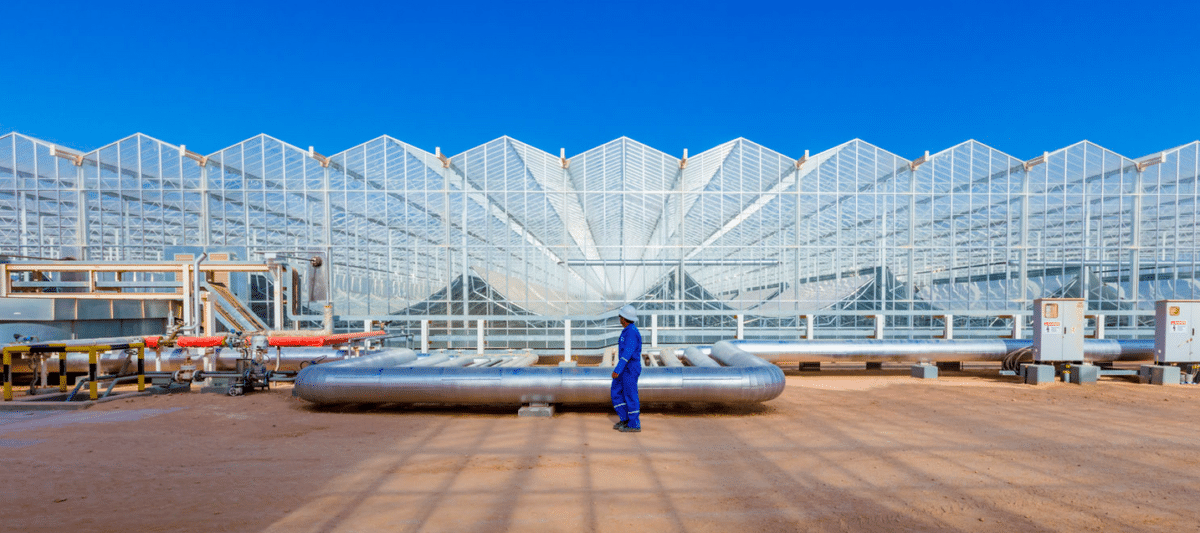

The company was going to use concentrated solar arrays housed in glass greenhouses to produce steam at gigawatt scale instead of using natural gas.

Oil field operators already use vast amounts of natural gas to generate steam to draw difficult-to-access oil from depleted wells via thermal EOR. This technique has been used for decades in depleted wells ranging from Middle East oil fields to Kern County, California.

The oil business uses a lot of energy to make energy. A previous GlassPoint CEO pointed out that oil companies are “heating a cubic mile of earth,” — by burning gas to create steam. The 1.7 quadrillion Btu of gas used to power thermal EOR “could power six of the largest states.”

Solar EOR can reduce an oil field’s natural gas consumption by up to 80 percent. That was the company’s value proposition.

Technology and troubles

GlassPoint’s greenhouse-enclosed parabolic solar troughs use mirrors to focus sunlight on a tube containing water, yielding high-pressure steam, which is injected into an oil reservoir to heat heavy oil. The greenhouse shields the mirrors from the desert elements, and an automated washing system cleans the glass. One of the cost drivers in a traditional concentrated solar power (CSP) project is building the system to withstand wind — strong foundations require more steel and concrete. GlassPoint’s CSP system allowed for cheaper, thinner mirrors and “half the amount of steel and aluminum” of an outdoor solar field, according to the company.

But, in 2019 Glasspoint had to retreat from its plans for an enormous 770-acre Aera Energy Belridge Solar Project west in Kern county because of lack of financing to begin construction.

There were a series of bridge loans, a do-or-die financing package, debt defaults, technical issues and delays on the Oman project. A financing round was closed with fewer investors and onerous terms.

Last month, CEO Steven Moss sent an email to all Glasspoint employees. Here is an excerpt.

Mitsui has informed us that due to the very difficult economic circumstances and uncertainty around the global Covid-19 pandemic, it cannot make the necessary and planned investment in GlassPoint at this time. Our current investors are facing the same very challenging business environment and are unable to provide further funds to meet the shortfall created in the absence of Mitsui’s participation.

Following a special meeting of the Board of Directors today, the decision has been taken to immediately place GlassPoint in a voluntary liquidation process. Unfortunately, this means that we will cease our normal business activities immediately. As a result, the Company is sadly forced to lay-off its employees. HR will be communicating with you directly on the arrangements that affect you personally.

This is an immensely sad day for myself and the entire executive team. I know how very hard you have all worked for the success of GlassPoint, its technology and our mission to positively contribute to improving the environment. However, the extraordinary global pandemic and resulting economic situation has presented unforeseen circumstances that proved too difficult for the Company to overcome. I’m truly sorry for this bad news, which comes at a time of considerable uncertainty for us all and our loved ones. I know that it will bring little consolation but I wish all of you the very best for the future and hope that you and your families remain safe and well.

The CEO has not responded to press inquiries.

A Shell spokesperson responded: “We regret that due to the current challenging economic circumstances and uncertainties, GlassPoint has not been able to secure the funding needed to allow the company to continue as planned. Over the years, GlassPoint and Shell have proudly collaborated both technically and strategically through a minority shareholding by Shell Ventures in 2012. We commend the GlassPoint management team for all their efforts to develop and grow the company and we are keen to see the technology continue to progress.”

Oman’s Sovereign General Reserve Fund released a statement a few days after this article was published.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Actually went and drove to the original first crappy site over 7 or 8 years ago

The green house design had flaws

The poorly solar design was pure crapola

JAMES ROBERT SEIDEL VK

SADLY YOU MONEY PEOPLE WONT LISTEN TO ME

I got over 35 years in solar game

Passport will travel

If you’re interested in reading more about the strangeness of this company’s ABC, you might like this article written by a bankruptcy and restructuring attorney: https://www.dailydac.com/assignee-unknown-the-curious-cases-of-smartlabs-shine-bathroom-technologies-liftopia-glasspoint-solarreserve-maker-media-toymail/