For the first time in company history, Tesla reported a positive Q1 GAAP net income, driven by the profitability of the Model Y in its debut quarter.

Tesla’s solar and storage ventures were less successful. And, some big board room news came out before the earnings report.

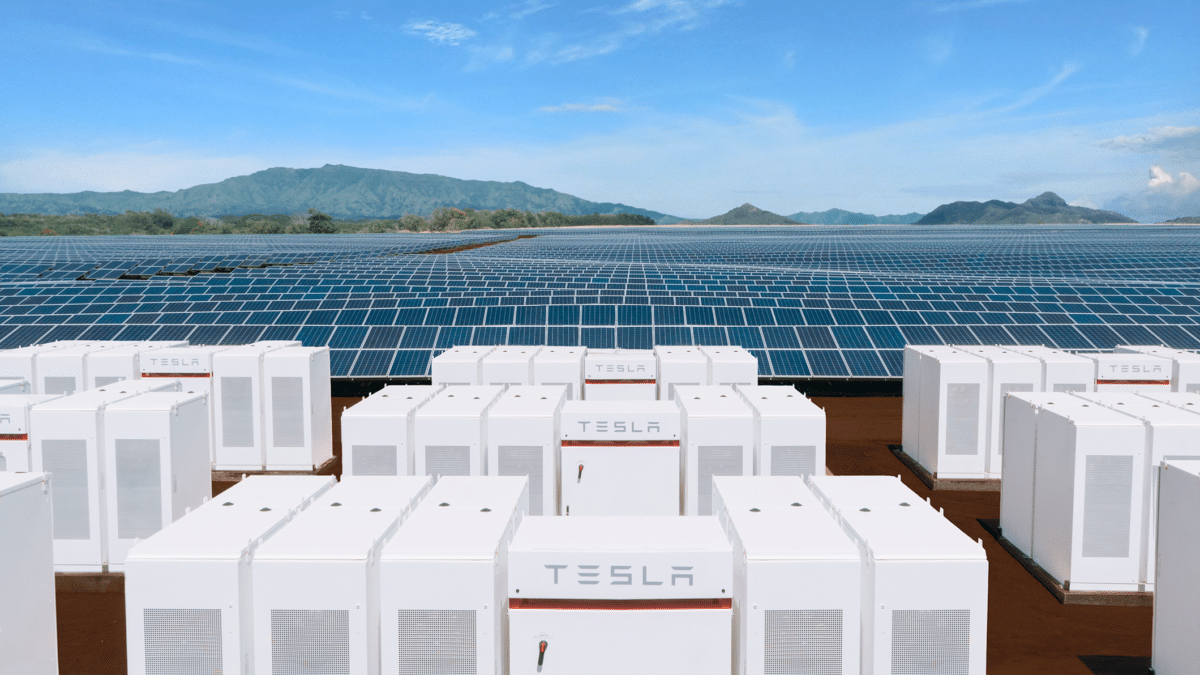

The company installed 35 MW of solar in Q1, down 35% from the 54 MW installed in Q4 2019, and down 26% from Q1 2019’s mark of 47 MW.

While Musk and the report tout reaching the production benchmark of 1,000 solar roofs a week, launch inefficiencies with the newest offering were to blamed for lower-than-expected deployment and profits.

As for energy storage, Tesla installed 260 MWh in Q1, down more than 50% from Q4 2019’s record mark of 530 MWh and the lowest since Q1 2019, when 229 MW were installed. The company did sell its 100,000th Powerwall in Q1 and noted that more than 40% of solar customers opt to install at least one Powerwall.

Vehicle production and deliveries were both down in comparison to Q4, with the company producing just under 103,000 vehicles and delivering 88,500, down 2% from Q4’s production 105,000 vehicles and 21% from the record-breaking 112,000 vehicles delivered that quarter. On the year, however, vehicle production is up 33% and deliveries are up 40%.

The first quarter is traditionally slow for the company and turning a profit in the year’s first three months was a point of celebration during the company’s earnings call. Year-over-year, Tesla experienced growth in vehicle deliveries, vehicle production and energy storage deployment, though solar deployment is down 26% from Q1 2019 numbers.

Elephant in the room

As for the elephant in the room, the Covid-19 pandemic reached its breaking point well enough into Q1 that the virus’ full effect will not be reflected until next quarter’s results. The shutdown of the company’s Fremont, California Model Y production facility has not slowed down Musk’s ambitions for the car, which he is confident will become the company’s best-selling product ever. Musk made that claim just moments before remembering to read the disclaimer about forward-looking statements.

Elon Musk vs. corporate governance

Yesterday, Tesla filed an amendment to its 10K, and in an unprecedented move, the company announced that directors and officers insurance was deemed too expensive, and that CEO Elon Musk would provide the coverage, for at least the next year.

Per the filing:

“Tesla determined not to renew its directors and officers liability insurance policy for the 2019-2020 year due to disproportionately high premiums quoted by insurance companies. Instead, Elon Musk agreed with Tesla to personally provide coverage substantially equivalent to such a policy for a one-year period, and the other members of the Board are third-party beneficiaries thereof. The Board concluded that because such an arrangement is governed by a binding agreement with Tesla as to which Mr. Musk does not have unilateral discretion to perform, and is intended to replace an ordinary course insurance policy, it would not impair the independent judgement of the other members of the board.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.