The US Department of Energy’s Lawrence Berkeley National Laboratory (LBNL) has released Utility Scale Solar: Empirical Trends in Project Technology, Cost, Performance, and PPA Pricing in the United States. The report covers a lot of information on an estimated 690 utility scale solar power plants 5MWac or larger, totalling 24.5GWac — and representing 60% of all solar installed in 2018.

(The report jumps between labeling data in terms of inverter sizing (ac) and solar module sizing (dc), and so does our article as we try to match data accuracy.)

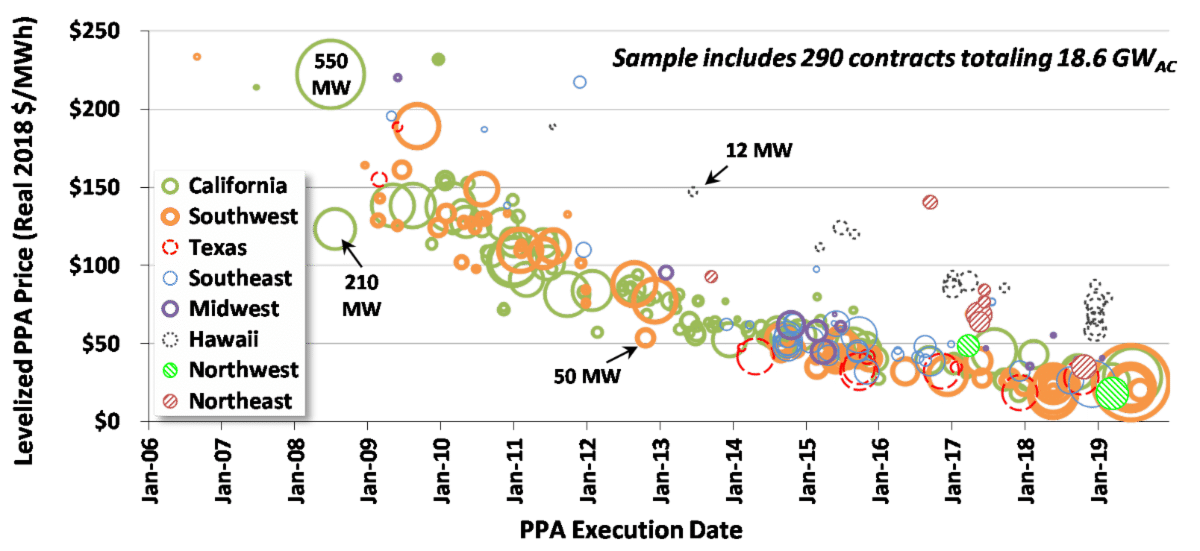

Pricing is still going down, with 27 of 38 post-2017 power purchase agreements in the sample at lower than $40/MWh, 21 PPAs lower than $30/MWh and 4 even lower than $20/MWh.

Here’s a condensed version of the author’s themes, which LBNL covers in a tweet thread:

- Installation and Technology Trends: Solar trackers are on 70% of all new capacity, fixed-tilt projects are predominantly in less-sunny regions but trackers are invading. Inverter loading ratio (“ILR” or DC to AC rating) has grown steadily since 2014, to 1.33 in 2018.

- Installed Prices: Average of $1.60/Wac (or $1.20/Wdc) for projects completed in 2018. The lowest 20th percentile of projects were priced at or below $1.30/Wac (or 97¢/Wdc), with the lowest-priced projects around $1.00/Wac (or ~70¢/Wdc).

- Capacity Factors: AC capacity ranges widely, from 12.1% to 34.8%, with a sample median of 25.2%. Tracking boosts capacity factors by up to 5% in higher insolation regions, and lesser elsewhere.

- PPA Prices and LCOE: PPA prices for utility-scale PV have fallen by $10/MWh per year in most years since 2013. Excluding the benefit of the 30% ITC, the median LCOE among operational PV projects in the sample stood at $53.8/MWh in 2018. The price declines for installation cost were larger for larger sized projects as can be seen when bucketing the projects: $1.42/Wdc for 5MW to 20MW, $1.21/Wdc for 20MW to 50MW and $1.04/Wdc for 50MW to 100MW.

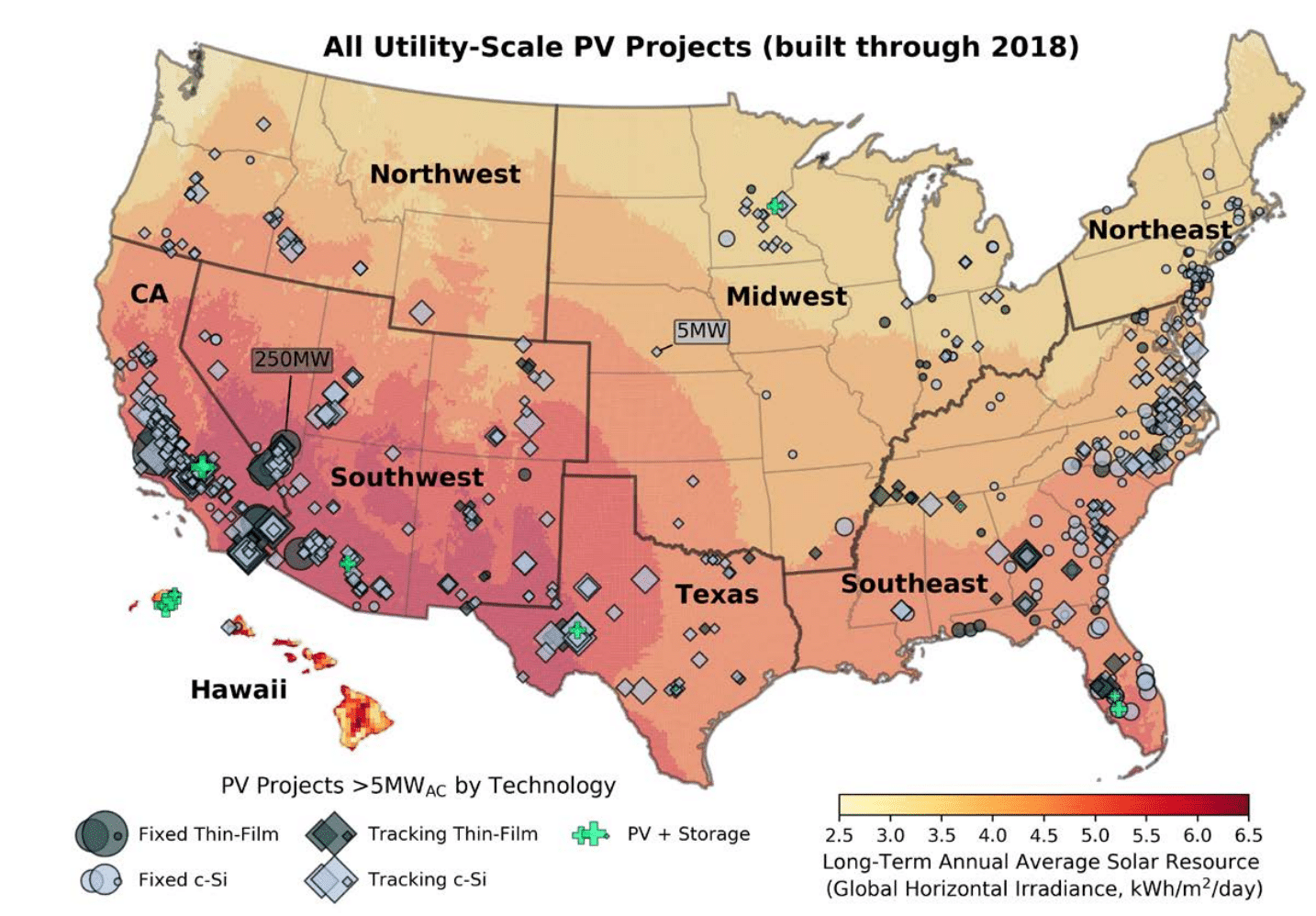

Solar is turning into a true national pastime, with four states – Connecticut, Vermont, Washington and Wyoming adding their first utility scale projects, and the southeast becoming the new growth region.

Florida is now the largest annual market at 1,010MWac of capacity with 25% of national additions. For the first time since 2011, California, which accounts for 40% of all solar installed in the US, is not the state with the most capacity growth, coming in second at 981MWac. Texas came in at number three with ~650MWac, and North Carolina added 472MWac. Outside of California, the Southwest only added 160MWac in 2018, and was surpassed by new installations in the Northwest (181MWac).

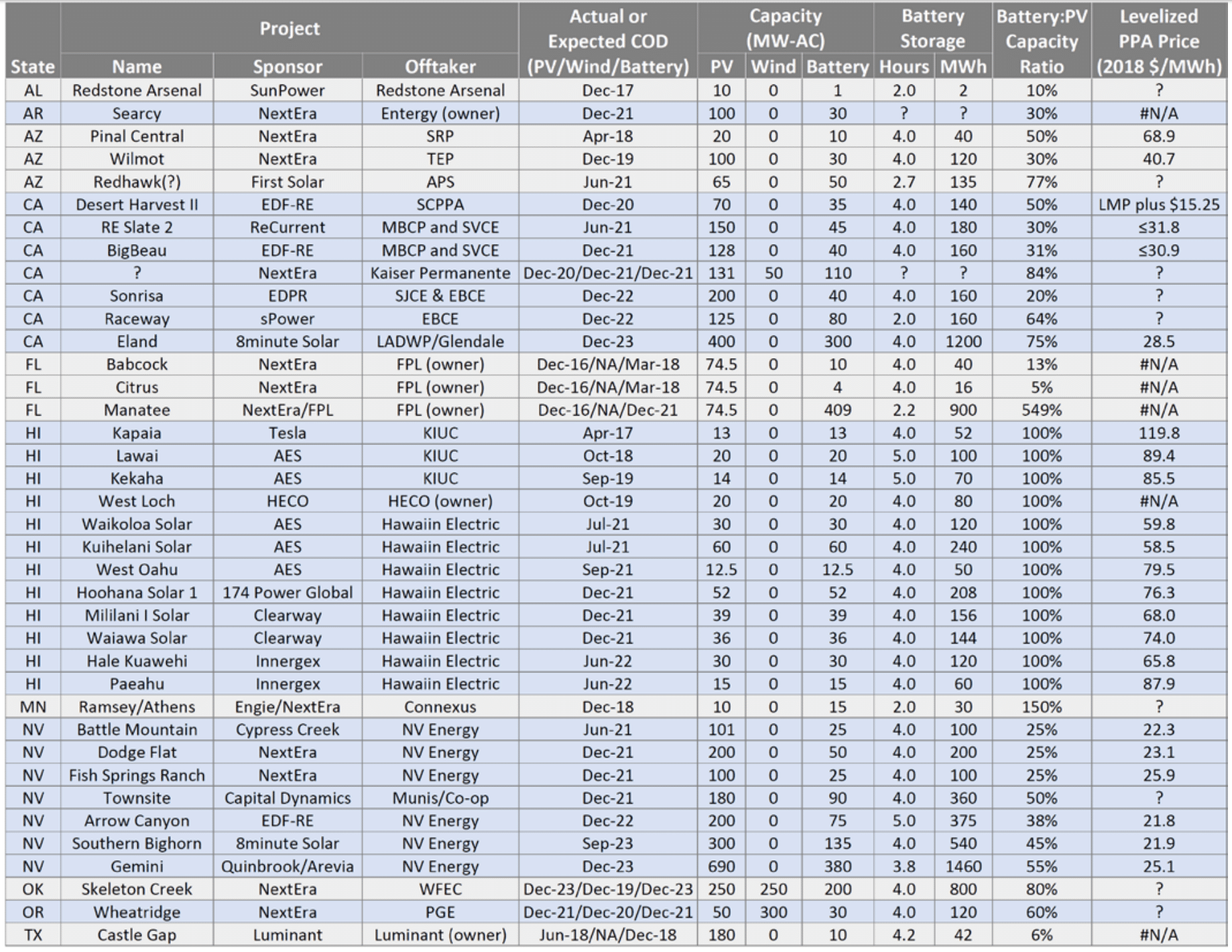

On the subject of energy storage, seven utility-scale PV+battery projects came online, with three existing solar power plants getting energy storage added. Six of these projects were built in high solar penetration markets: Hawaii, California, Arizona and Texas.

The above chart covers 38 projects in the database, the majority of them not actually built yet. The project are in 11 states totaling 4.3GWac of solar and 2.6GW/9.88GWh of battery capacity.

We’re also starting to get more pricing data on the ratio of battery capacity (megawatts) relative to the power plant’s inverter capacity (AC). And this matters because due to our interconnection size often being a limiting factor, we’re going to be regularly thinking about how fast we can charge our batteries with our DC oversized solar plant, and how fast those batteries with their many hour of storage can deliver that electricity. Notice in the above chart that all 12 projects in the highly constrained power grid of Hawaii have a ratio of 1:1.

The size of the incremental PPA price-adder for 4-hour storage varies linearly with this ratio of capacites. Staring with the energy storage inverter capacity at ~25% of the solar power inverter capacity, we found the PPA increased by ~$5/MWh. We saw $10/MWh at a 50% ratio, and $15/MWh for batteries sized at 75% of solar capacity. The authors note this is limited sample data, and that there was only a single 1:1 project ratio outside of Hawaii, which didn’t sign a PPA. There was a separate discussion on the fleet of 1:1 ratio Hawaii facilities.

And lastly, energy storage compensation methods vary.

- Five of the earliest hybrid PPAs (in Hawaii and Arizona) simply bundle the storage cost into the overall (in these cases, time-invariant) energy price, with the PPAs further specifying how the storage is to be utilized.

- More recently, three PPAs in Nevada (Arrow Canyon, Southern Bighorn, and Gemini) similarly subsume the storage cost within the energy price, but in all three of these cases the energy price spikes to 6.5x its normal level during five peak hours (4-9 PM) each day in the summer months of June-August, which is presumably when the batteries earn their keep.

- Desert Harvest II provides no direct compensation for storage within the PPA, but given that the PPA is priced at the prevailing local nodal price (plus $15.25/MWh for RECs), the sponsor has an incentive to store energy during the lowest-priced hours (typically mid-day) and deliver stored energy during the highest-priced hours (typically in the late-afternoon).

- In contrast, seven other PPAs (in California and Nevada) compensate the storage component through a separate fixed capacity payment (expressed in either $/kW-month or $/MWh terms).

- Meanwhile, the eight most recent Hawaii projects are all using the new “Renewable Dispatchable Generation” PPA, through which the PV+battery projects are paid a lump sum (rather than a volumetric $/MWh rate) for being available to be dispatched by the offtaker.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Do you have an index of Utilities across the US and the Fastest-to-Slowest ones for PTO times after install? Asking for a friend.