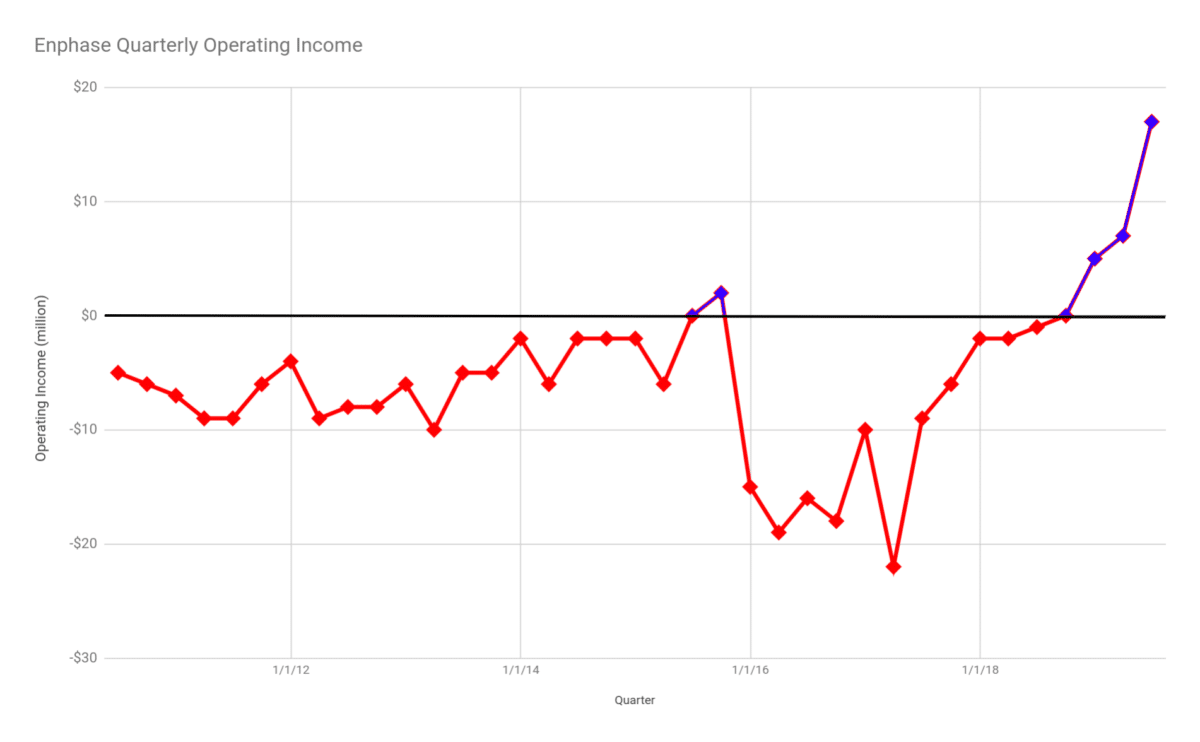

Enphase’s biggest story started in 2017, when margins were low and the company lost over $20 million in the first quarter of the year. The current chapter of this story has Enphase shipping 1.2 million microinverters totaling 416 MW, earning $17 million in operating income, $11 million in profit, and three straight quarters of solid profits. The company’s revenue is up 77% over the last twelve months, with their quarterly profit improving by $14 million during in that period.

With the solar industry expecting to grow 25% in 2019 and Enphase being sold out through the end of the third quarter, launching new products, expanding and extending within current markets, there is reason to think that the company can sustain at least some of this momentum.

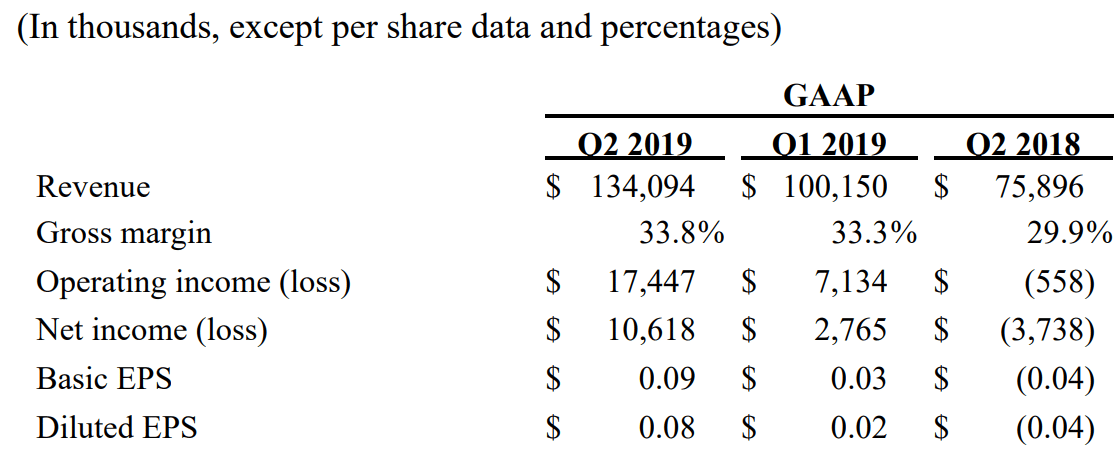

Enphase’s GAAP revenue was $134 million, noted in its quarterly letter to investors (pdf), its operating income was a positive $17 million, with an operating margin of 13%. Compared to a year ago, the revenue increased by 77% from $76 million. The company’s operating income increased from a loss of $558,000 by 33x, with net income’s profits coming from a deeper loss of $3.7 million to a positive $11 million.

Over the last four quarters, Enphase’s net income totals just under $12 million, and the company exited the quarter with $206 million cash on hand.

In the middle of Q1 this year, Enphase thought it important enough to publicize that it was at a 13-15 week backlog that was slowing revenue growth, and the company hoped to have it down to 6-8 weeks by Q3-4. On the call, company officials noted they were sold out through the end of Q3 – one day short of nine full weeks.

Home Management

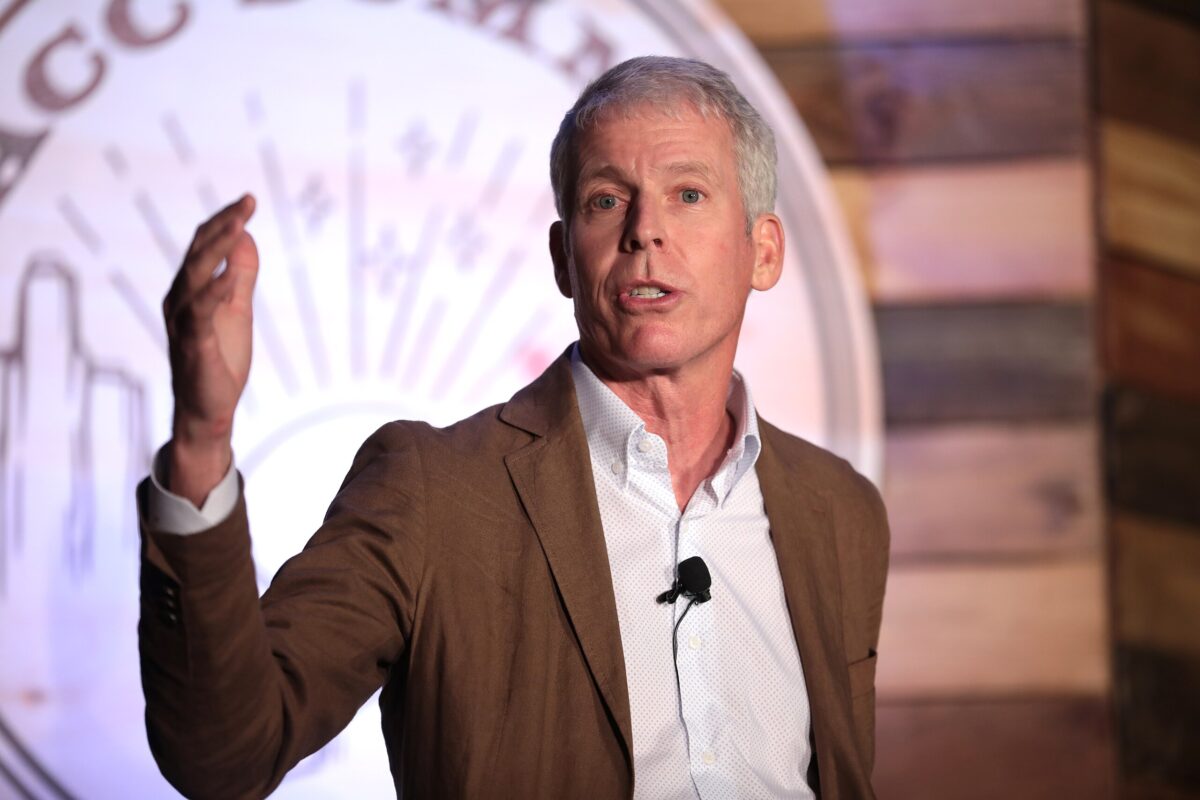

While many technical topics were covered – including much chatter on the coming IQ8 launch, President and CEO, Badri Kothandaraman also got into the big picture. First he stated that “we are working on transforming Enphase from a solar microinverter systems company to a home energy management systems company” – then later got a bit more specific:

We expect to release new products over time with advance hardware and software capabilities to manage consumption in a fine-grained manner, both at a breaker level as well as the appliance level. We will provide details of these products in the coming quarters.

Already, the coming Enphase IQ8 suggests some sort of appliance-level understanding in how it is able to instantly able to react to items turning on and off. Now, Enphase is seeking to explicitly understand every item in your home – and is going to sell that knowledge to you, allowing you to become better at managing it.

The company revealed breaker-level electricity usage knowledge (akin to Sonnen and Eaton’s WiFi breaker switch), and then stated the goal was “fine grained” appliance level information. Does this mean Enphase is going to offer wall plugs in addition to a circuit panel? Little WiFi units that you stick at the end of all things plugged in? With the IQ8 product being described as off-grid, it could mean that the company will offer a solution similar to off-grid companies today who give a full circuit panel with their hardware solutions.

What we do know is that in coming quarters products will be announced, and that we ought consider this trend of the solar power inverter extending its reach from solar to take over the home electricity systems. Already, electric utilities are using home inverters to replace their own power grid hardware (Sonnen and Tesla). And as noted above, off-grid inverter companies have been managing the central electric panels for decades already. As well, the quietly growing gorilla is vehicle-to-grid – with SolarEdge and Tesla sitting at the forefront of integrating these large, underutilized moving batteries into our home lives.

Other Revenue Streams & Ongoings

As a component shortage issue (component noted in bottom of article) is slowly brought under control, starting this summer, Enphase is now “on track” to deliver 2 million microinverters per quarter starting in the fourth quarter of this year. If the 2 million unit number is hit, that will be almost triple the 675,000 units delivered one year ago.

The company’s AC Energize program has now signed up 500 installers who know how to install solar modules with factory integrated Enphase microinverters.

Enphase said it is nearing completion of the “final requirements” of IQ8, having shipped 1000 units to a partner in Q2. The company hopes to increase this value in Q3 – but would give few details on this other than that they’d not talked about it much as the original launch date had slipped, the 4th quarter was the current focus, and they “were keeping their head down”.

Another very interesting revenue stream was revealed – one that is unique to others in the solar manufacturing field – the company’s hardware upgrade program launched in 2018. Enphase explained that it has just signed up its 5,000th customer in this program, but specific revenue from the program wasn’t yet broken out.

Enphase also reported that its Mexico manufacturing ramp up, in order to defend against Trump’s tariffs on China inverters, hit a snag when they tried to copy 230 unique processes, and two of them failed. By Q1’20, the company expects that facility to be at 100%, but for it to only ship 200,000 units to the United States during the third quarter. There was a hope to see three full shifts running, but that isn’t expected until after the ramp completes.

The CEO also noted a transformation, described as four gears:

- Energy generation – “the core part of our business today”

- Energy storage – “enabled by the Encharge battery, which is a modular 3.3-kilowatt hour solution – which will soon play a major role in our near-term revenue growth”

- Energy consumption – noted above with the home energy management that, “will provide customers the ability to measure, report and manage their consumption”, and

- Services, noting that the,”existing installed base of more than approximately 940,000 systems worldwide, represents many potential opportunities, including product upgrades for solar and storage, in addition to software services.”

Telling the future…

And just to remind all of us that sometimes we don’t know anything about the coming shape of the world: a company last summer paid money to publish a press release that “questions the reliability of ENPH’s financial statements and estimates its stock to have a fundamental value of ~$1/share, implying 85% downside“. Boy did those folks miss out on something:

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Great story. I am an Enphase long who has been investing and following Enphase for 2 years now. Your story gave really interesting insights into both the longer term vision and the Q call. Keep up the good work. I remember that Bearish story well – seemed like a hit piece and it did hurt the stock price big time for a while. One big upside – it gave us true believers more chances to buy under $5. But as someone who was badly burned by SUNE, it did rattle me.

However the more I researched this, the clearer it became that this was a solid management team behind a really powerful new technology that has the potential to help millions of people around the world and usher in a new world of abundant clean energy. Keep up the good reporting!

I do own 500 shares of enphase