The basis of our modern reality is that economics drive us (right up until the fear of climate change fundamentally alters our pace). And, while the warm and fuzzy aspects of solar and wind power open the doors in our sales calls, it’s the payback in the spreadsheets that closes the deals. Solar power is increasingly fitting into global investment portfolios because of those spreadsheets.

Dividend Solar got the industry’s first AA bond rating recently, increasing volumes of projects are being sold globally for their decades of cash production, quarterly revenues are increasing at solar lease companies who are continually successful at securitizing their products, all the while project developers are getting snapped up for their construction revenue potential.

And now, for the first time in the United States, a not-for-profit Community Choice Aggregation (CCA) group – Marin Clean Energy (MCE) – has received an ‘Investment Grade’ rating from Moody’s.

#Official, CCA in CA validated in ability to offer affordable, renewable, and reliable, electric service. @MoodysInvSvc assign first-time Baa2 Issuer Rating to MCE showing long term financial strength. MCE, 1st CCA to obtain investment-grade credit rating! https://t.co/gj7wRPX0K1 pic.twitter.com/WrvIxyTASK

— MCE Clean Energy (@MCECleanEnergy) May 23, 2018

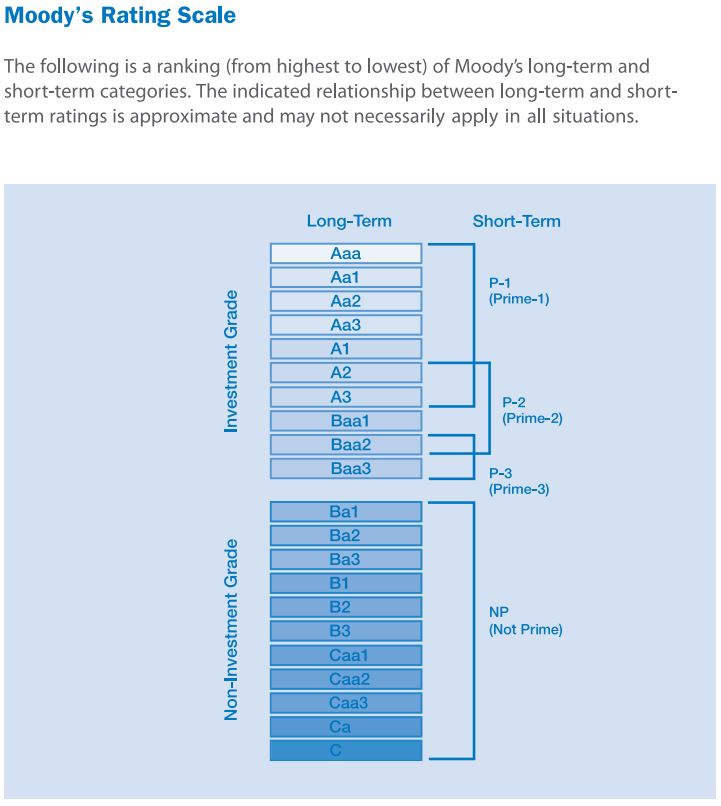

Moody’s Rating Scale and Definitions considers anything above a Baa3 rating to be considered ‘Investment Grade’. Moody’s Rating Rationale goes deep into the logic behind the rating.

The main driver seems to reflect, ‘the strength of the California Joint Power Agency (JPA) statute and the MCE JPA agreement be California Joint Power Agency statute.’ This legal structure in California, along with broader politics, gives confidence to Moody’s that the state will continue to support CCAs.

Additionally, since MCE has continually lower rates than the state’s investor owned utilities, it is expected that long term positive performance will continue.

The greatest future risk that Moody’s sees is in the ability of MCE to procure future electricity generation resources at pricing that will enable it to keep its customer base, and grow further.

The group’s cash reserves were $37 million, and are expected to grow to $60 million in 2019, which would offer 100 days of liquidity. Moody’s noted that if the company were to break 150 days of liquidity, it could lead to a rating upgrade.

MCE has more than 400,000 customers.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.