Two weeks ago, Sunnova, the second-largest residential solar company in the United States, filed for bankruptcy. The announcement heightened concerns that the residential solar market could be nearing collapse, following a 31% drop in installations in 2024, a string of industry bankruptcies, and uncertainty around the future of the federal residential solar tax credit.

Yet even as the company restructures, its solar systems continue operating, and the bond ratings tied to nearly $6 billion in securitized residential solar loans and leases remain stable.

On June 6, shortly after a Sunnova subsidiary (Sunnova TEP Developer) filed for bankruptcy, KBRA (formerly Kroll Bond Rating Agency) issued a statement reinforcing its confidence in the underlying assets:

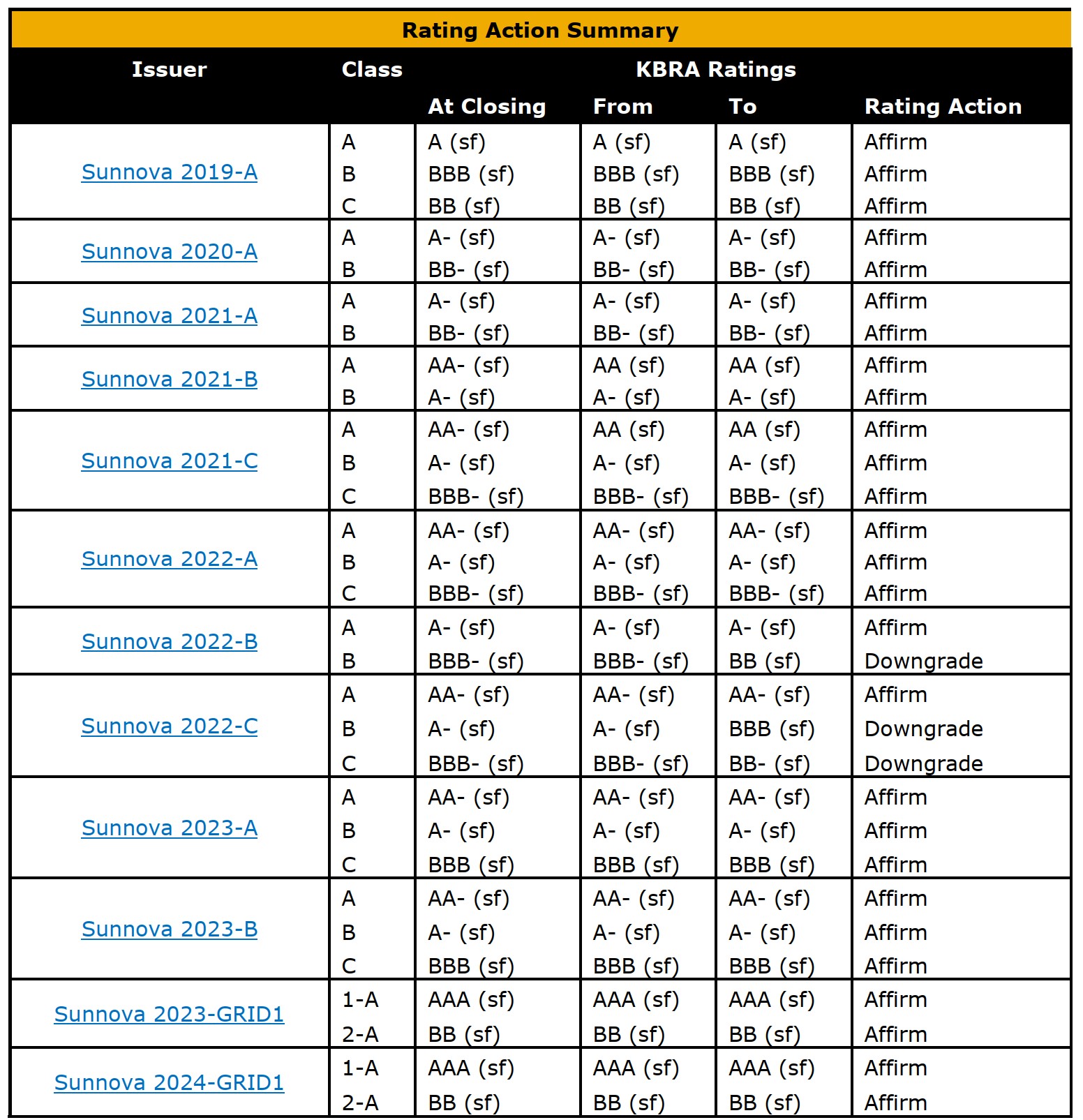

KBRA currently maintains ratings on 30 classes of notes issued from 12 solar loan ABS transactions totaling $2.6B of initial principal balances, and on 21 classes of notes issued from 11 solar lease ABS transactions totaling $3.2B of initial principal balances where Sunnova is the sponsor.

This assessment aligns with KBRA’s Comprehensive Surveillance Report, published May 5, 2025, which outlines structural protections embedded in Sunnova’s securitizations. Each bond deal includes a designated transition manager (either Computershare Trust Company or Wilmington Trust, N.A.) responsible for overseeing the servicer and facilitating a smooth handoff in the event of a servicer or manager termination.

Additionally, all Sunnova bonds structures include a back-up servicer to prevent disruption in billing or paperwork if the original servicer fails.

Strong CNL buffers across transactions

KBRA’s report includes technical metrics that suggest Sunnova’s securitized portfolios are performing well within expectations, and, most importantly, are making their contracted interest payments.

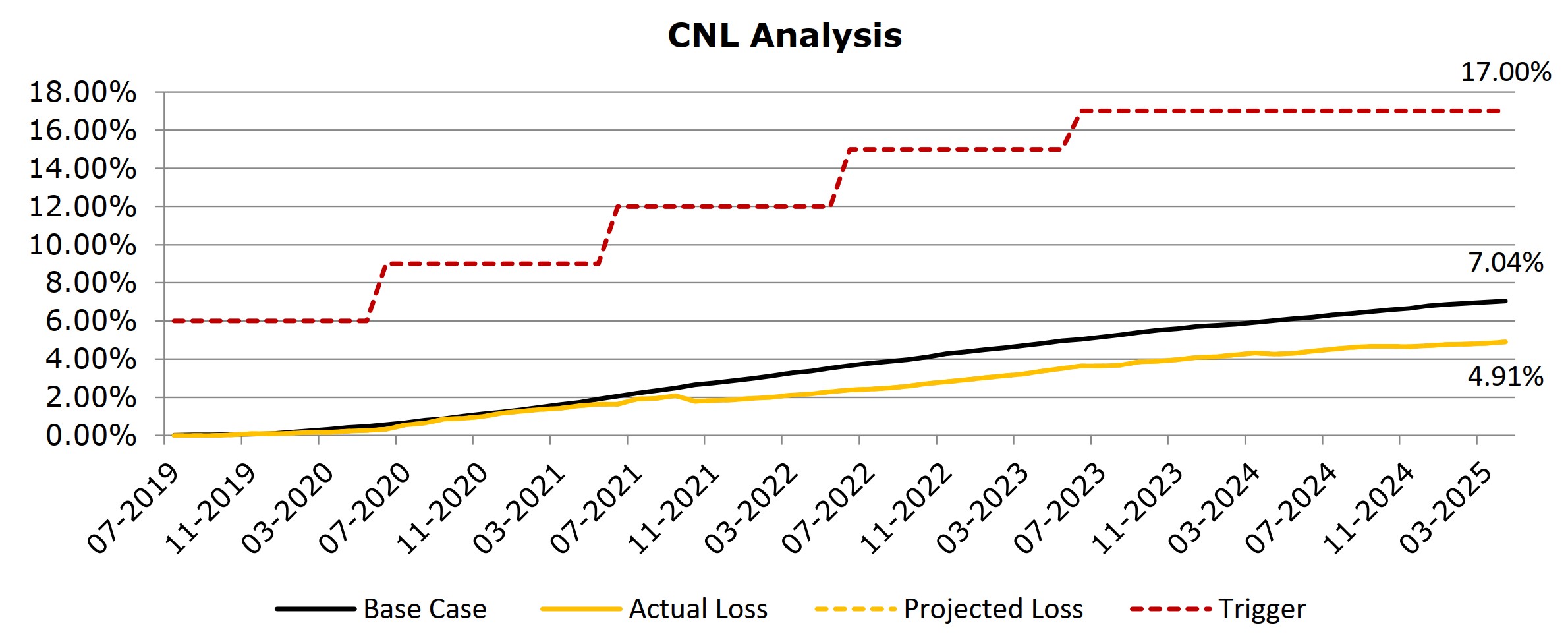

One of the more closely watched indicators in the surveillance report is the cumulative net loss (CNL), which tracks how much of each loan pool has been lost due to defaults or charge-offs. Losses are expected over time, but as long as they stay below a defined threshold, the deal remains in good standing. This threshold, called a trigger, increases gradually over the life of the bond.

Across the $6 billion in portfolios, KBRA highlights a substantial cushion between current loss levels and these triggers. For example, the original 2019-A portfolio of loans has an actual CNL value of 4.91% (meaning 4.91% of leases have defaulted), versus a current allowable trigger of 17%. Currently, over the lifetime of the portfolio, it is projected the lifetime CNL rate will stay under 10%.

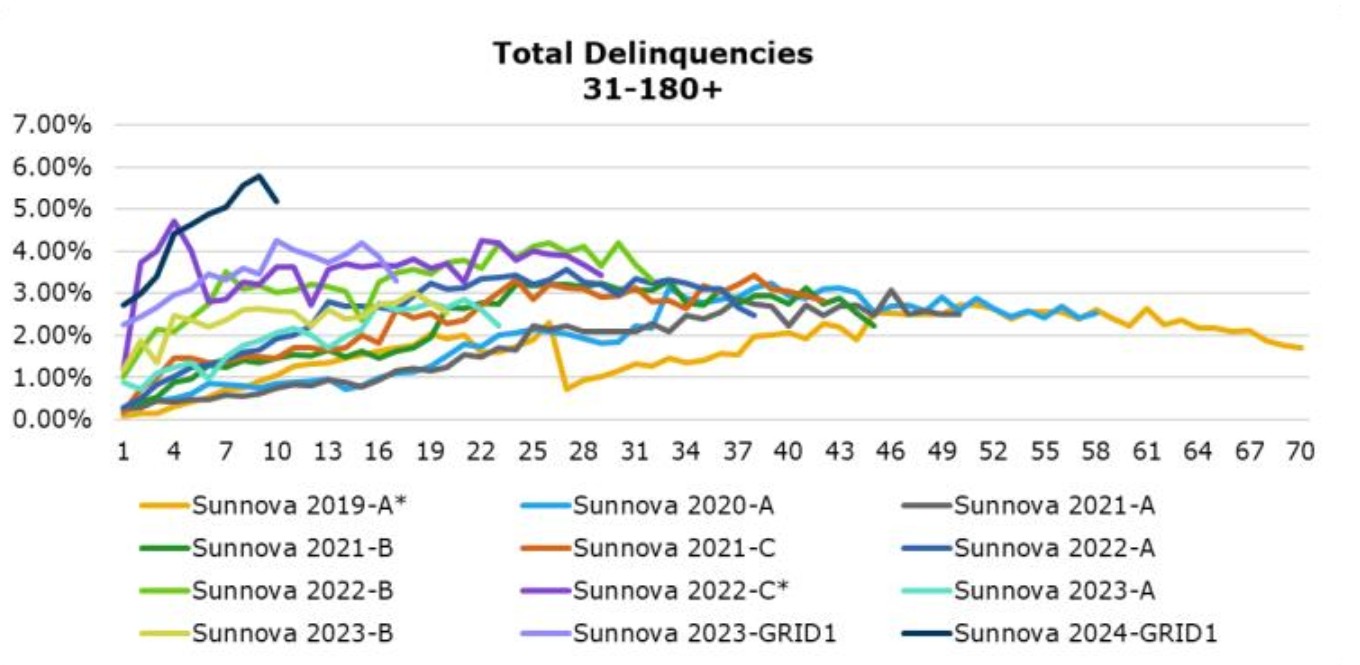

While KBRA’s analysis emphasizes technical metrics like CNL and credit enhancements, many investors place greater weight on the strength of the guarantors. In Sunnova’s two most recent portfolios (Hestia 2023-GRID1 and 2024-GRID1) the Class 1-A notes are backed by the U.S. Department of Energy’s Loan Programs Office.

These programs were designed to expand access to solar for low-income households, allowing credit scores as low as 550. Despite this higher-risk borrower pool and elevated delinquency rates (as seen in the chart above), KBRA assigned the top AAA rating to the senior tranches—reflecting the superior credit quality of the DOE guarantor relative to individual borrowers. Despite recent turmoil, market confidence remains high that the DOE will honor its commitments, supporting the perceived stability of these assets.

pv magazine USA reached out to KBRA on June 23rd, after Sunnova’s full bankruptcy announcement, noting that no follow-up statement had been issued. KBRA confirmed that its outlook on the securitized assets remained unchanged since its June 6 statement and May 5 report, and that performance expectations remained consistent.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.