Clean energy investment and green jobs: Since passage of the IRA, over $240 billion has been invested in clean energy manufacturing and infrastructure projects. This includes over $86 billion invested in nearly 300 new solar, wind and battery energy storage projects, according to a recent report from Intersolar North America and Energy Storage North America. In addition, over 170,000 direct jobs have been created since IRA and the Intersolar report forecasts as many as 1.5 million new jobs in clean energy can be expected by 2030.

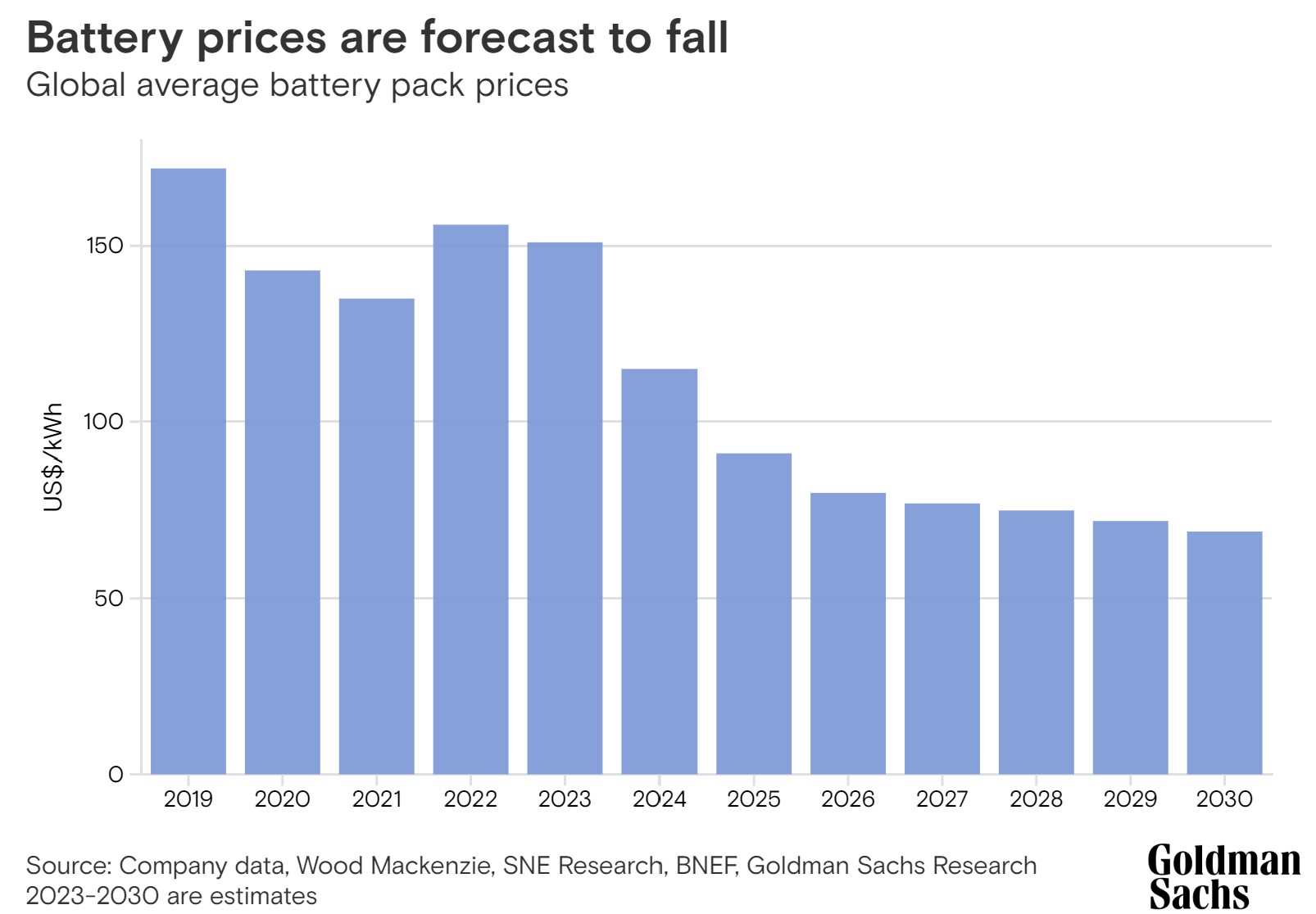

Battery prices tumble: From July 2023 through summer 2024, battery cell pricing is expected to plummet by over 60% due to a surge in EV adoption and grid expansion in China and the U.S. Driven by these price declines, grid-tied energy storage deployment has seen robust growth over the past decade, a trend that is expected to continue into 2024. The U.S. is projected to nearly double its deployed battery capacity by adding more than 14 GW of hardware this year alone.

Another California misstep: California missed another opportunity when the California Public Utilities Commission asserting in its proposed decision on the Community Renewable Energy Act that the Net Value Billing Tariff outlined in the Act “conflicts with federal law and does not meet the requirements” of the bill. Coalition for Community Solar Access (CCSA, a national trade association and the bill’s sponsor, said the CPUC missed an opportunity to become a national leader in community solar.

IRS final guidance on elective pay for clean energy tax credits: The IRS issued its final guidance on the elective pay rules for clean energy tax credits created by the Inflation Reduction Act. The guidance removes any temporary regulations and enacts the final rules. The IRS provided updated elective payment frequently asked questions, which includes a step-by-step guide on how to become eligible for direct pay or credit transfers, and how to file these transactions.

New York bill would increase rooftop solar tax credit to $10,000: Senate Bill S3596B aims to increase the maximum state income tax credit for those who install residential solar projects at their residence. Since 2006, New York’s Solar Tax Credit has been capped at $5,000 per household installing solar. The new bill would double that cap to $10,000, allowing customers to offset state income taxes with a credit. For eligible low- to moderate-income residents, the tax credit would also be available to be collected as a tax refund.

Massachusetts expands net metering: Bucking the national trend of squashing net energy metering, the Commonwealth of Massachusetts instead expanded access, showing a commitment to distributed energy. It used to have an exemption for small systems of 10 kW or less, but this cap is now lifted to 25 kW, and behind the meter systems over 60 kW, and up to 2 MW are now exempt from the cap. The Department of Public Utilities expects to save ratepayers $10 million with the regulatory change.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.