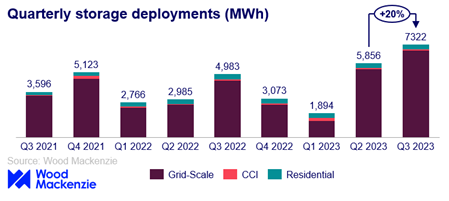

The recent surge in energy storage installations in the U.S. is seen in both residential and grid-scale sectors, while commercial and industrial saw a slight decline quarter-on-quarter, according to the recent Wood Mackenzie and American Clean Power Association (ACP) US Energy Storage Monitor report

The cumulative volume installed across all sectors between Q1 and Q3 of this year totals 13.5 GWh, compared to the 12 GWh installed in all of 2022. It would have been much higher, noted Vanessa Witte, senior research analyst with Wood Mackenzie’s energy storage team, had 80% of projects in the pipeline being delayed.

In Q3 grid scale increased deployment by 37% quarter on quarter for 2.2 GW/6.8 GWh. This boost led to a record-breaking quarter for both MW and MWh installed.

“Energy storage deployment is growing dramatically, proving that it will be essential to our future energy mix,” said Frank Macchiarola, ACP chief policy officer. “This industry will serve as the backbone of our modern grid. As we continue to build a strong domestic supply chain, streamlined permitting and evolving market rules can further accelerate the deployment of storage resources.”

Source: US Energy Storage Monitor | Q4 2023, American Clean Power Association and Wood Mackenzie

The grid-scale sector’s 2023 forecast increased just slightly due to strong Q3 volume, however, the remainder of the forecast lowered by 7% on average. This sector faced multiple challenges, which caused volatility in the market and hindered project completion, according to Witte.

“Grid-scale declines were more focused on challenges not only with supply and permitting, but also with the backlog of applications in most ISOs interconnection queues that are preventing projects to move through the development process,” said Witte.

In the community, commercial and industrial (CCI) storage sector, deployment fell 7% quarter on quarter, with an estimated 30.3 MW and 92.9 MWh installed. While California had a growth of 35% in energy storage this sector in Q3, Massachusetts recorded none, which lowered the overall percentage for the nation.

Interconnection queue issues affect all solar sectors but was especially felt with CCI deployment. Despite challenges, which also include state incentives and community solar programs, the CCI sector is forecast to double in 2024, and to “become a larger share of the forecast in 2025 and beyond, which will bring more geographic diversity to the U.S. market,” said Hanna Nuttall, a research analyst with Wood Mackenzie’s energy storage team.

The residential energy storage segment contracted 14% over 2022, deploying a combined 88.31 MW in Q3. California had a slow first half of the year when it saw a contraction of 31% over the first half 2022. But it did much better in Q3 with 78.4 MW of energy storage deployed, an increase of 35% year over year.

Regional deployment

Regionally, California almost doubled its installed capacity of energy storage quarter over quarter to finish with 78.4 MW installed—the largest increase in the country. All other states deployed a combined total of 88.31 MW, a slight decrease over Q2, which saw 89.53 MW deployed.

At the grid-scale level, California and Texas had 694 MW and 758 MW installed, respectively, accounting for 67% of Q3 capacity. Arizona came in third with 508 MW installed.

The CCI sector is strong in California and is expected to double in 2024 as California opens its community solar-plus-storage program.

The 2023 residential forecast increased by 4% as the California market began to pick up in Q3 after the passage of NEM 2.0. The residential segment is expected to double between 2023 and 2025, but growth slows later in the forecast period as solar penetration increases in California.

Looking at the duration of grid-scale storage by region, the report indicates that California California led with 2.7 GWh for a 40% share of Q3. Texas came in second, with 1.5 GWh. The average duration for the quarter clocked in at 3.1 hours.

Key drivers

Drivers of energy storage markets include price declines coupled with lower demand for electric vehicle batteries. The report estimates that, for example, median grid-scale lithium-ion battery storage system prices declined 23% quarter over quarter as a result of easing supply chain challenges and lower commodity pricing.

Where prices are increasing is in balance of plant (BoP) and engineering, procurement and construction (EPC), which the report contends is mostly due to high labor demand along with administrative cost increases due to try to meet the new prevailing wage and apprenticeship requirements brought about by the Inflation Reduction Act.

While the future looks bright for energy deployment, the report revised the Q2 forecast down 5%, estimating that the U.S. storage market will install approximately 63 GW between 2023 and 2027 across all segments.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.