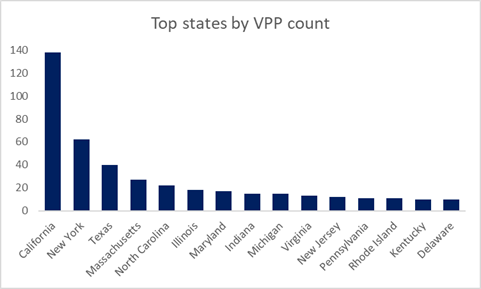

California dwarfs all virtual power plant (VPP) markets in North America, housing 24% of projects in the region, according to Wood Mackenzie’s ‘North America VPP market: H1 2023’ report.

“VPPs continue to receive growing attention from the energy industry. Our new market study unveiled California as the clear leader, containing more VPPs than the three follow-up U.S. states combined,” said Ben Hertz-Shargel, global head of Grid Edge at Wood Mackenzie.

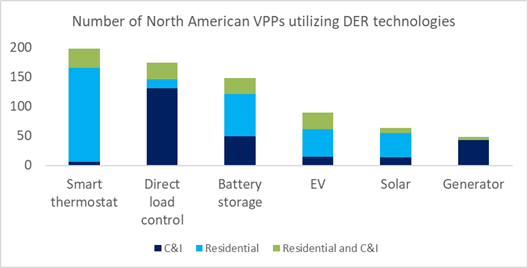

VPPs are aggregations of distributed energy resources (DERs) that provide grid services to utilities and wholesale markets. The U.S. Department of Energy’s (DOE) Loan Programs Office (LPO) says a VPP is a virtual aggregation of DERs like solar, energy storage, EV chargers and demand responsive devices (such as water heaters, thermostats, and appliances). Jigar Shah, director of the DOE LPO, sees VPPs as providing more than just decarbonization and grid services, increasingly giving grid operators a large-scale and utility-grade alternative to new generation and system buildout through automated efficiency, capacity support, and non-wire alternatives. He noted in the article Real barriers to virtual power plants that “by deploying grid assets more efficiently an aggregation of distributed resources lowers the cost of power for everybody, especially VPP participants.”

Wood Mackenzie determined that VPPs are highly market dependent. The top four states by VPP deployment, California, New York, Texas, and Massachusetts, are located within an organized retail power market, but also offer aggregator-friendly standard offer programs for distributed energy resource (DER) capacity. The California solar market was recently dealt a serious blow in December when the California Public Utilities Commission adopted Net Energy Metering 3.0 . As is often the case in the technology world, the U.S. will be watching California’s response to the rollout of NEM 3.0 as an indicator for how their state’s respective utility commissions will adopt rulemaking changes and how its market participants pivot around new rules. Many solar companies see California as a market ripe for VPPs. For example, PearlX, self-described as a flexible energy provider, recently announced the launch of a multi-family virtual power plant (VPP) service in California dubbed ‘Flexifornia’.

Utilities are also seeing the advantages of VPPs. Swell Energy, a VPP and DER integrator, partnered with the Sacramento Municipal Utility District to aggregate 20 MWh of residential battery capacity and 10 MW of co-located solar power capacity into a residential VPP system.

Source: Wood Mackenzie, North America virtual power plant (VPP) market, 1H 2023

The landscape of VPP operators is highly concentrated, with seven having over 1 GW of disclosed capacity under management. The top four, CPower, Enel, AutoGrid, and Voltus, have portfolios greater than 4 GW in North America, which would place each within the top ten largest independent power producers in the U.S. backseat to the supply side. We are seeing that change, a trend that will accelerate given transmission constraints, generator interconnection delays, and regulator recognition that demand response is an essential tool to prevent grid failure,” Hertz-Shargel said.

Source: Wood Mackenzie, North America virtual power plant (VPP) market: 1H 2023

According to the report, EVs have not reached the level of penetration in VPPs that behind-the-meter batteries have. Nearly all participation today involves charging curtailment, with vehicle-to-grid functionality remaining at the pilot phase. This may change, however, as EVs and EV charging systems proliferate. President Biden set a goal of building out a national network of 500,000 EV chargers, which got a boost with the announced funding to accelerate the creation of zero-emission vehicle (ZEV) corridors that expand the nation’s EV charging infrastructure. A recent Wood Mackenzie report forecasts that the fast EV charging market will grow sixtyfold by 2050. Such growth will bring opportunities for EVs to shore up VPPs.

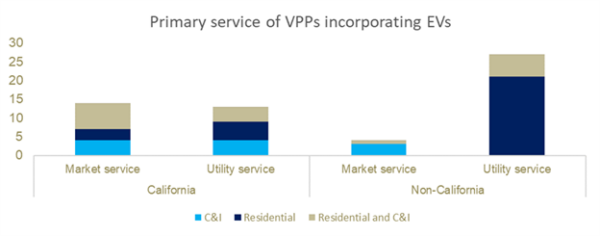

The Wood Mackenzie analysis found that among the 50% of VPPs that incorporate EVs outside of California, very few are market integrated, with 68% participating in utility residential demand response or managed charging programs.

Source: Wood Mackenzie, North America virtual power plant (VPP) market: 1H 2023

“Considerable first-mover advantage therefore remains to bring EV flexible capacity to utilities and wholesale markets. This is particularly true for public EV charging stations and commercial and municipal fleet depots, many of which will be deployed with collocated storage and will be capable of providing advanced grid services,” Hertz-Shargel concluded.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Most Cal if not all VPPs are poor, using it rarely with little money going to the customer that has $9k batteries to pay off.

Texas utilities that by, sell at demand pricing, it a far better deal.

So to open it up you need a open utility market that utilities can do this and people get paid for what they make, buy and when.

Eventually they need to just take a 10% cut of the action since all it costs is a computer to keep track.

And V2G with most auto allowing it except Tesla that fears the storage competition, will be in high demand in 2 yrs as news spreads. Since no measurable impact on EV pack life done right and the bidirectional charger doesn’t cost more, it is basically free storage and in 4 yrs, a TWh and the next yr another TWh of storage in the US, it will be far bigger than anyone thinks now.

Agreed. Maybe the most significant transition will be solar parking lot canopies with integrated stationary storage batteries & V2G chargers at existing large, widely distributed parking lots, like at large apartment & condo developments, neighborhood shopping centers, business parks, hospitals, schools & other common public facilities. This can happen quite rapidly,… with standardized technology, expedited local approval & an existing trained workforce. People who oppose utility scale solar “farms” on existing farmland or environmentally sensitive habitat are unlikely to oppose solar canopies shading large existing parking lots.

This is the quick way to reduce utility & transportation costs for tenants of leased commercial property by producing & storing reliable power right where most energy is consumed, and create a matrix of reliable networked neighborhood micro grids. Accomplish all this without expensive new land acquisition or long distance utility transmission spending. Widely distributed, cheap, reliable neighborhood power production & storage instead of remote, unreliable utility monopoly power.

With H2/FCV trains & maritime transports starting up in Europe, another huge addition to V2G will soon be available. Dual-use is only going to get bigger…and likely cheaper.