Kayne Anderson Capital Advisors, an energy private equity investment firm, announced the launch of the Kayne Anderson Renewable Infrastructure Index (Ticker: KRII) in conjunction with S&P Dow Jones Indices.

The renewable index fund is a modified floated-adjusted market cap weighted index comprised of public wind, solar and energy storage companies, as well as related companies, which stand to benefit from the energy transition toward carbon-free energy.

As of September 30, the index fund was heavily weighted by renewable power producer companies (32%), clean-energy focused utilities (26%), project developers (19%), solar and wind energy YieldCo’s (14%), and biomass and other infrastructure technologies (9%).

By region, the fund is weighted by company geography of the U.S. (38%), Europe (32%), Canada (18%), Australia and the Asia-Pacific region (12%).

The Renewable Infrastructure fund’s top five U.S. and Canadian holdings, as of September 30, are NextEra Energy, Clearway Energy Group, AES Corporation, TransAlta and Brookfield Renewable Partners, with these companies representing 22.3% of the new ETF’s holdings.

Kayne Anderson first began investing in renewable energy in 2013 and has $1.5 billion in renewable energy infrastructure assets under management since launching a renewables-focused infrastructure fund in 2017.

“Renewable infrastructure is one of the most attractive investment opportunities in the global infrastructure sector and this index helps define the universe of publicly traded companies,” said J.C. Frey, co-head of Kayne Anderson’s renewable infrastructure group. “The energy transition is a global megatrend that will benefit the renewable infrastructure sector for the next several decades.”

“While it is clear investors are interested in renewable energy, until now there has not been a transparent index to define the opportunity set for listed renewable infrastructure companies,” said Jim Baker, co-head of Kayne Anderson’s energy infrastructure group. “Just like Kayne Anderson helped establish the MLP sector, Kayne is proud to collaborate with S&P Dow Jones to launch what we believe will be the index that helps define the sector as an asset class.”

Other index funds that measure and follow the performance of public renewable energy companies include Invesco Solar ETF (TAN), iShares Global Clean Energy ETF (ICLN), the NASDAQ Clean Edge Green Energy Index Fund (QCLN), and S&P North America and Europe Clean Energy Index.

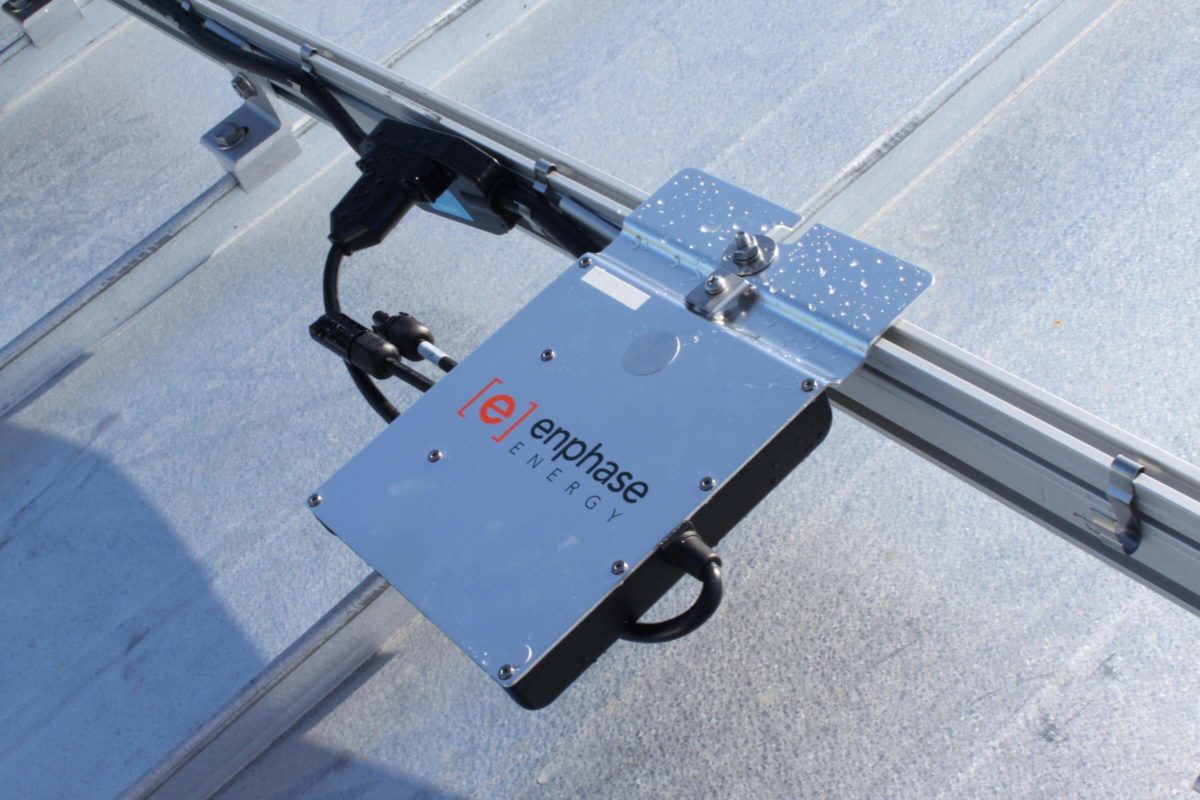

Companies that are followed on most of the indices include Enphase Energy, First Solar, SolarEdge Technologies, Sunrun, JinkoSolar and Canadian Solar, among others, including global utilities with renewable energy developments.

Over the last year the pv magazine USA editorial team has published quarterly earnings reviews that provide the latest financial and operational metrics of many of the key North American solar and energy storage technology suppliers found on these indices, such as FTC Solar, REC Silicon and Canadian Solar, as well as others engaged in rooftop solar and commercial solar development.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.