Distributed standalone energy storage continues to be an in-demand technology in the Texas ERCOT region, as a new joint venture between Regis Energy Partners and Excelsior Energy Capital dubbed REX Storage Holdings committed $400 million to energy storage development in the region.

The portfolio begins with the announcement of four distributed standalone 9.9 MW battery energy storage systems. Regis Energy Partners will operate as independent developer, owner, and operator, while Excelsior will act as an investment fund. The initial four battery systems are expected to come online in 2023.

Energy storage developer Stem will provide battery hardware and operate its AI-powered energy management software system. Stem will also offer in-market solutions for ERCOT development and provide ongoing services once the batteries are operational.

“The energy storage market in Texas represents a significant growth opportunity for leading renewable energy investors like Excelsior who recognize the rich merchant revenue opportunities in the ERCOT market. Stem has spent the past decade helping project developers and independent power producers (IPPs) get projects to commission and drive higher economic output with our AI-driven Athena platform, energy consulting and support services, and ability to manage and optimize projects over time. We will continue to partner with regional developers like Regis to collectively help investors achieve their energy optimization goals in the region while accelerating the adoption of renewable assets,” John Carrington, chief executive officer of Stem

Standalone energy storage systems now offer greater value under the Inflation Reduction Act of 2022, which extends the 30% investment tax credit to the technology. Previously, only co-located batteries paired with renewable energy generation were eligible for the credit.

Texas grid to benefit from distributed storage

In 2021, Winter Storm Uri became a landmark example of the unpredictability of climate, and its harsh impact on the legally mandated core requirements of electric utility companies: to provide electric service reliably and to furnish just and reasonable prices to customers.

The electric grid’s functional collapse during the storm was an example of the ERCOT grid’s failure of achieving those mandated goals. By some estimates, the storm caused $130 billion in near-term economic damages, and the long-term consequences have not yet been fully assessed.

The sudden spike in unplanned-for energy demand caused by extreme weather led to wholesale market spot prices skyrocketing up to $9,000/MW, and that price held for over three days. Historically, the price cap is only hit momentarily, and pressures are relieved quickly.

This unprecedented price spike was caused by a combination of nonfunctioning natural gas equipment, and congestion on the grid from intense localized energy demand, that caused substations to cut power to stabilize the grid. A study by the Federal Energy Regulatory Commission found 87% of the outages were caused by issues with natural gas supply as uninsulated stations failed to function.

A panel at the RE+ event in San Antonio reviewing the ERCOT grid shared that 40,000 power outage events occurred in the U.S. last year, a 50% increase over 2020.

The figures highlight two problems. First, the centralized grid is failing the people who rely on it. Second, the climate is adding more pressure that will need to be dealt with to keep these systems running adequately.

This is where energy storage comes into play, and where intelligent planning of the grid is critical. At RE+ San Antonio, residential installer Sunrun shared that its home battery systems provided 234,000 hours of backup power following Winter Storm Uri. Interest in batteries skyrocketed, with hits on Sunrun’s battery-related website pages increasing 350% in the direct aftermath. This backup was about more than just comfort, but also about safety. Uri took an estimated 246 lives in Texas.

The financial cost of such events is massive, too. Retail energy providers who did not properly hedge against the risks of the volatile ERCOT wholesale market were hit with fees so sharp that many went out of business overnight. Homeowners in predatory contracts were also exposed directly to the wholesale market, and many were faced with multi-thousand-dollar utility bills.

Congestion on the grid was a key cause of the problem. Delivering power from generation centers in remote places across long distances to load centers in large cities often runs into bottlenecks, leading to curtailment and scheduled blackouts.

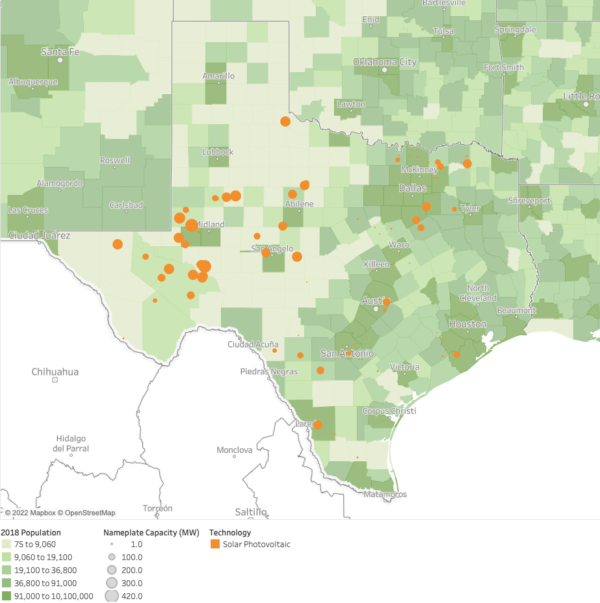

A vast bulk of the large-scale solar projects are in the western, sunnier part of Texas, and are delivered to population centers in the east. The issue can be looked at as a microcosm of the entire United States, where legislators are suggesting building a transmission superhighway from the west to the eastern seaboard.

Congestion rents, or the cost of transmission services, are expected to worsen in many areas across ERCOT, despite hundreds of millions of dollars planned to build transmission to alleviate the congestion.

Image: ERCOT

Solar and batteries can serve a critical role in alleviating this congestion, reducing renewables curtailment, smoothing the curve of wholesale market demand spikes, and providing critical backup power in times of crisis.

When located closer to load centers, or the location of energy demand, batteries can readily dispatch backup power. By locating the batteries as “nodes” further down the grid, pressure is taken off key bottlenecks like substations, which shut down in times of extreme peak demand, and are extremely expensive to upgrade.

Batteries can also serve as peak-demand shavers, avoiding those massive spikes in wholesale market volatility. This is the main way they are currently deployed in ERCOT, and peak demand shaving represents a massive market opportunity. At RE+ utility-scale solar and storage developer 8-minute energy shared that 95% of the revenue generated by a two-hour duration battery is earned in the first hour of dispatch. 8minute said the market opportunities for batteries could be improved, if “predefined revenue streams” are created, like in the capacity-based, forward looking market of California’s CAISO grid.

This article was amended on December 13, 2022 to reflect the fact that the four projects are each 9.9 MW, rather than a combined total of 9.9 MW as previously stated.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.