If consumers could vary their electricity consumption up or down based on wholesale electricity prices, demand for power would be more flexible. That would help balance variable renewable generation, and yield annual system savings of $33-50 billion nationwide across several scenarios, found a modeling study by Pacific Northwest National Laboratory.

Most of the savings would result from lower capacity payments to hold generation capacity in reserve to meet peak load. Reserve capacity can help prevent steep increases in wholesale energy prices when power demand surges, or many generators go offline. The demand flexibility from real-time pricing would reduce peak load, reducing the need for reserve capacity and the amount of capacity payments, the study found.

Additional savings would result from lower wholesale energy prices and greater consumption of energy when prices are lowest, for instance at times of high renewable generation. Customer electric bills would be reduced by up to 17% for participants, and by 10% for non-participants, in a moderate renewables case.

Pilot studies

Following a pilot study in southern California that showed real-time pricing worked on a distribution circuit, utility SCE has launched a follow-on $2.5 million real-time pricing pilot to help prepare for potential extreme summertime weather. The pilot is open to residential, commercial, and industrial customers with price-responsive end-uses, such as electric vehicle charging, behind-the-meter batteries, and controllable loads, which are equipped with suitable software.

Also in California, state regulators approved a $3.25 million pilot program to offer dynamic hourly pricing for agricultural pumping loads. Regulators directed utility PG&E to implement the pilot in coordination with community choice aggregator Valley Clean Energy, which proposed the pilot. VCE’s agricultural pumping load represents 15% of its annual load.

For a real-time pricing pilot project that will involve residents of three rural communities in Maine and New Hampshire, the US Department of Energy has granted $6.65 million. The Post Road Foundation is leading the project, which involves New Hampshire Electric Cooperative and Efficiency Maine, a quasi-state agency.

“Several jurisdictions currently offer real-time pricing rates,” noted the California Public Utilities Commission, in a decision approving the two California projects. Those include ComEd and Ameren in Illinois for 30,000 customers, Georgia Power for 2,000 customers, and Spain, where it is the default rate for 10 million customers, the commission said.

Sending prices to devices

For its modeling study, researchers at Pacific Northwest National Laboratory modeled the consumption of electricity under real-time pricing in the ERCOT grid region in Texas, which they considered generally representative of the United States, and which enabled them to compare their modeled end-loads to actual end-loads in ERCOT. They then scaled up the results to the United States as a whole.

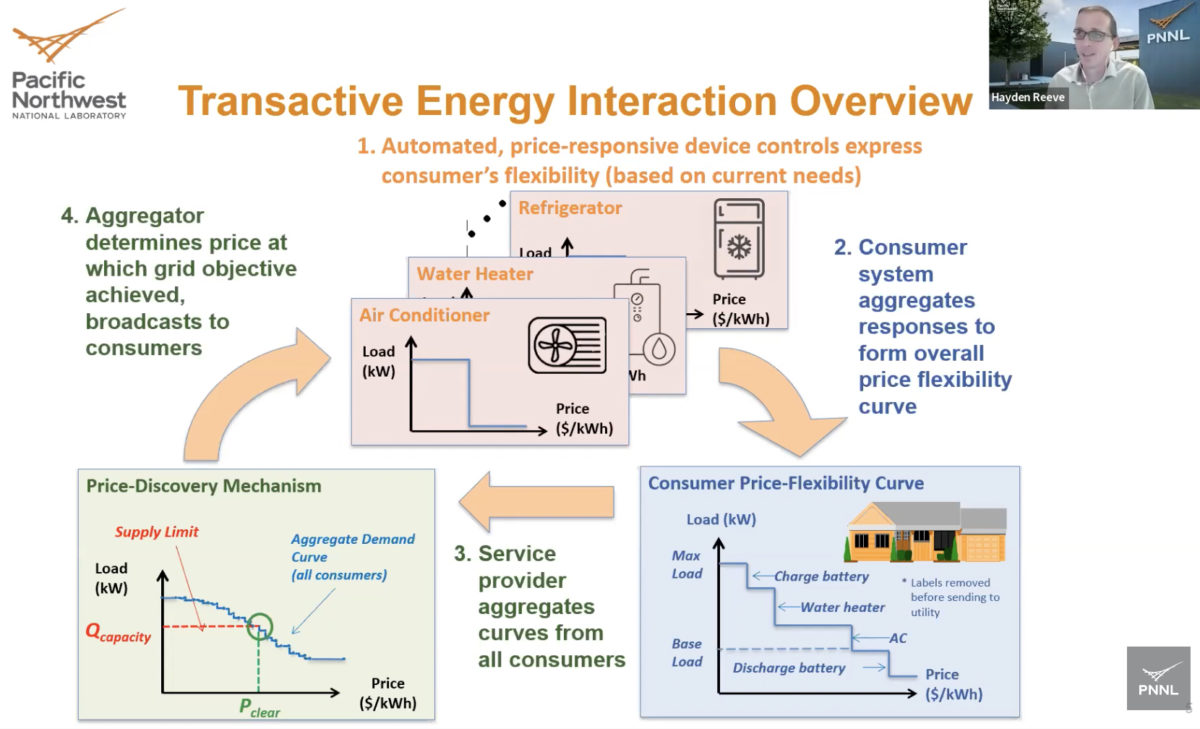

As shown in the featured image above, the modeled system requires automated, price-responsive device controls, a price-flexibility curve set by each consumer, a service provider that aggregates those consumer choices, and a price-discovery mechanism that determines the price at which the grid objective is achieved. That price is then sent to the device controls, to achieve the grid objective, explained Hayden Reeve, senior technical advisor at PNNL, in a webinar. The modeling used both day-ahead and real-time wholesale energy prices.

The real-time pricing scheme modeled by researchers involved four price elements: the wholesale locational marginal price of electricity, a congestion cost, a distribution cost, and a fixed meter charge. The congestion cost was not modeled as revenue to utilities, but was distributed back to customers.

The modeled scenarios involved two separate deployments of distributed energy resources: flexible loads (HVAC units and residential water heaters) and behind-the-meter batteries. Each type of deployment was evaluated under a business-as-usual case, a moderate renewable generation scenario, and a future higher-renewables scenario that included the deployment of rooftop solar and electric vehicles.

Although ERCOT does not have a capacity market, the researchers modeled a system with a capacity market, in order to represent the entire United StatesMaine where capacity markets are widespread.

Texas has outlawed retail rates indexed to wholesale prices, following surging wholesale prices during the Texas freeze, noted Reeve, during a presentation on the study at a conference organized by IEEE, the global society of engineers. Reeve questioned the state’s use of “a five-minute economic signal to guide multi-decade investments,” and suggested that end users should be protected by capping price signals. “Beyond that, there’s open space in terms of what is the right economic signal to make these multi-decade investment strategies worthwhile to people.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Fixed by the PUC in each state, Time of day pricing would work if the lowest price for electricity is the same time daily 7 days a week and from 10:00 AM to 4:00PM daily year around with the permanent implementation of year around daylight savings time. When Solar is at its peak, it needs to be used up to get the greatest value. Some utilities that have GAS in their Name make 1:00AM to 11;00 AM their low rate so they can keep their Gas Fired power plants making money then make their peak priced time 4:00 PM to 9:00 PM when everyone gets home from work, turn on their heat or air conditioning and makes dinner.