When assessing states on the basis of their commitment to the transition to renewable energy, attention almost always goes first to how much renewable capacity each state has operating. The states typically lauded as solar leaders are typically those with the multi-GW capacity, like California, Texas, Florida, New York, and Massachusetts, among others.

Enter Vermont. With roughly 400 MW of solar installed to date, it would be easy to write the state off as another middle-of-the-pack adopter, putting some capacity on line, but not fully embracing solar. Vermont, however, is New England’s least-populous state, and those ‘meastly’ 400 MW serve just over 16% of the state’s electricity needs, more than every state listed previously, save for Massachusetts (20%) and California (25%).

On the policy side, rating Vermont’s commitment to renewables is a bit trickier. The Green Mountain State doesn’t have a 100% renewable by X date mandate; instead, in 2015, it mandated that utilities reach 75% renewable energy by 2032 – which is arguably more aggressive than the interim targets in most other states. The reason it’s arguable is that Vermont includes hydropower in its renewable mandate, a resource that allows for vast capacity additions across singular projects, but one that is also not viable in many other states, forcing them to look elsewhere for their renewable generation.

In 2019, the state’s largest utility, Green Mountain Power (GMP), announced a decarbonization target of 100% zero-carbon electricity by 2025, and 100% renewable energy by 2030, with specific focuses on installing distributed energy resources, (DERs) like residential solar, and increasing the amount of storage installed in the state. However, both hydropower and renewable energy purchases imported from Quebec both count as renewables to GMP.

Solar in Vermont

As was outlined previously, Vermont is home to 400 MW of installed solar, with just 145 MW expected to come on-line in the next five years, according to predictive data from the Solar Energy Industries Association (SEIA) and Wood Mackenzie. Those 145 MW are 49th across all 50 states and Washington D.C. in that five-year timeframe, however, the new capacity will bring Vermont to roughly 22% of its energy needs met by solar, so it really is much more useful to talk about Vermont on a per-capita basis, rather than gross capacity totals.

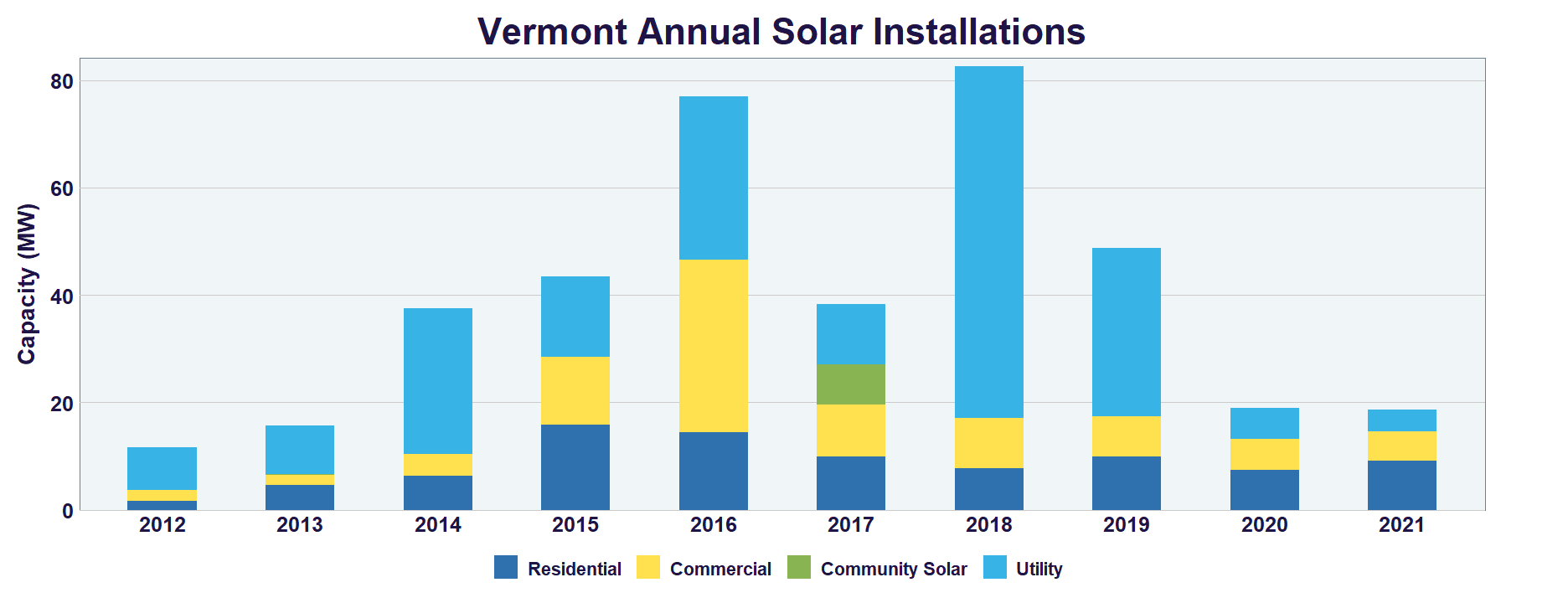

As is illustrated above, much of Vermont’s capacity additions have come via utility scale installations, a fact that holds true in most states. The state has a pretty consistent capacity mix, with a relatively healthy residential market and a very strong commercial and industrial (C&I) market.

Incentives and Programs

Outside of the federal investment tax credit (ITC) for solar installations, solar hopefuls in Vermont have a handful of different incentive and rebate programs available to them, provided by both the state and utilities.

In addition to the Federal ITC, Vermont also has a 6.24% state-level credit for solar systems activated on or before 12/31/2022. After that date, the credit steps down to 5.28% for systems placed in service by 12/31/2022, at which point it will drop further to 2.8% indefinitely.

The state also exempts solar projects under 50 kW from statewide property taxes.

Before the system is even designed, homeowners in Vermont have policy peace of mind in the form of the state’s Solar Rights Laws. These laws forbid any sort of ordinance, bylaw, or other binding agreement to be instituted that would prohibit the installation of a solar system, though size and orientation restrictions are still allowed, assuming they don’t affect a potential project’s overall generation or economic viability.

Vermont, like every other state except Tennessee, has a statewide net metering program. Generally available to systems up to 500 kW, the rate at which customers are credited for their excess generation varies from utility to utility, though it is consistently about a cent per kWh lower than the base rate for electricity purchased from the utility. For GMP, the utility which covers about 75% of the state’s landmass and most of its population, the rate is 14.84 cents per kWh. For Vermont Electrical Cooperative customers, the rate is just under 16 cents per kWh.

The state previously had a cap on net metering, wherein the cumulative capacity of net-metered systems was limited to 15% of a utility’s peak demand; however, this was eliminated in 2017.

GMP also offers Tesla Powerwall and Bring Your Own Device (BYOD) home battery programs. The BYOD program is an open incentive system for customers looking to add a battery, while the Powerwall program allows customers to lease a system at a flat rate that provides savings over a standard installation.

The BYOD program offers customers up to $10,500 in upfront incentives to purchase their own batteries through local installers. The program is set to support at least 500 customers annually, until the 5 MW yearly storage cap is reached. Under this program, participating customers agree to provide access to stored energy during peak demand times, in order to meet demand and drive down the price of electricity. Moreover, the customers have a relatively expansive list of participating battery options to choose from.

The Powerwall tariff allows up to 500 customers to enroll each year, where they can choose to pay $55 per month for two Powerwall batteries in a 10-year lease which covers standard installation, with the option of five more years at no additional cost or just pay $5,500 up front. Akin to the BYOD program, customers agree to share their stored energy with GMP during peak demand times.

Peer-to-Peer Energy Trading

In 2019, GMP launched a real-time, blockchain-tracked peer to peer energy trading platform which allows businesses to purchase solar power from customers who own the rights to the renewable energy credits via a phone app.

The program was developed to run on LO3 Energy’s existing platform, and all transactions will be tracked and verified via blockchain, allowing individuals to transact privately, but still giving GMP the ability to closely monitor the RECs as they’re moved through the marketplace.

Participants will be able to set desired bids to purchase the local attributes. The transactions will happen live, however, GMP will monitor all transactions to verify everything is moving smoothly. The utility has proposed to take a 5% transaction fee on these transactions, paid by the seller of the RECs.

***

Last time, we reviewed the solar incentive profile of Vermont’s’ southern New England neighbor, Rhode Island, a state similarly committed to making solar one of its foundational resources for the future, but in different ways. Our next stop on the 50 states of solar incentives tour will take us out of New England and into the mid-atlantic.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.