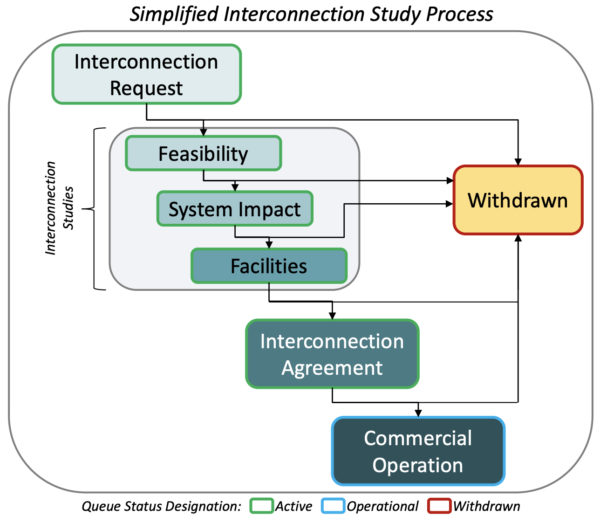

To build a utility scale solar project, a developer must get in line and wait for a facilities study from the transmission provider. That study specifies the infrastructure needed to connect the planned project to the grid, and its cost. The project developer can then pay that cost and sign an interconnection agreement that obligates the transmission provider to build the infrastructure. The project can then be built. A simplified process diagram prepared by Lawrence Berkeley National Lab is shown in the nearby image.

Yet for all the publicity about the vast amounts of solar and storage projects in the interconnection waiting lists, or queues, data are sparse regarding the pace at which transmission providers complete facilities studies, so that the projects may be built.

Solar project developers have recently highlighted the problem of delays by transmission providers and high cost quotes for interconnection facilities. Solar-focused trade associations have said that interconnection studies could be completed in months, not years, and have asked federal energy regulators to speed the process by establishing enforceable timelines and competition. And a law professor has suggested public control of regional grid operators, also known as RTOs and ISOs.

Because regional grid operators are the transmission providers in most of the U.S., much of the attention so far has focused on them.

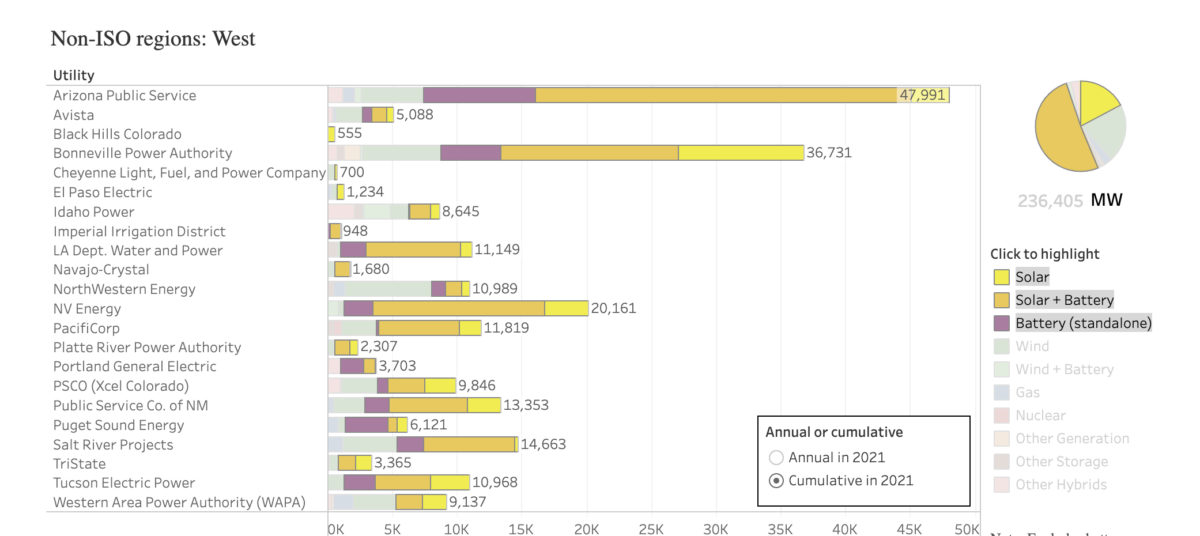

But in the Southeast and much of the West, there is no RTO or ISO, and utilities are the transmission providers. Solar projects totaling 136 GW are waiting in the interconnection queues of utilities in the West, as shown in the featured image above, and 58 GW are in the queues of utilities in the Southeast, as shown in a Berkeley Lab report.

So we reached out to 10 utilities in each region that have the largest amounts of solar in their queues, to ask about the facilities studies for solar projects they completed last year.

Only one, Los Angeles municipal utility LADWP, provided the requested information, reporting that it completed facilities studies for 835 MW of third-party solar projects last year, and for 530 MW of third-party storage, with both values including solar-plus-storage projects.

Berkeley Lab studies

Berkeley Lab reported last month on power plants seeking transmission interconnection as of year-end 2021, based on publicly reported data on interconnection queues and non-public information. Their study sampled 30 projects that entered interconnection agreements with Western “non-ISO” utilities in 2021, and found those projects had been in the queue for a median of about 32 months; in other words, half had been waiting longer. The study reported that interconnection requests have soared nationwide in recent years, with requests totaling over 600 GW added in 2021, which suggests that wait times could increase unless transmission providers have increased their capacity to complete studies.

Berkeley Lab analysts noted in a February study that although the federal energy regulator FERC requires transmission providers to provide data on their pace of completing interconnection studies, under FERC Order 845, “trends are not yet apparent” for the RTOs and ISOs they studied, because those data only became available beginning in January 2020, for a total of 21 months at the time of that study, while the time from an interconnection request to an interconnection agreement is typically longer than 21 months. They said they did not collect data that are available for some “non-ISO” transmission providers, that is, utilities in the West and Southeast.

Some utilities in the West and Southeast operate in a single state, suggesting that FERC’s Order 845, as a federal regulation, may not apply to them. Jeff Dennis, managing director and general counsel of trade group Advanced Energy Economy, said that while “some utilities in the West and Southeast are not subject to full FERC regulation, nonetheless, FERC rules can still influence their practices.”

Berkeley Lab is now preparing an interconnection cost analysis for six RTOs and ISOs, which will use a random subsampling analysis because “data collection is labor intensive (i.e., manual PDF scraping).”

Related data

Several utilities provided related data in response to our inquiry. PacifiCorp said that it completed a cluster study last November for projects totaling 7.7 GW of third-party solar and 49 MW of third-party storage at nine cluster locations. The study shows the costs of interconnection facilities in each cluster location, which would be allocated across projects in that location. Facilities studies for those projects are under way, said a company spokesperson, while restudies on many cluster locations are needed, due to the “significant” number of projects withdrawing.

PacifiCorp would require about 72 months, or six years, to complete the interconnection facilities after execution of interconnection agreements, the cluster study says. The utility serves customers in Utah, Wyoming and Idaho.

Duke Energy provided information on feasibility studies and system impact studies, but not on final facilities studies, for its three operating companies in the Southeast.

A spokesperson for Tampa Electric in Florida said that the data we requested was “not public information.”

Utility PNM, which serves New Mexico, provided a response but did not provide a requested clarification.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

This is why I built an off-grid, self-contained solar system with batteries for my home first. Our current grid electrical system was made to get profit making power plants, through profit making transmission lines, through local profit-making distribution with utilities. 70% of what homeowners pay is just for profits and overhead on getting the power to them. Eventually, utilities will want a profit off your roof and battery system if you have one. Considering how out energy policies switch with administrations, you can never count on what will be available in 4 years.

The blame for ANY DELAY in implementing rapid deployment of Solar Energy (specially PV) to Eliminste Pollution rests with The White House and President Biden’s “army of experts”…

Till today the President has refused to utter the words .. ZERO POLLUTION BY 2050 (or whatever year) as it latches on to “Climate Change” which will NOT END the 9Million PreMature Deaths Annually and 275Million DALY of Suffering around the Globe.

The USA needs a Kennedy type/style ” man on the moon by the end of the decade”… once Biden “reaches the heights” of JFK eithba National Goal to end pollution, will USA and the Utilities realize the “goal” is 15TW, generating 18,000TWHrs/yr by using AgriVoltaics (AV),ON ONLY 2.5% OF THE EXISTING FARMLAND IN USA…

This National Goal will “open the floodates” of Expansion of the Grid to handle 15TW as against 1+TW TODAY, and put an end to all these “delays” as Utilies/Regulators realize the future is much much more than they can even imagine today …. but First Thing First…

THE USA NEEDS TO GRASP THE MOMENT AND LEAD THE WORLD IN ACHIEVING ZERO POLLUTION ASAP.. TO PUT AN END TO THE ABOVE DEATHS AND SUFFERING….

EVERY DAY’S DELAY RESULTS IN 25,000 DEATHS .. THIS IS THE URGENCY…

THE WORLD FACES ANNUAL DEATHS AND SUFFERING MATCHING THOSE DURING WORLD WAR II YEARS… and WITHOUT A WAR TOO…

THE PEOPLE ARE WAITING FOR THEIR PRESIDENT TO LEAD AND NOT DITHER AND FOLLOW (Europe..??) …