The purpose of the Public Utility Regulatory Policies Act (PURPA) was to help defend the United States during an energy crises with foreign powers. One manner of doing this was to force electric utilities to make use of domestic energy generating resources – like renewables. The tool states that if a domestic energy generator can produce electricity at a price lower than an electric utilities “avoided costs,” then said utility was required to buy this electricity at a predefined fixed rate over an appropriate time frame. PURPA is a political tool as well – a lever of sorts. Reality is that fossils like coal and gas, along with a slow to move executive culture, had become locked into a dependent relationship of building new fossil facilities to gold plate their returns – and PURPA was the catalyst necessary to force this relationship to evolve.

A report, An empirical analysis of avoided cost rates for solar and wind a qualifying facilities (QF) under PURPA (pdf), by the Concentric Energy Advisors – prepared for the electric utility lobbying group, the Edison Electric Institute – suggests:

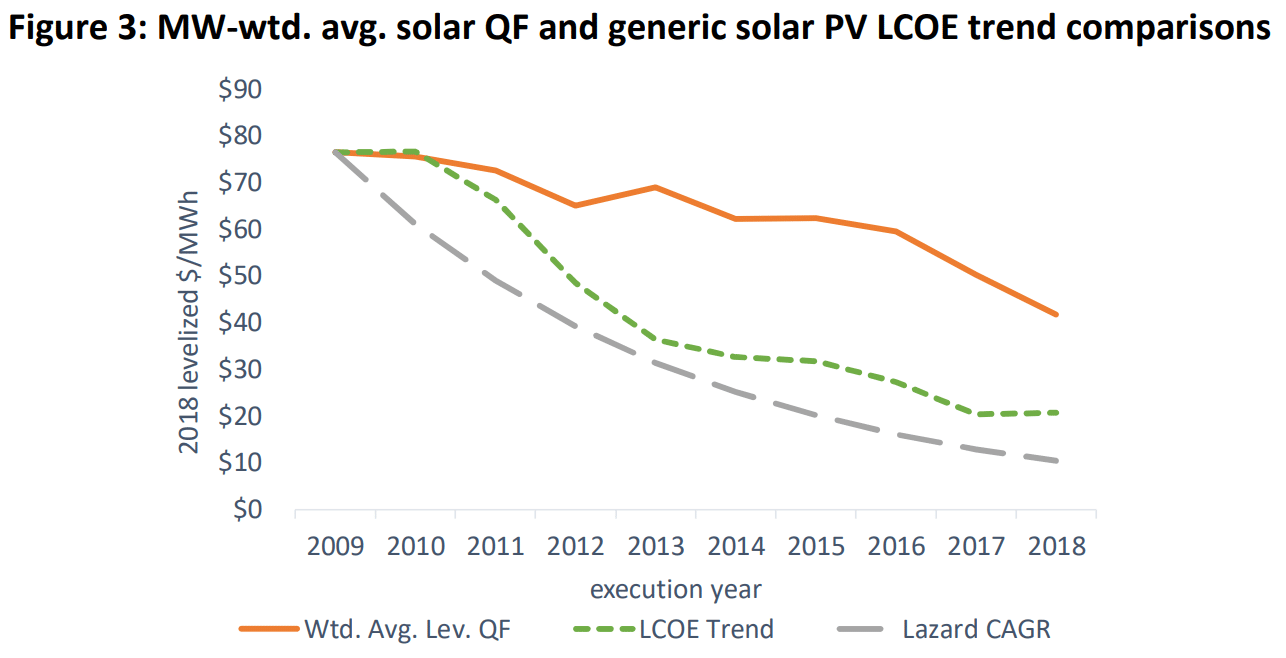

On an annual levelized cost basis, the solar QF contracts signed between 2013 and 2019 exceeded a competitive market rate by between $6.27/MWh and $10.79/MWh in 2018 dollars. We also estimate this cost-per-MWh differential results in an estimated overpayment relative to the market-based alternative of between $67.9 million and $116.8 million per year for the solar QF contracts we reviewed.

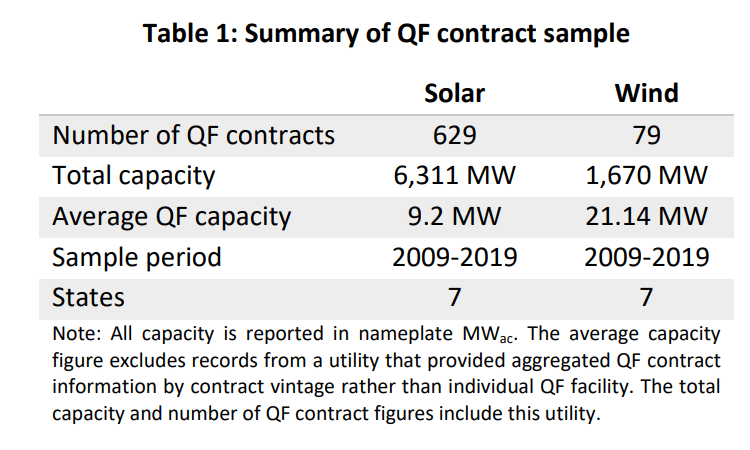

The report compares 629 solar power plants with 9.2 MWac solar power projects, totalling 6.3 GW of projects, to 232 solar power plants averaging 62 MWac totalling 14.4 GW from a Berkeley Lab power purchase agreement (PPA) sample. This author believes that this major sampling error could very well account for the disparity in pricing, and asks that the Concentric Energy Advisors release an addendum to the analysis solving for system size across the Berkeley Lab dataset.

The report noted that in 2013, the competitive benchmark solar PPA rate and the sample average QF rate were roughly comparable, at 6.85¢/kWh and 6.9¢/kWh, respectively. The QF rates did not decline over time as rapidly as the competitive solar PPA prices. The report suggests that over time average pricing of PURPA versus market priced PPAs have separated due to the slow moving politically managed pricing structure of PURPA versus the market’s more fluid movements.

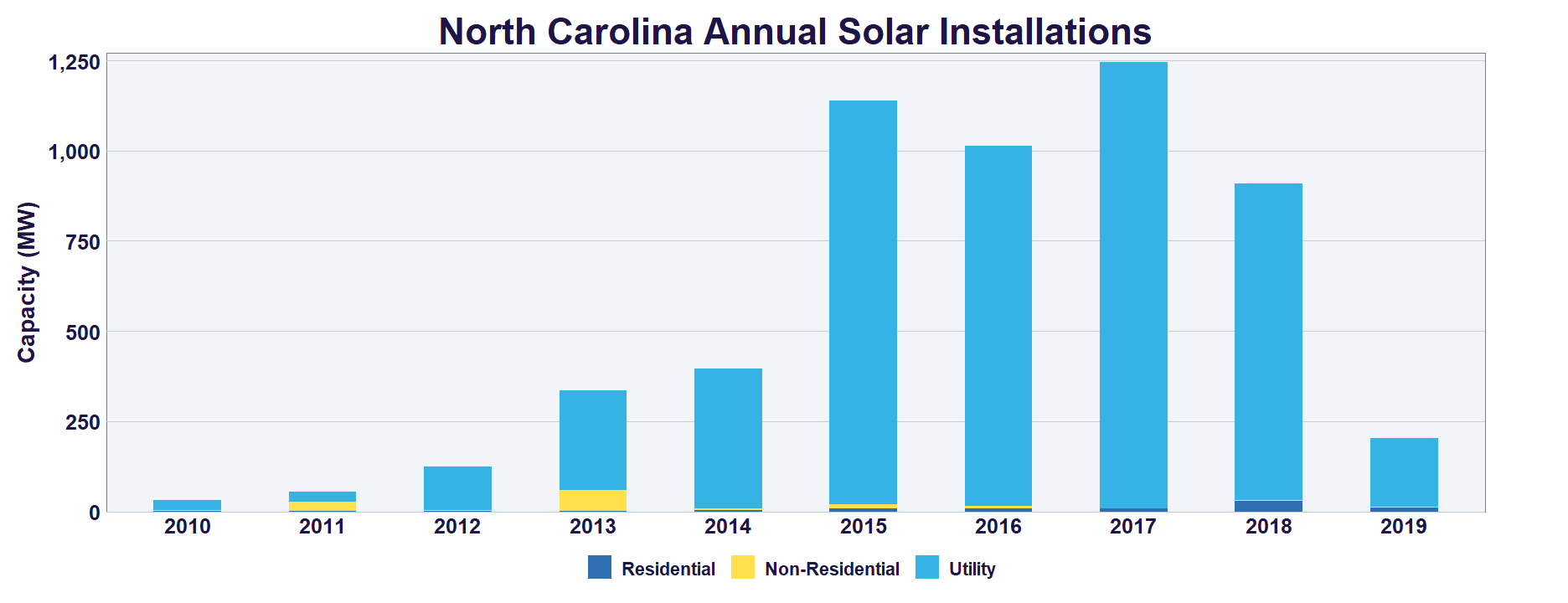

PURPA can arguably be said to have brought utility scale solar power to the east coast of the United States of America when North Carolina became the second leading market in the nation (below image). Groups like Cypress Creek and Strata have been deploying 5 MWac solar power, and solar+storage power plants across the state. pv magazine USA has speculated that utilities constantly hacking at PURPA, led to layoffs at Cypress Creek, followed by a structural evolution.

And it is without a doubt that the political level of PURPA is still needed, as we’ve recently seen Michigan, Arizona, and Moscow Mitch appointed regulators all attempt their own hatchet swings. A Montana developer had to win in court to build a plant that would triple state’s capacity. A judge has set rates for an 80 MWac solar project at 3.833¢/kWh for 25 years after previously finding that state regulators had violated due process in intentionally setting rates too low for the facility under PURPA.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.