Lazards has released their two levelized cost of hardware reports – 2019 Levelized Cost of Energy (pdf) and the 2019 Lazards Levelized Cost Storage (pdf) analysis. At a high level, both solar power and energy storage have shown continued price declines, but the numbers are of course much more complex.

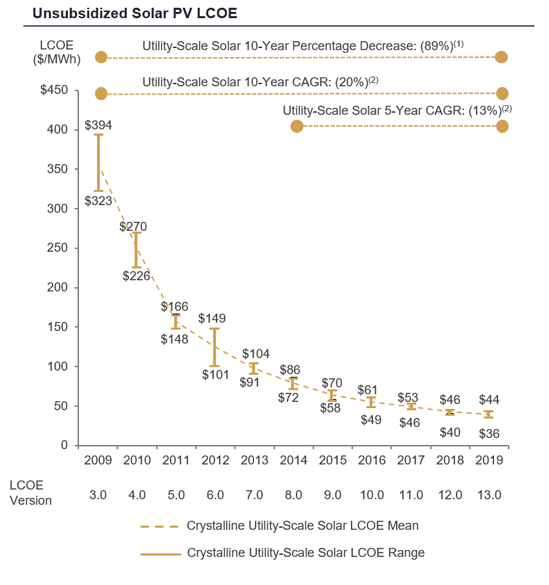

Solar power’s utility scale price declines have slowed over time. The report suggests an unsubsidized utility scale solar power plant is going to generate electricity at a cost between 3.6 and 4.4¢/kWh. This price has fallen 89% over the past ten years, an average of 20% decline per year over the period. Over 5 years, that decline fell to 13%, and over the last year that price decline was 4-10%.

When adding in the 30% Investment Tax Credit for the US market, utility scale projects fall an additional 0.1-0.2¢/kWh.

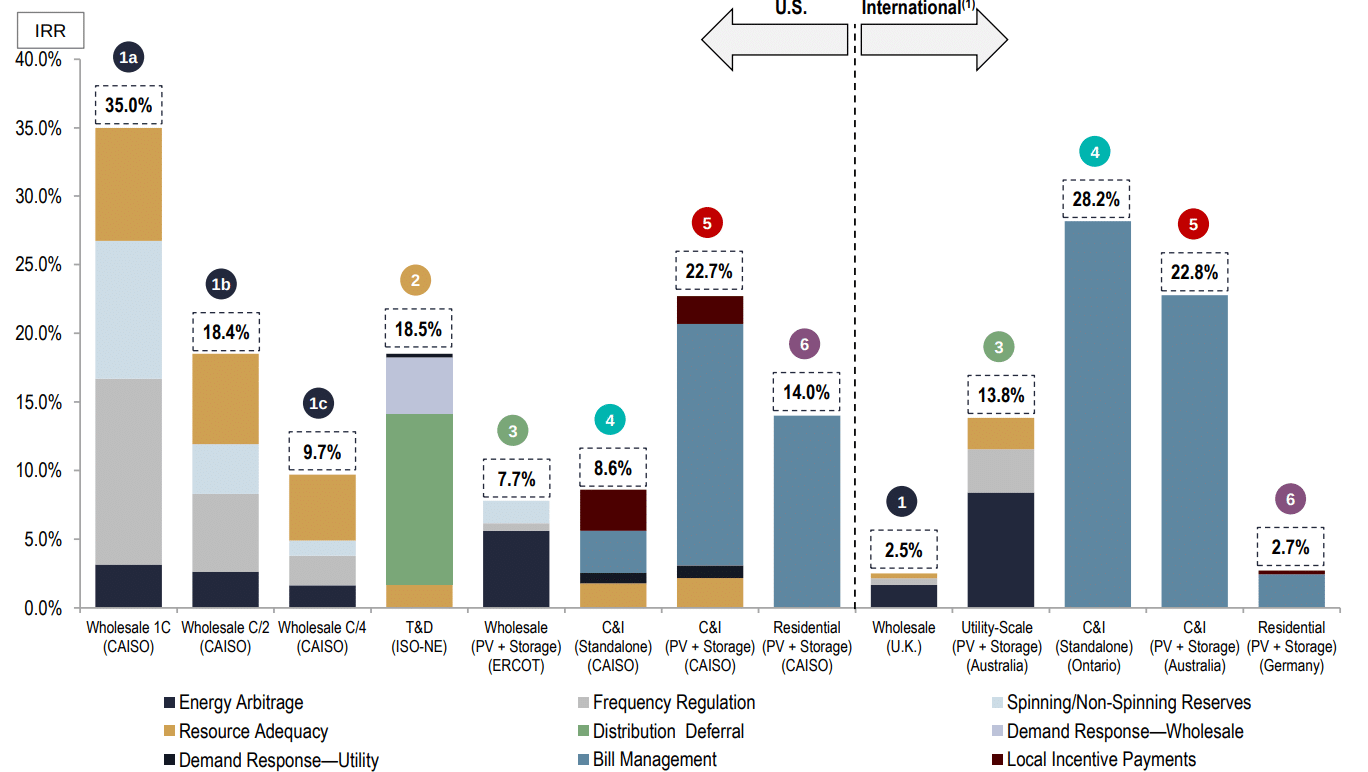

Energy storage has also seen across the technology spectrum price delines, with lithium ion outpacing other sources of storage. However, the technology is still expensive with its use cases dictating when it can be used in a financially viable manner. The energy storage report’s financial modeling shows Levelized Project Internal Rates of Return (IRR) ranging from 35% for a standalone 100 MW / 100 MWh facility in the California Independent System Operator (CAISO) region, down to a 7.7% IRR for a 100 MW solar + 50 MW / 200 MWh storage sized facility in the Texas ERCOT region.

The above chart breaks down the various services that energy storage can offer, and shows how it varies greatly across use cases even in the same markets. For instance, in CAISO you see hardware participating in the wholesale market earning revenue from resource adequacy, spinning/non-spinning reserves, frequency regulation and demand response. While we see residential and commercial/industrial solar+storage making almost all of their money from bill management – which is demand charge management of time of use arbitration.

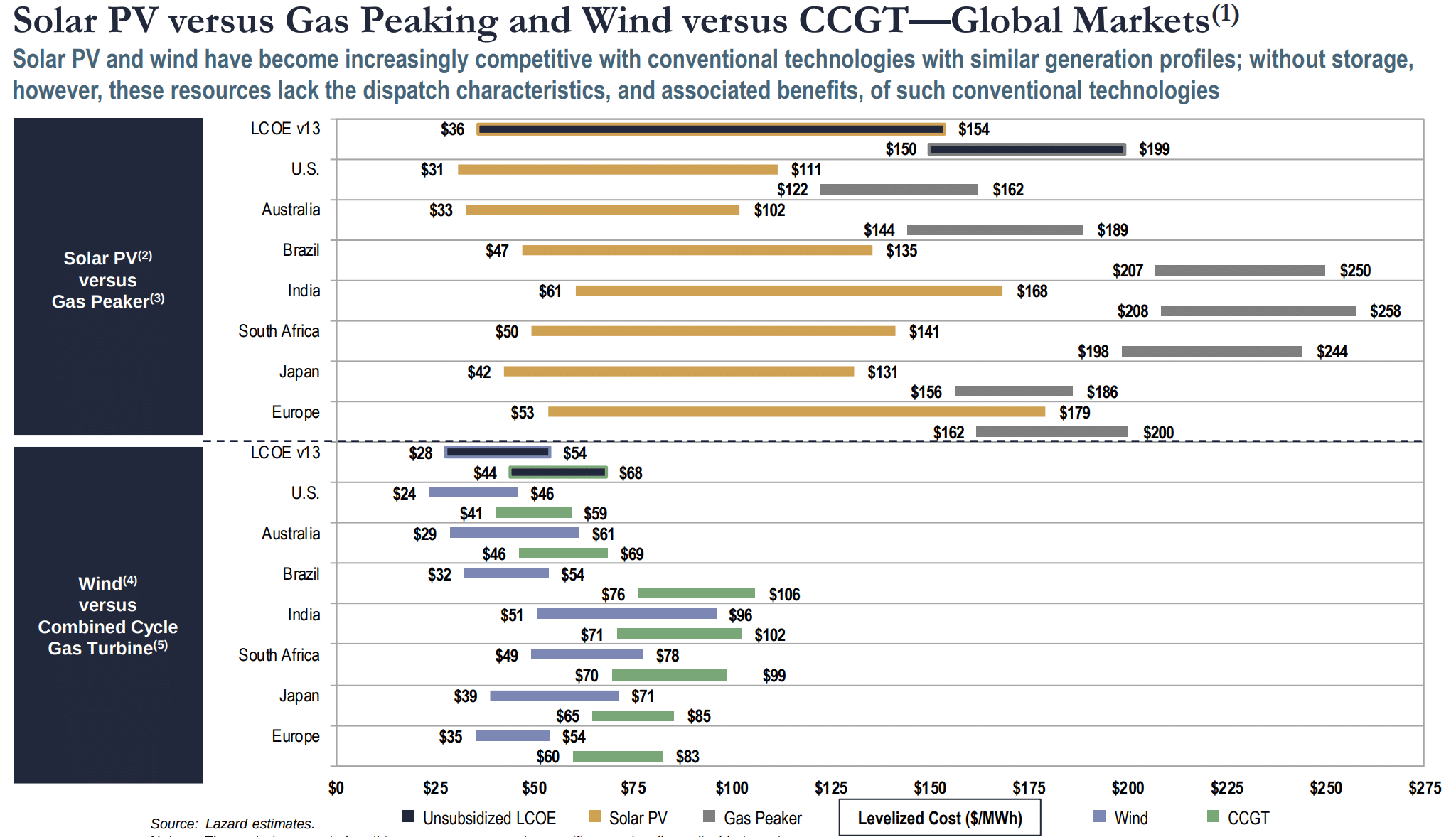

Last year’s report showed that new wind and solar power were cheaper than certain already running resources (coal and nuclear, and some gas), unsubsidized, in the United States. This year, that modeling expanded globally and shows that solar power on its own can beat gas peaker plants on their own – without storage – in most any market. This is setting us up to see a new report showing how solar+energy storage peaker plants are ready to dominate. This is already happening in key markets in the USA.

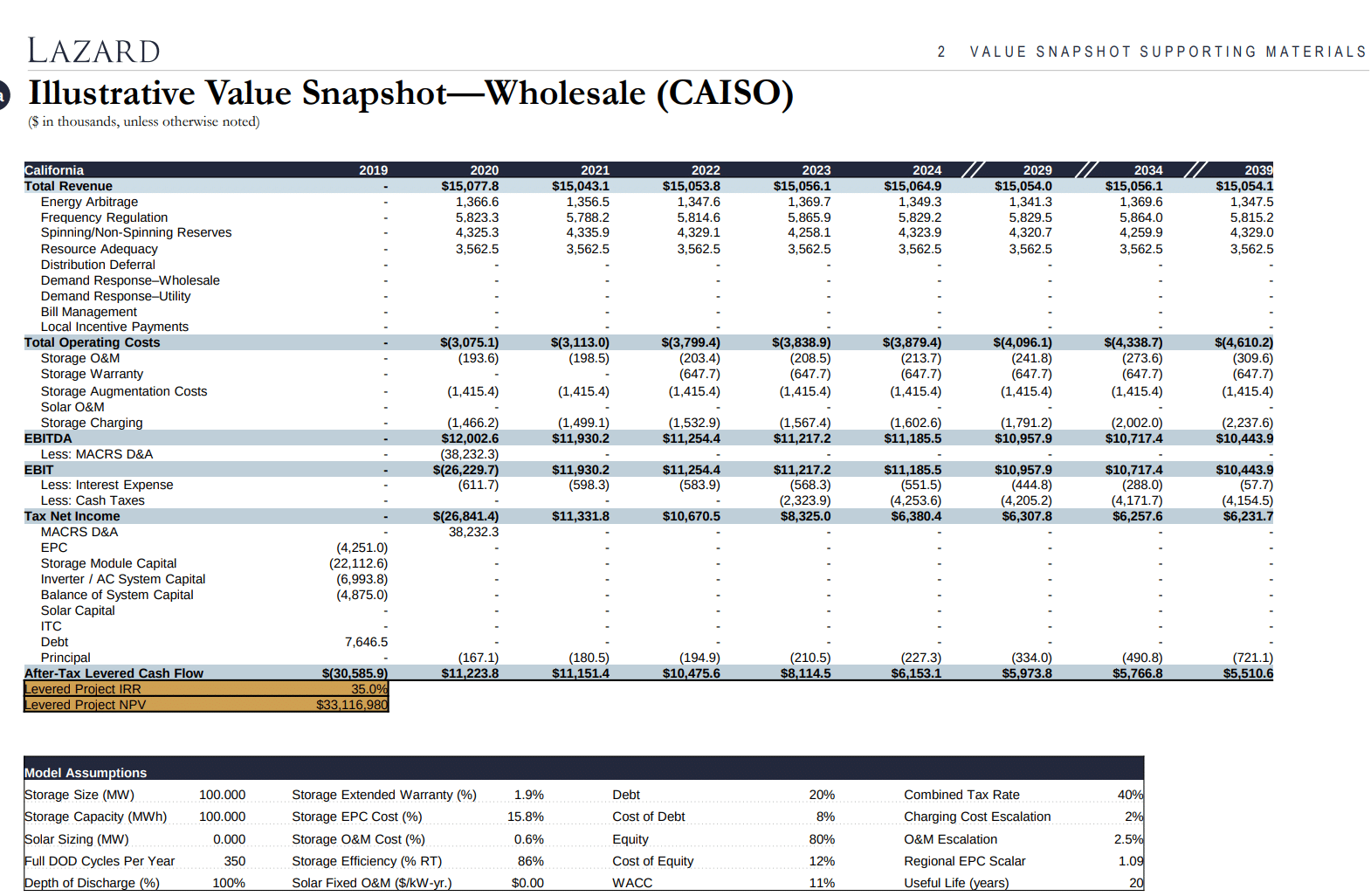

Both reports contain far more information than the above short summary, including, decently in-depth financial analysis to help you understand the variables driving these costs. For instance, the below illustrative value snapshot of the 35% IRR CAISO wholesale energy storage project breaks down operating costs, tax dynamics, and the various revenue streams by year.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

@ John Weaver, the LAZARD report is in majority utility scale energy generation and storage, BNEF seems to follow with it’s studies and predictions. A couple of tables in the LAZARD report mentions solar PV and Energy storage at the $457 to $663 per MWh of generation and storage for residential installations. While IOUs like PG&E in California is pushing the PSPS as “the” cure to wild fires for the next 10 years, what happens if the next goal to 5 million residential roofs get a nominal 7.5 to 8KWp solar PV roof and a 24 to 36kWh back up battery across the U.S.? Do you think after seeing the number of companies bringing out residential energy storage at the recent, SPI trade show. Just two years ago most folks could name two maybe three companies, now there are at least 10 or 12 large company backed residential energy storage entities today. As a hands on guy, where does your experience lead you to believe solar PV and energy storage will be in 2023, when the ITC rolls off?

My question is: how does a potential lender/investor determine interest rates and the minimal equity an entity (private) must be faced with to secure project financing? This is a project that combines two countries in Africa, that has a 25 year PPA in place and all of the necessary documents and registrations that are NOT seeking Sovereign loan guarantees.

The entity seeking funds has very little personal funds to commit.