In SolarEdge’s first earnings call since the passing of their founder and CEO – Guy Stella – numbers were met, earnings solid, sales are growing, and the conversation with analysts was calm.

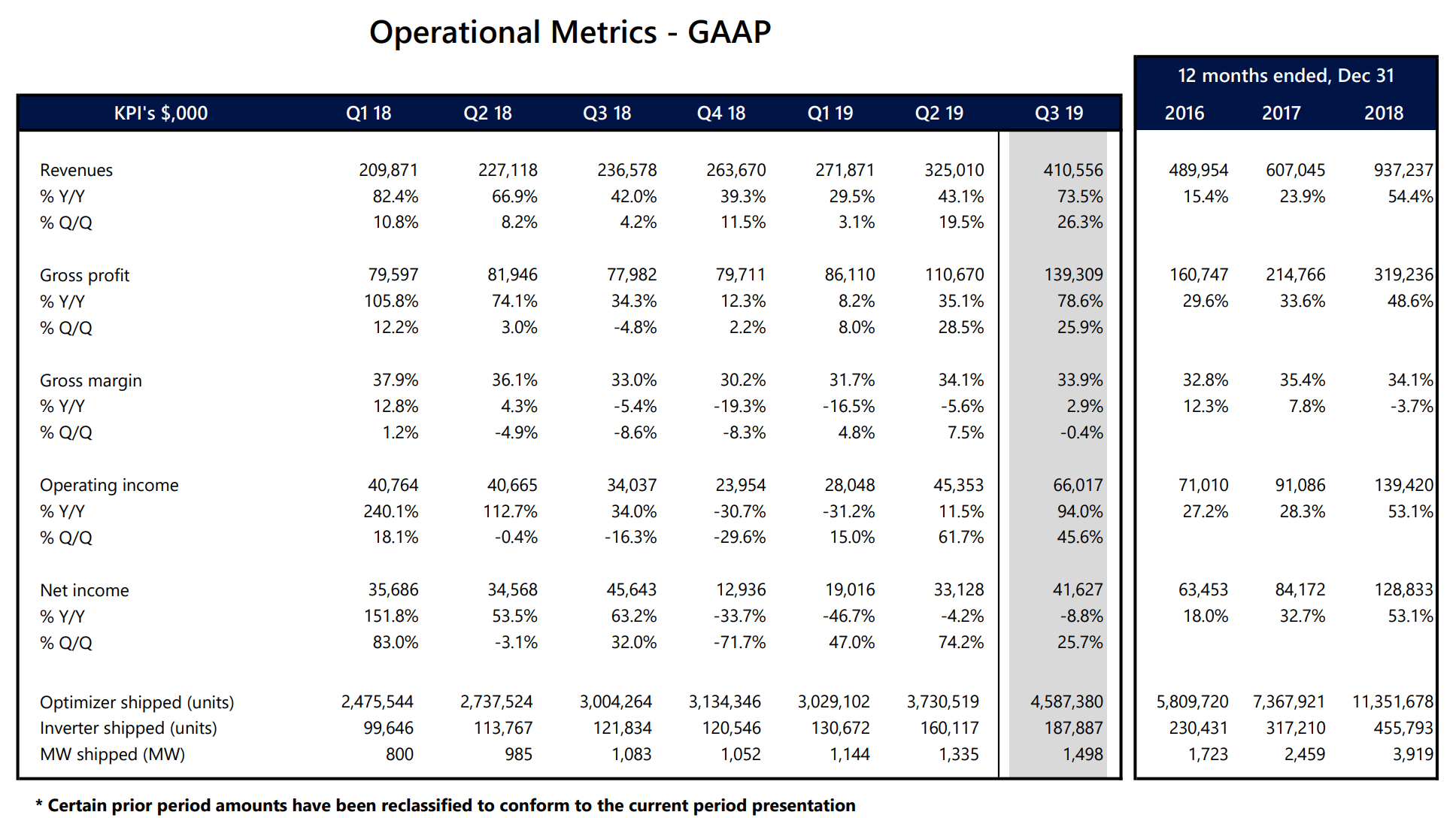

The company shipped 1.49 GWac of solar inverters in 187,887 individual units, along with 4.6 million optimizers, in Q3’19. For the year’s first three quarters they’ve totaled just under 4 GW shipped, about equal to what they shipped in the whole of 2018.

The company’s revenue for Q3’19 grew 73.5% year on year, and 26.3% over Q2’19, totalling $410 million. They broke $1 billion in revenue for the year, which is greater than their 2018 total. Their quarterly operating income was $66 million, allowing for an operating margin of just over 16%. The company ended the quarter with $247 million in cash, and 1.3 billion in total assets on their balance sheet.

In the first quarterly call led by Uri Bechor, the new Chief Operating Officer, announced that capacity ramps in Vietnam, Europe and China were ongoing. It was noted that the first optmizers built in Vietnam were shipped the the US, and that inverters were expected soon. Hungary and Vietnam were noted as soon to be default manufacturing bases for US product.

North American was shipped 598 MW of product, while Europe received 712 MW, about 200 MW for the rest of the world. 543 MW of commercial solar inverters were shipped, which was down from Q3’s total due to strong residential demand limiting manufacturing line time for the commercial products.

The company noted that failure rates of their hardware were still higher than they wished, and suggested two reasons for this. The first is that their product lines are still maturing, and the second is that growth has led to new installation crews who are still learning the ropes.

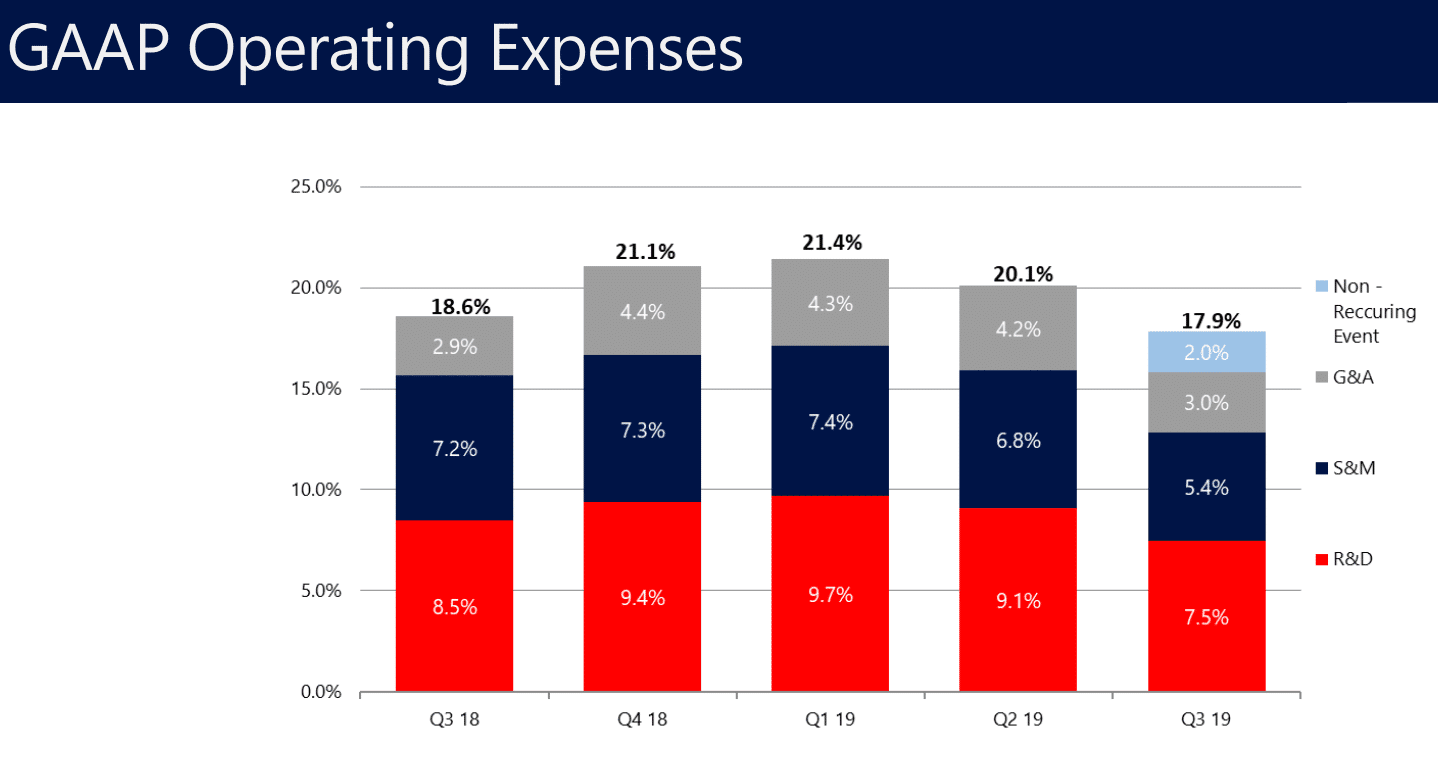

The company said they lost 2.54% of gross margin above impact of last quarter’s air shipment costs. The company expects this value to increase in Q4’19, before declining in Q1’20.

And while the earnings call was appropriately focused on SolarEdge’s inverter business, there was a nugget for those of us looking forward their broad future of advanced energy manufacturing. The company noted that for the first time, non-solar business broke even on an operational basis on $23 million of revenue.

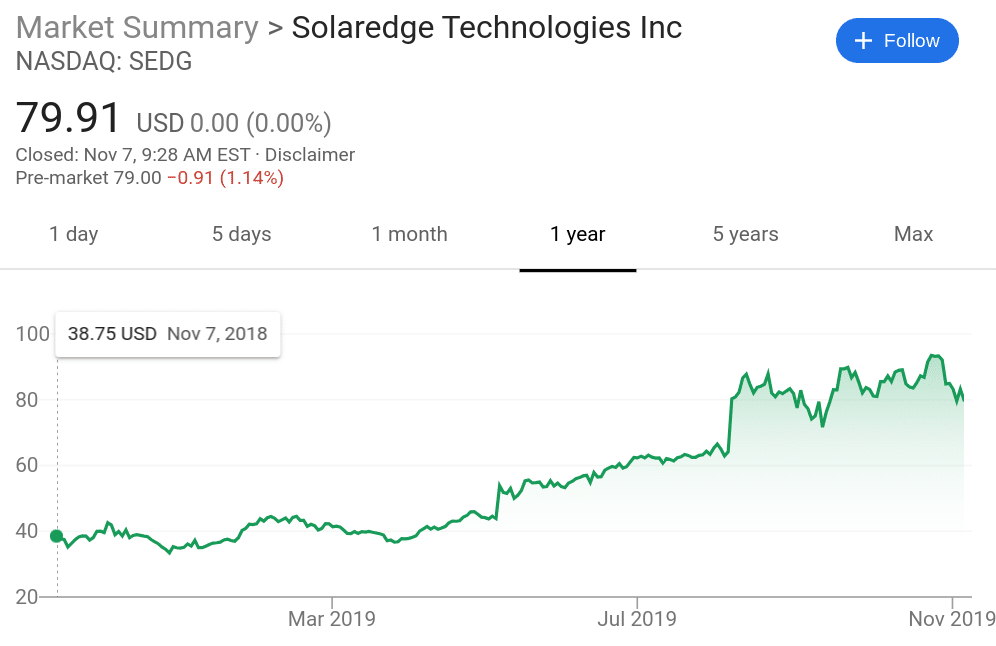

The one soft spot in the report was that the company projected $410 to $420 million in Q4’19 revenue, which would be 0% to 2.4% growth quarter over quarter, and only 55% to 59% growth versus Q4’18. The market, which has pushed SolarEdge up 106% from one year ago to close of business yesterday, opened down as much as 6% before pulling back at time of press.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.