SolarEdge is growing in sales of solar inverters shipped, revenue streams, global footprint and U.S. residential market share. As well, SolarEdge’s CEO Guy Sella suggested high confidence in the company’s very strong Q3 guidance of $395 to $410 million in revenue – which would be growth of 67% to 74% year over year.

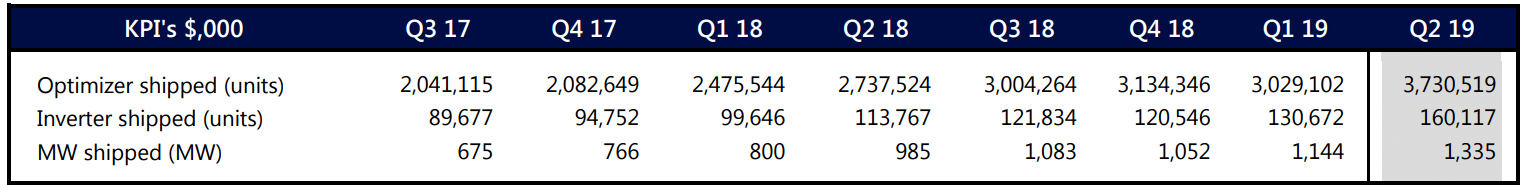

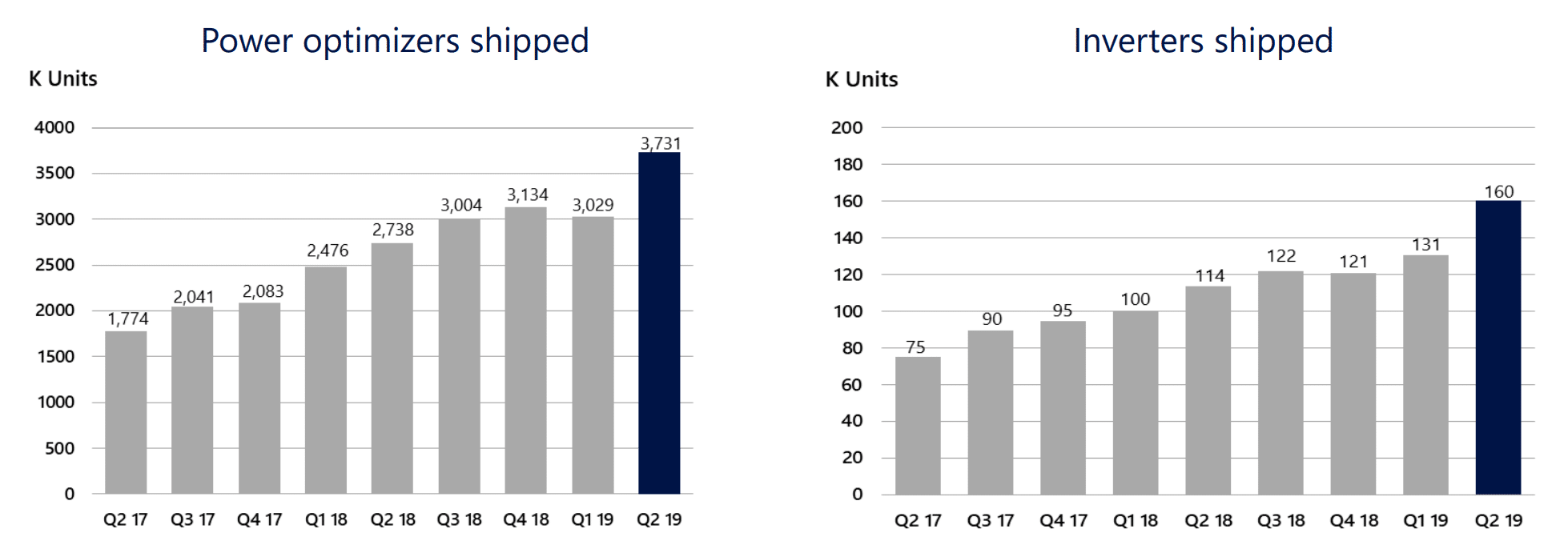

The company said manufacturing capacity increased 25% during the first quarter, repeatedly citing its new Vietnamese facility. U.S. orders were about 430-440 MW of the 1.3 global GW volume shipped. A record 48% of revenue came from Europe, with the Netherlands, Germany, Sweden and Poland being the drivers. The United States represented 41% of total solar revenue.

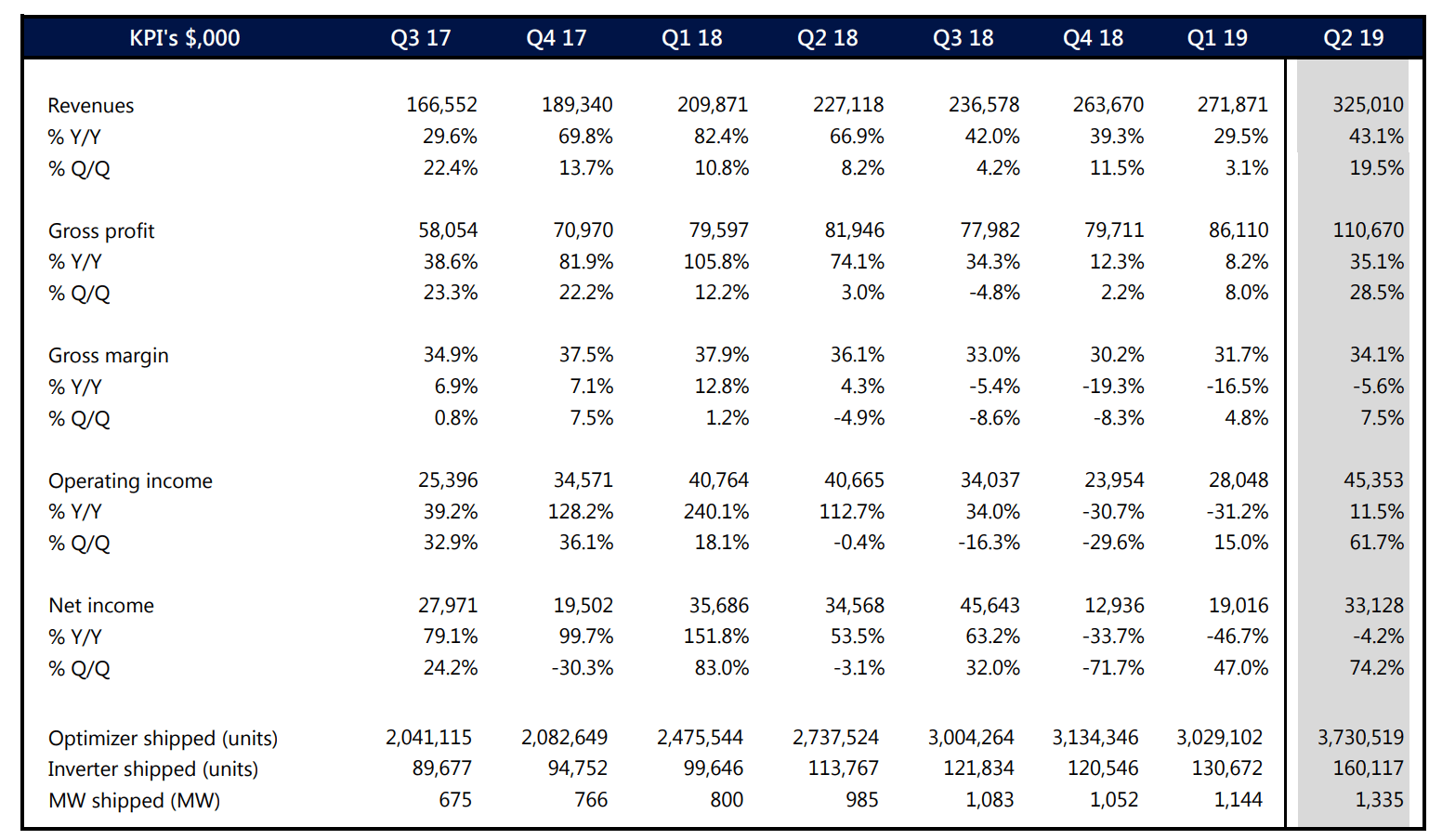

SolarEdge’s GAAP revenue was $325 million, noted in its quarterly slide presentation (pdf) and its operating income was $45 million, with an operating margin of 13.8%. The company’s net income showed a profit of $33 million. Compared to a year ago, revenues have increased by 43% from $227 million. Of that $325 million in revenue, $306 million of it was solar hardware – while the remaining $18.3 million was mostly lithium ion and storage products, plus a bit from other non-solar revenue streams.

After an analyst sought insight on where the big Q3 growth would come from, the USA’s 3rd/4th quarter now expected growth in volume deployed was referenced, and that significant U.S. growth was expected for the rest of the year with a backlog currently into the 4th quarter, but that no “safe harbor” money was thought to be in Q2’s revenue, and none in the projected Q3 volumes.

This U.S. growth combined with the company’s new manufacturing volume coming online and the six week lead time if shipped by sea, means SolarEdge expects to expedite product transport to arrive before year end and take a 2.5% hit on the margins.

The company suggested that the increasing hardware failure rates of later 2018 and early 2019 might be slowing. The average sales price of products had increased, however, this was because of tariffs that were being passed onto customers. There were no questions or comments on exactly how much these tariffs are increasing the company’s reported revenue.

A total of 115,000 systems were added to the first million total system hit at the end of Q1. The residential-commercial business split in the U.S. market roughly matched the world’s distributed with commercial being about 44%. When asked about the revenue potential of utility scale business, Stella noted what he thinks the company, will offer a “unique, brilliant solution” for the space that we’ll see in 2020, and SolarEdge will sell in 2021.

Stella broke from tradition by referencing a “competing MLPE manufacturer”, and that data from an objective third party (probably this document) had suggested SolarEdge’s shipment volume (not market share) increased from 45% in Q1 2018 to 51% in 2019, and the “other company’s” had shrunk from 23% to 17% in the same period. And when including Enphase’s purchase of SunPower’s microinverter business, share of shipped volume fell from 29% to 27%.

To upgrade the company’s lithium ion battery cell manufacturing facility in South Korea it will cost $50-60 million, and have a capacity of 1 GWh to 1.8 GWh/year of lithium ion cells – with ordering of equipment expected in Q4 2019. Further out, the facility has the capacity to reach greater than 5 GWh/year of cells. The factories will produce cells for third party products, as SolarEdge energy storage and vehicle product lines.

A SolarEdge manufactured battery is expected to launch in the first half of 2020, both AC and DC coupled. In the coming quarter, SolarEdge expects to launch the first three phase residential energy storage system for Europe in the third quarter (as 80% of solar installations in the residential market were three phase).

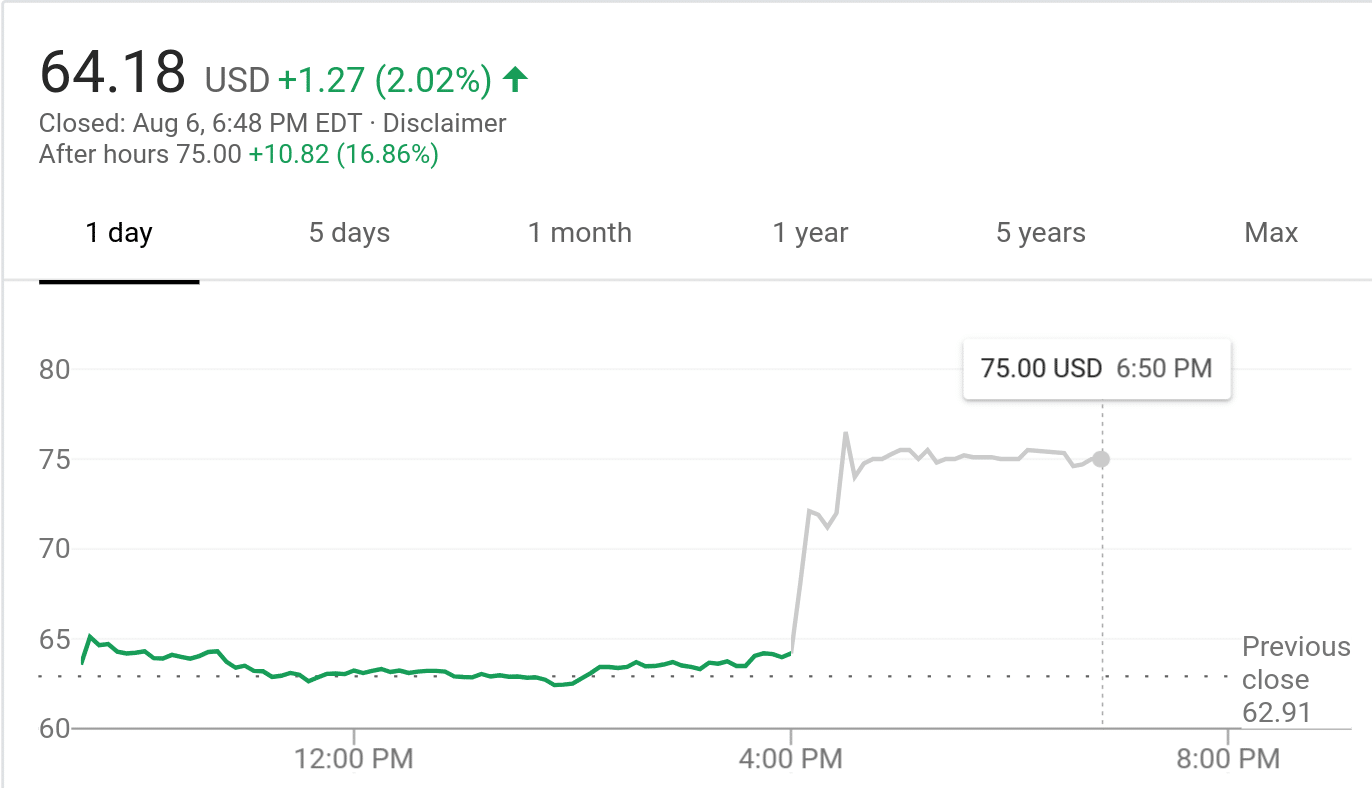

And as of time of this article’s publication, the market was happy with the results – up almost 17%.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I rue the day I learned of Solar Edge. The tech is very good but they are growing faster than they can manage and support is terrible. After almost 2 years I can’t get a permit approved here in southern California to install the system, because no Single Line Diagram is available. Three applications were turned down and I went to a Grand Jury, who also said, “shut up and follow the rules”.

The main problem is two companies are involved, SolarEdge and LG Chem. Both are good outfits with good products but their service departments don’t talk to each other. I installed the system and used it up to now, it works fine except for the battery component. No one knows how to configure it.