One dynamic of selling solar power in the United States is that we have 50 unique state markets and a whole bunch of sub-markets within those states as utilities and municipalities interact, as well regional organizations that are inter- and intra- state. This multi-dimensional regionalization means that the solar power pro forma changes, along with other paperwork, utility contact names and processes in all those regions as you shift from residential to commercial and into utility scale – and this is part of what drives the soft cost challenge that US solar industry bears.

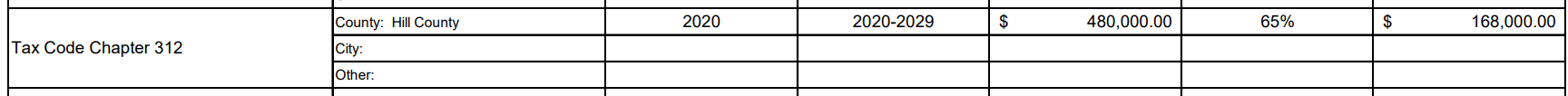

Texas Governor Greg Abbott has signed 86(R) / HB 3143 (direct link to pdf of language)- an act amending the Property Redevelopment and Tax Abatement Act, known by its place in the tax code Chapter 312, with the following refinements:

- Extending the expiration date ten years to September 1, 2029

- A requirement that any changes to this law involve a public meeting

- Requiring public posting of tax abatement guidelines

- A public posting of tax abatement ruling meetings, in which project information is included

- Annual reporting on all project’s valuation for three years after the abatement ruling

The purpose of the law is to allow local jurisdictions to use their own judgment in creation of “redevelopment zones” that qualify for refinements to local tax laws. The logic is, some business at a lower tax rate is worth it since it’ll generate jobs – as long as the cost to manage those businesses isn’t too great.

The Texas Comptroller Chapter 312 includes Biennial Reports and Other Data (within which the word “solar” appears 19 times out of 271 pages). This pv magazine USA author, when researching Texas projects, often searches for Chapter 313 school value tax documents, to gain additional information on solar developments.

For instance, the top listing at time of publication on the Chapter 313 page is the Sun Valley Solar 250 MWac solar power project. The documentation notes two long term jobs at just under $50,000 year for O&M, and an estimated project value of $187.5 million with an annual tax levy of $480,000 before benefit. Post benefit, the project hope to pay $168,000/year – a 65% discount (page 62 of application – pdf).

There are many tax structures across the country to push solar power. Federally, the two largest are the 30% Investment Tax Credit that is being proposed for an extension and the accelerated deprecation that allows you to write off the remaining depreciable base in a single year. Across the nation there are a wide range of examples like Massachusetts giving a 20-year property tax abatement, by default, for any increases in value created by the solar installation (see the list at DSIRE).

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.