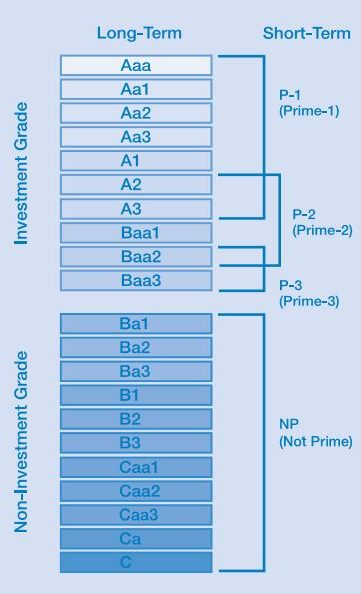

Moody’s Investors Service has assigned a Baa2 rating to Peninsula Clean Energy Authority (PCE), a Community Choice Aggregator (CCA) in California. The rating agency notes the outlook as stable.

This is at least the second California CCA that has received an investment grade rating, as Marin Clean Energy – the first CCA to form in the state – received the same Baa2 rating from Moody’s in May of last year.

The rating was made taking into account the ongoing bankruptcy proceeding at Pacific Gas & Electric (PG&E). All of PCE’s customers are located within the PG&E region, and PG&E – as per the CCA structure – bills and collects all money from those customers, then distributes them to the CCAs. Moody’s noted that a judge’s “first-day orders” directing PG&E to continue standard payment processes was also considered in their rating.

The rating was made taking into account the ongoing bankruptcy proceeding at Pacific Gas & Electric (PG&E). All of PCE’s customers are located within the PG&E region, and PG&E – as per the CCA structure – bills and collects all money from those customers, then distributes them to the CCAs. Moody’s noted that a judge’s “first-day orders” directing PG&E to continue standard payment processes was also considered in their rating.

Moody’s first comment in the document noted the strength of the service territory – San Mateo County (Aaa stable rating) – and that all twenty of the cities in San Mateo County and the county as a whole voted affirmatively to join PCE as their CCA is described as a “credit positive”. The CCA has 285,00 customers in San Mateo County, and – as Moody’s noted – the statutory structure of CCA allowed PCE to become the default generation procurement entity county-wide.

At the end of March 2019, PCE had unrestricted cash of about $108 million, an increase of $42 million from fiscal year end 2018, and they expect to have around $125 million in cash at June 30, 2019, its fiscal year-end. PCE’s ability to generate sustained free cash flow serves to mitigate the CCA’s limited three-year operating history.

Moody’s suggested that longer term market considerations, such as the statutory structure noted above, that the PG&E bankruptcy will go on for several years, and that the CCA model is being defined as a key element in the advancement of the state’s objective to lower carbon emissions gives the CCA model perceived stability. The rating agency feels both state and local policymakers, as well as the state Public Utility Commission, are generally on the same page as to their support of and ultimate success of this model, an important consideration in our view.

Moody’s says the short term challenge most significant is the ability to manage energy procurement. Per the report, PCE is strengthening procurement capabilities by not overcontracting capacity (net short position), building internal liquidity and supplementing the internal liquidity with external liquidity through a Barclays Bank line of credit, and focusing on customer needs within the county. Load demand reductions are a risk, however, electric car uptake is seen as a growth opportunity.

According to PCE’s financial statements, the CCA has entered into forward purchase commitments for delivery of renewable energy on an as-available basis that aggregates $966 million at fiscal year-end 2018. To mitigate this long term contractual risk, PCE long-term arrangements approximate 20-30% of its expected load with the remainder being satisfied by medium-term, short-term, and market purchases across a very diverse list of energy suppliers with not one provider exceeding 15% of its load requirements.

The company has over 158 days of cash on hand, with a goal of reaching 250 days by the end of 2019.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Moody’s, the outfit that gave an A rating to Wall Street mortgage bonds pre-2008. They are a pay-to-play crony business, their “ratings” are worthless.