California has 12 GW of renewable energy planned in the most recent iteration of its 2017-2018 Integrated Resource Plan (IRP) Cycle, which has a looming responsibility to ensure the state is on a credible path to 100% clean energy by 2045. The document (pdf) approved IRPs from 20 of 39 utilities and community choice aggregators in the state. The final 19 did not provide adequate information on their plans.

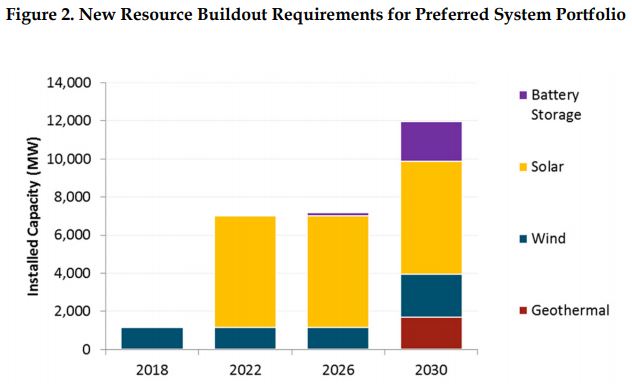

The current IRP version modified the prior proposed potential capacities as the “Preferred System Portfolio”, shown roughly below.

The Solar Energy Industries Association (SEIA) comments (pdf) noted that in most respects the group supports the IRP conclusions, however SEIA seeks refinement in the analysis of the value of solar+storage, a procurement track definition that will drive industry continuity, as well reconsideration of transmission as being able to deliver out-of-state solar in addition to out-of-state wind.

As part of the map to 2030 moves forward, the CPUC made strong considerations for how to integrate renewables and the state’s transmission development (already we’ve gotten a taste for solar’s effects on transmission). Concerning this topic, SEIA notes that:

To date, the IRP modeling using RESOLVE has not treated solar plus storage as a separate candidate resource, even though this pairing allows the storage component to qualify for the 30% federal investment tax credit, significantly lowering the cost of storage. This significant benefit of reducing the cost of storage is not available to other renewable technologies.

As a result, SEIA says that it is very concerned that wind and geothermal are considered “higher value” resources than solar for resource adequacy (RA) purposes. Overall, SEIA proposes that solar+storage should be given its own classification separate from solar. This will allow for greater utilization of the resource when consideration of in-state transmission are made.

SEIA notes that “tapping this emerging flexibility may require new and innovative arrangements for how solar and solar plus storage projects operate and are compensated”, but the feasibility is being rapidly developed and is being clearly demonstrated.

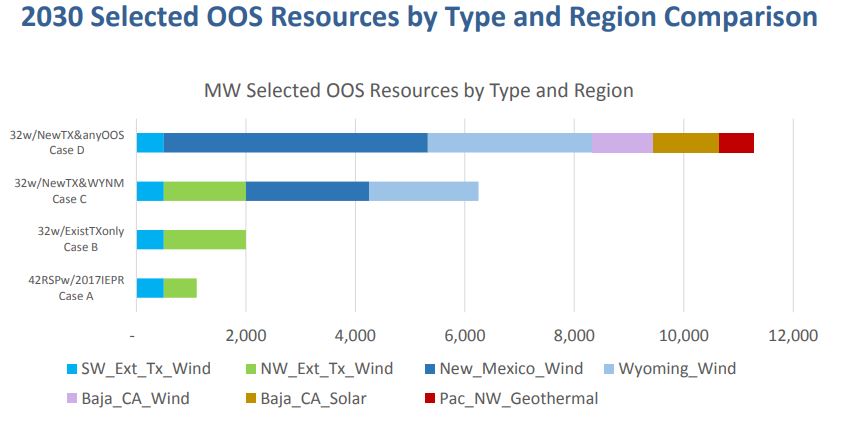

SEIA supports the CPUC’s case for new transmission to bring incremental wind resources to California from out of state resources (above image), however, they suggest the modeling should examine more than just new lines that access wind resources as record low solar contract prices have been reported in Idaho, Nevada, and Arizona.

SEIA recognizes that there are substantial siting and economic hurdles to building major new regional transmission lines. However, the accelerating closures of major coal plants in the West may free up existing transmission capacity, and the organization argues that CPUC should prioritize a study on these power lines.

As well, in a winding vein throughout the document SEIA proposes that these above programs be developed with a consistent long-term procurement model to make sure that volume is getting installed in time, and in a manner that allows for consistent operation at businesses that will drive the best bidding opportunities from experienced and financially viable groups.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.