Consumers listen when money talks, but to move cash toward clean energy technologies, financial signals must be paired with trust and made easy to act on, new research from The Economist Group found.

In Empowering energy consumers: Putting people at the heart of the energy transition, a report published by The Economist Group, a sister publication of The Economist, said that cost emerges as the dominant factor in energy-related decisions. The Economist Group surveyed 10,000 energy consumers about barriers to action, 58% of respondents cited concerns about cost, while 36% pointed to a lack of financial incentives. The survey included energy consumers from United States, Canada, United Kingdom, France, Italy, Germany, Japan, China, India and Australia.

After cost, trust became the next hurdle, which was closely tied to a third barrier: limited knowledge of available technologies.

Consumers identified trust in energy providers and transparent pricing as a top factor in energy-related decisions. The report notes that many customers worry about being overcharged or misled, and that this mistrust can undermine adoption even when price signals are aligned. For example, the authors said that “financial incentives that reflect supply and demand in real time” could reward flexible energy use. However, most consumers lack the knowledge and guidance needed to interpret or act on these signals. When pricing is opaque or poorly understood, incentives often fail to land.

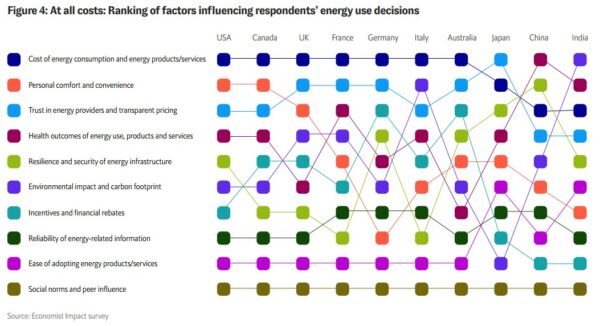

The authors of the paper argue that a broad push on energy education is needed because awareness alone—even recognition of the climate crisis—is not enough to drive behavior. While 70% of respondents acknowledge the link between their energy use and climate change, and 25% say cleaner energy should be the top priority for lawmakers, most people still don’t act on that concern. According to the report, nearly 80% of consumers “remain passive” in the transition. When asked what most influences their energy decisions, respondents ranked environmental impact and carbon footprint just fifth out of the ten factors noted in the above chart.

Financial incentives support smarter energy use, but “lasting change also depends on awareness, trust and convenience,” the report said. “Consumers who have better understanding and awareness of energy tools and technologies are even more likely to adopt them than those with higher incomes.”

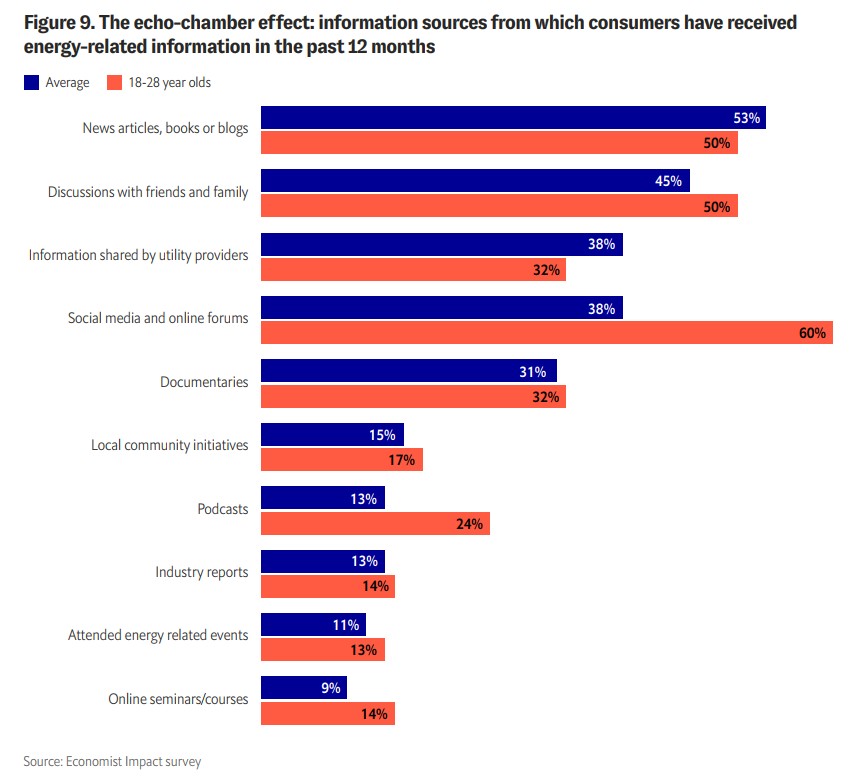

To close the gap, the report recommended turning to trusted third parties for energy information and guidance. Utility companies rank low on trust, while consumers place more faith in advocacy groups, government agencies, and personal networks such as friends and family. With over half of respondents relying on digital sources — blogs, social media, and forums — outreach efforts need to meet people where they already are.

Regional patterns in the data hint at deeper economic and cultural undercurrents.

Perhaps unsurprisingly, German consumers ranked personal comfort last, while prioritizing resilience, incentives, and transparent pricing. In a country known for engineering rigor and cultural thrift, comfort often takes a back seat to efficiency and reliability. Germany’s post-Fukushima nuclear phase-out, its aggressive push toward renewables, and the energy shocks triggered by the ongoing war in Ukraine have reinforced a national approach that treats energy as a matter of infrastructure and resilience—not lifestyle.

With more than two million premature deaths linked to air pollution annually, China’s top-ranked concern — health outcomes — reflects a population acutely aware of the human toll of fossil fuel use. Resilience came in second, highlighting a focus on collective well-being over individual preferences.

This prioritization of health and stability over immediate financial incentives appears across several Asian markets. In Japan, China and India, incentives and financial rebates ranked just eighth or ninth out of ten factors—suggesting that in these countries, cultural context, public health, and reliability often outweigh short-term discounts when it comes to clean energy decisions.

In contrast, the wealthy societies of the United States, Canada and the United Kingdom placed cost and personal comfort at the top of their energy priorities, with environmental impact, ease of adoption, and social influence falling to the bottom. It may be that high prices are driving this fixation on affordability—but it’s hard to ignore the post-WWII legacy of comfort-centric consumption that defines American, Canadian, and British culture. Either way, the data suggest that moral appeals and climate messaging alone aren’t moving the needle in these markets.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.