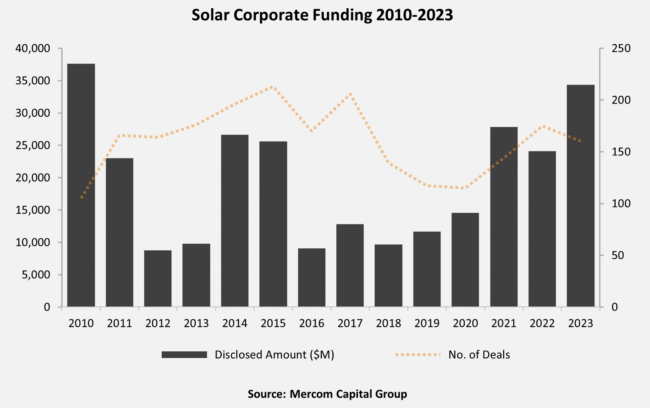

Mercom Capital Group released its corporate funding report for the solar industry for 2023, noting a 42% increase in funding globally year-over-year.

The report tracks venture capital funding, public market, and debt financing into the solar sector, which totaled $34.3 billion raised in 160 deals in 2023. This compares to the 2022 total of $24.1 billion across 175 deals. Mercom said 2023 had the most corporate funding in solar in a decade.

“Despite high-interest rates and challenging market conditions, corporate funding in the sector was the highest in a decade,” said Raj Prabhu, chief executive officer, Mercom Capital Group. “Debt financing also hit a decade high, and venture capital investments and public market financing recorded the second-highest amounts since 2010. Driven by the Inflation Reduction Act, the global focus on energy security, and favorable policies worldwide, solar continues to attract significant investments.”

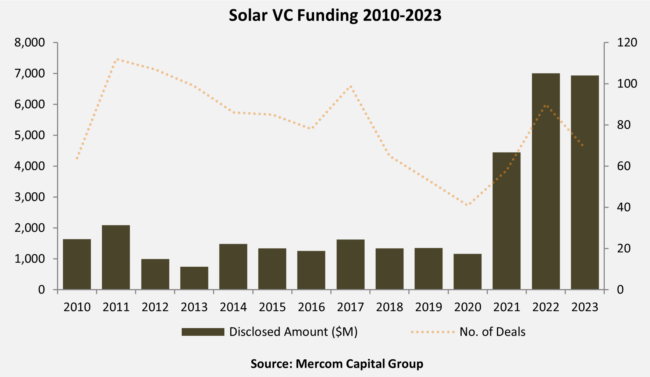

Global venture capital (VC) reached $6.9 billion in 2023, with 26 VC funding deals of $100 million or more in 2023. This was down 1% from the $7 billion raised in 2022.

The largest global VC deal was for 1KOMMA5°, a Germany-based solar installer, which raised $471 million in a Series B funding round.

In the United States, project developer Silicon Ranch announced that it conducted a $600 million equity raise. An initial $375 million in funding closed in December 2022, with an additional $225 million closing in 2023.

Public market financing for 2023 totaled $7.4 billion, up 45% from the 2022 total of $5.1 billion raised.

Debt financing took an even larger leap, growing 67% year-over-year to $20 billion, up significantly from the $12 billion raised in 2022, and the highest amount since 2010. Mercom said securitization activity was a key contributor, adding $3.4 billion over 11 deals.

Mergers and acquisitions (M&A) declined over 2023, with 96 transactions over the year, down from 128 corporate M&A transactions in 2022. The largest transaction was by Brookfield Renewable, which agreed to acquire Duke Energy’s unregulated utility-scale commercial renewables business in the U.S. for approximately $2.8 billion.

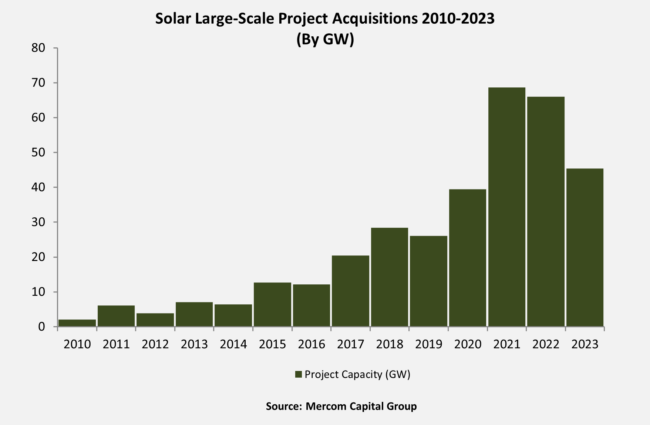

As for project acquisitions, over 45.4 GW of projects were acquired in 2023 across 231 projects. This slowed down from 2022, when 268 projects totaling 66 GW were acquired.

Mytilineos, a Greek industrial conglomerate, acquired 1,410 MW of a solar portfolio from Westbridge Renewable Energy for $1.2 billion. The portfolio included over 1.2 GW of solar capacity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.