The top 10 global solar inverter vendors accounted for 86% of market share in 2022, increasing by 4% year-over-year since 2021, according to a recent study by Wood Mackenzie.

The market grew 48% year-over-year, attributed to the ease in supply chain challenges, coupled by strong government support, as seen in the U.S. with the passage of the Inflation Reduction Act of 2022.

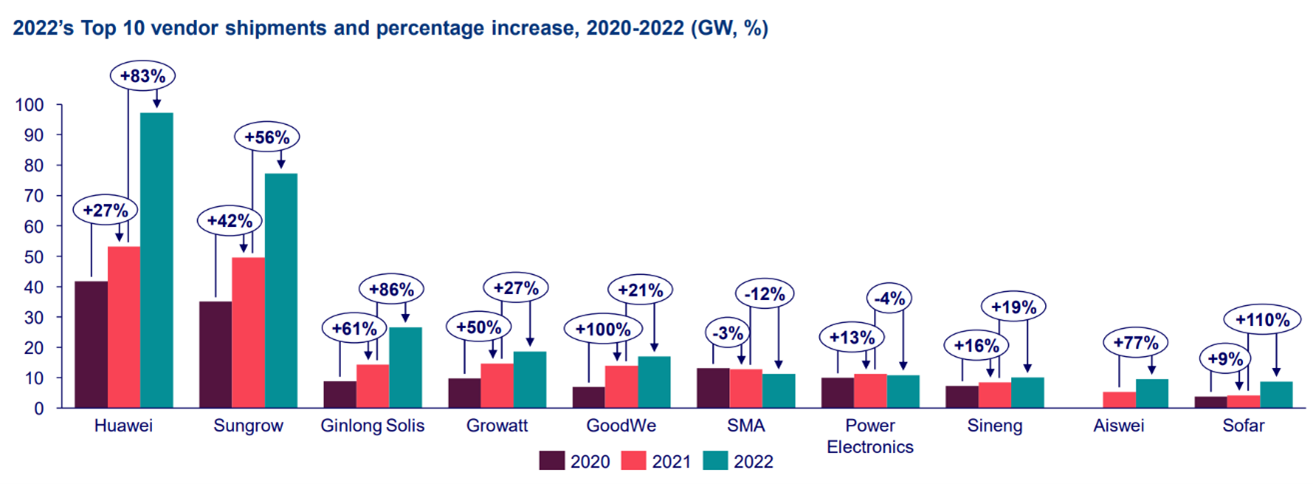

Wood Mackenzie noted that the top five vendors shipped more than 200 GWac and accounted for 71% of total global PV inverter shipments in 2022, up 8% from 2021. The report notes that 2022 top vendor Huawei shipment increased 83%. Ginlong Solis posted growth of 86%.

For the eighth consecutive year, the top two vendors were Huawei and Sungrow. Huawei held the first position with a 29% market share in 2022. Sungrow, winner of the pv magazine award in 2021 and in the “highly recommended” category in 2022, increased its market share two percentage points, from 21% in 2021 to 23% in 2022. Ginlong Solis moved up to third place in 2022, driven by the company’s shipments in China.

The top eight vendors of 2021 were very similar to the lineup in 2022, with only Ginlong Solis and Growatt swapping third and fourth positions from 2021. Aiswei and Sofar jumped up three ranks to enter the top 10 ranking, holding the ninth and tenth positions respectively in 2022. In the APAC region, China led the market with 78% of inverter shipments as solar experienced unprecedented growth. India retained its position as the second largest inverter market in APAC in 2022, but Wood Mackenzie estimates that it had a 25% decrease in shipments year-over-year. Japan had 7 GWac of inverters enter the country, overtaking Australia as the third strongest market with growth of 23% year-over-year growth.

The European region experienced the highest shipment growth with an 82% increase in 2022, following its 44% year-over-year growth in 2021. Wood Mackenzie attributes this to the move toward carbon neutrality by 2050, as part of the European Green Deal plan. Europe accounted for 28% of the global market with 92 GWac shipped.

While the U.S. market is beginning a strong growth trajectory, it accounted for only 13% of the global market with 42 GWac shipped to the country. Solar-plus-storage hybrid inverters made up 10% of the regional shipments as the curtailment of net metering in some markets are leading to a strong energy storage market.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.