Net zero strategies by commercial, industrial and utility counterparties have pushed the rate of solar developments into a new arena as projects become larger and more complex. With new projects supported by state and federal incentives and a higher frequency of extreme weather comes an increased premium for insurance protection.

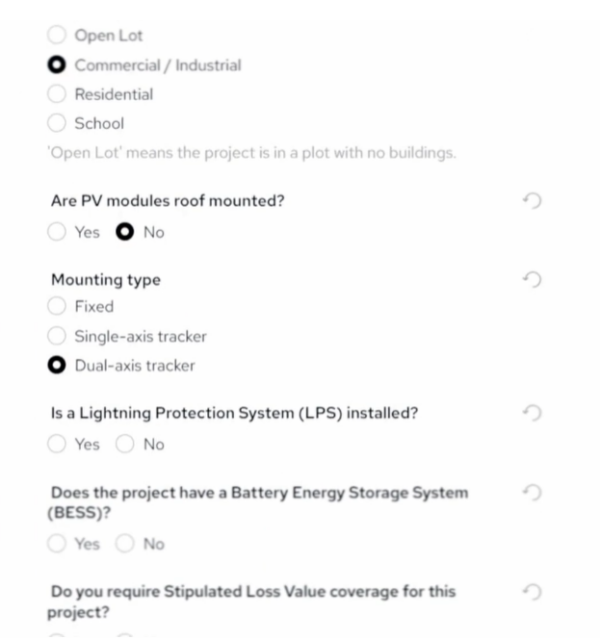

NARDAC Insurance Services, a Newport Beach, California insurance underwriter, announced the launch of its Community Solar platform, an online platform for insuring commercial and industrial-scale solar photovoltaic sites such as community solar projects across the U.S.

Retail clients can access quote and bind to insure “middle market” U.S. commercial and industrial solar projects with limits on replacement cost of $2 million to $20 million per project site location, the company said.

NARDAC’s online platform generates quotes from uploaded underwriting information for each solar site. Initially, operational risks and business interruption coverages will be offered, with plans to expand coverages through 2024, said Hannah Webb, underwriting partner at NARDAC.

NARDAC Insurance Services

“We have designed an efficient solution to underwrite an under-served market segment that is full of entrepreneurial insureds, while lowering the barrier to entry for insurers seeking to actively support the energy transition,” said Jatin Sharma, managing partner, NARDAC. “This innovation will disrupt the U.S. commercial and industrial solar insurance market.”

Insurance products for distributed generation and utility-scale solar have been few and far between since the August 2022 passing of the landmark Inflation Reduction Act, providing a vast gap of coverage for novel products to protect new solar installations. kWh Analytics launched a put insurance product early this year for primarily the utility-scale solar segment.

The lack of insurance products comes amid a heightened frequency of natural catastrophe (NATCAT) losses. According to global insurer SwissRe, insured NATCAT losses were at least 42% higher in 2022 compared to the 10-year average. Losses from Hurricane Ian in September 2022 alone accounted for roughly half of the $115 billion in insured losses for the year.

In the U.S., demand for new renewable energy projects is concentrated largely on the east and west coasts, which coincides with the most severe weather events such as wildfires in the west and hurricanes along the east coast. Financing such projects in more constrained land areas has proven to be more difficult and requiring new insurance and other solutions for assets whose contractual lifetime is often 20 or more years, the company said.

Project finance lending structures are risk averse. According to BloombergNEF, in 2021 around $50 billion was invested in U.S. renewables. Assuming half the financing structure was equity financed, that leaves $25 billion of exposed assets. With a 70% shareholder equity to debt ratio for projects, this leaves leaves lenders to absorb up around $18 billion in annual risk.

Lenders will seek full-limit insurance policies where possible. NARDAC says the reality is that insurers are more reluctant than ever to give full-limit coverage for exposed projects. When full-limit is unavailable, the company’s insurance products can structure standalone NATCAT solutions to bridge the gap.

Formed in August 2020, NARDAC is an employee-owned brokerage firm whose management team has insured 150 GW of renewables assets at previous firms GCube Insurance Services, Lloyds London Insurance and Willis Ltd., as well as project developer Bechtel.

The company’s Community Solar underwriting platform is led by Canopius Syndicate 4444 with a panel of A-rated Lloyd’s and Company Market issuance capacity. Syndicate 4444 is an insurance company managed by Canopius Managing Agents Limited, the ninth-largest global managing agent.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.