kWh Analytics, an insurance provider for zero carbon assets, announced the launch of a property insurance product in partnership with Aspen Insurance. The offering covers physical damage to solar and other renewable energy assets.

A spokesperson for kWh Analytics told pv magazine USA that the product is expected to be primarily used for utility-scale solar assets. The company has a database of over 300,000 operational renewable energy assets informing its property risk assessment capabilities. kWh Analytics has insured over $4 billion in assets to date.

“The shift to a decarbonized economy is the largest macroeconomic revolution of our generation, and insurance will play a critical role in securing its future,” said Jason Kaminsky, chief executive officer of kWh Analytics.

Asset owners have suffered from reduced limits and substantial cost increases in recent years, presenting a need for new solutions to managing and underwriting risk. The new product is aimed at mitigating the risks in a changing market and intensifying climate, enabling financing for new projects.

The property insurance offering joins the company’s solar revenue put production insurance, which protects against downside risk and helps unlock improved financing terms.

In addition to its underwriting services, kWh Analytics leverages its data to develop resilient design practices. Through the evaluation of operational data, the company identifies the most relevant failures in PV asset operations. The findings are incorporated with the new property insurance underwriting and will be distributed to the company’s clients and broadly to manufacturers, operators, carrier partners, and investors to reinforce the further development of sustainable solar projects.

“[The energy transition] requires a new approach to pricing, managing, and ultimately mitigating the new risks of the clean energy asset class, kWh Analytics is committed to underwriting products that enable the financing of renewable assets,” said Kaminski.

Aspen Insurance commended kWh Analytics’ data-driven approach to underwriting. For the year ended 2021, Aspen reported $13.8 billion in total assets, $7.6 billion in gross reserves, $2.8 billion in total shareholders’ equity and $3.9 billion in gross written premiums.

Asset data

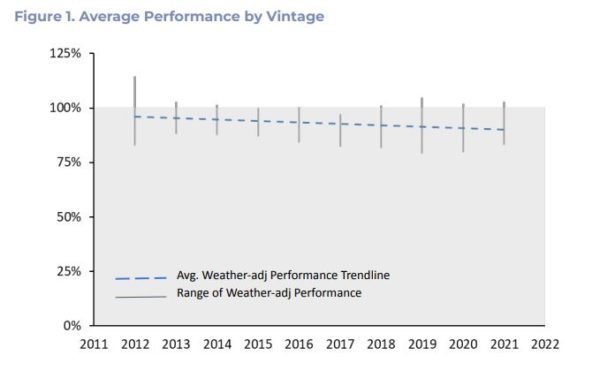

Last month, kWh Analytics shared findings from its operational asset database in a solar generation index report. The study found broad underperformance in the field when compared to forward-looking performance estimates.

On average, projects constructed after 2015 have generated 7% to 13% less electricity than P50 production estimates. P50 means there is a 50% chance in any given year that production will be at least a specific amount. If an array has a P50 production level of 500 kWh, it means that on any given year there is a 50% chance that production will be at least 500 kWh.

The report concluded that as the gap between actual and expected generation grows, underperformance risk jeopardizes investor returns and the industry’s ability to achieve sustainable growth.

The underperformance trend is a nationwide phenomenon, said kWh Analytics. Under 10 years of operational data, average lifetime performance ranged from 5% to 10% below initial P50 estimates across seven major US regions. The report also evaluated system performance based on project capacities and mount types and found no underperformance trends isolated to any specific group of projects.

Formed in 2012, kWh Analytics is based in San Francisco and has raised $26.8 million in equity to date. Its most recent raise in February 2022 brought in $20 million in Series B funding from Lacuna Sustainable Investments.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.