The solar industry is forecast to build as much capacity in the next five years as it has over the previous two decades. As the industry matures, risk assessments support the build out of bankable projects that perform at a high level.

This is the motivation behind the annual kWh Analytics Solar Risk Assessment report, now in its fifth year. In the 2023 report, the firm highlights key risks in extreme weather, finance, and asset operations.

(Read part one: Extreme weather and part two: Financial modeling)

“Mitigation of these risks will be critical to our industry’s shared goal: investment of capital into solar to attain sustainable growth,” said Jason Kaminsky, chief executive officer, kWh Analytics. “Doing so will require industry leaders to continue working together as new environmental, technological, legislative, and economic challenges arise.”

1) Industry losing $2.5 billion annually on equipment underperformance

Raptor Maps analyzed 24.5 GW of operational solar assets, finding $82 million in total losses from equipment issues. Extrapolated to the whole of U.S. solar assets, this equates to a staggering $2.5 billion loss.

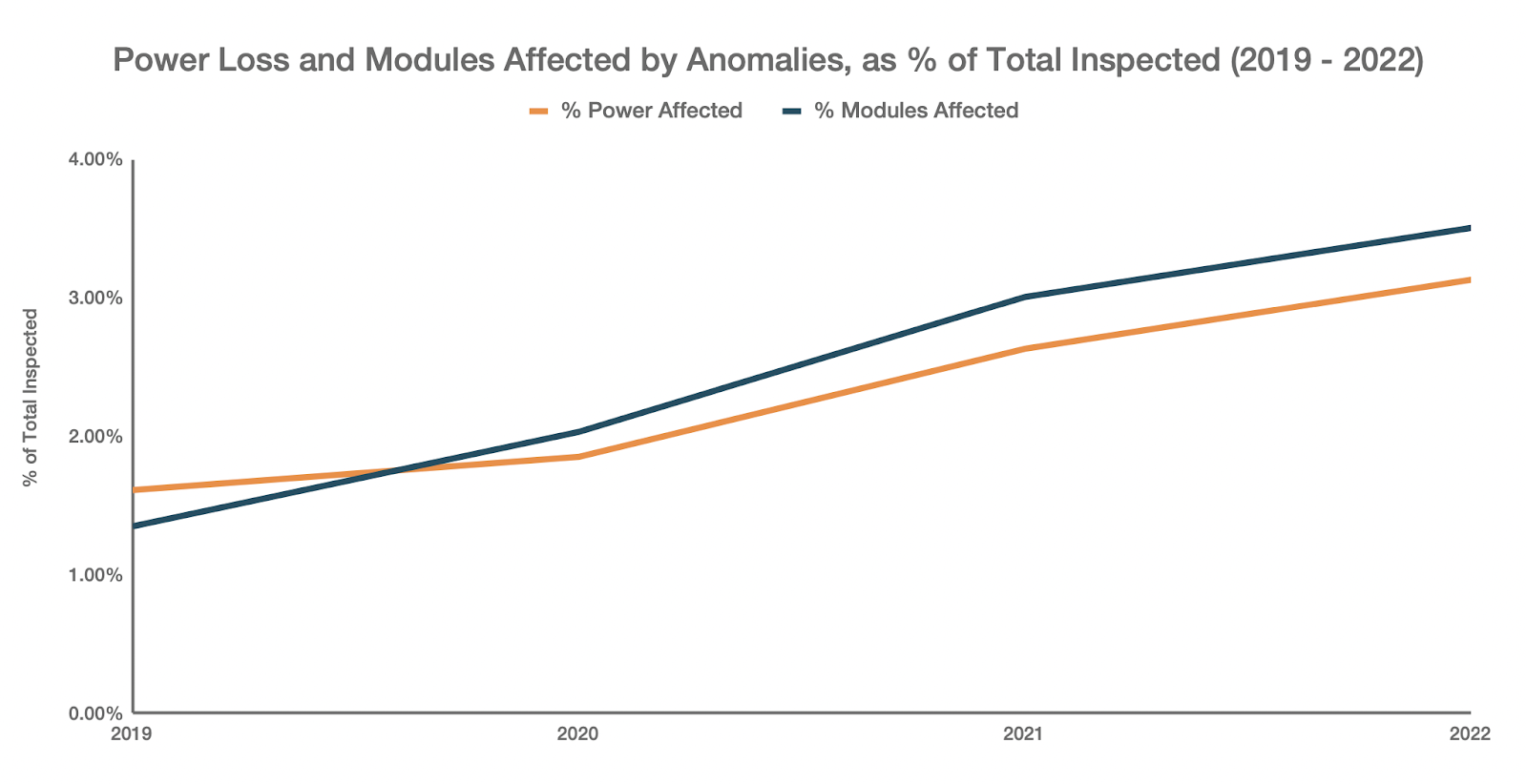

The issue of equipment anomalies was found to occur across projects regardless of size. Raptor Maps said equipment operation anomalies increased 94% since 2019. These events can include extreme weather or equipment malfunctions.

“With solar assets consistently underperforming and competition driving down PPA rates, this growth in power loss could have severe ramifications for the bankability of future projects,” said Raptor Maps.

Large sites have suffered the highest percentage increases affecting power production, with power loss increasing by 336% for 50 MW to 100 MW sites, 243% for 200 MW or more sites, and 168% for 100 MW to 200 MW sites.

“Thus, a standardized and centralized system that collates all relevant data in a digital twin – including inspections, power production, irradiance, and equipment maintenance history – is critical for the solar industry’s reliable growth,” said the company.

2) Hourly data leads to clipping loss errors

Hourly resolution in solar production modeling is still industry standard, but Akanksha Bhat, product manager, Clean Power Research suggests this can be improved. High-resolution, granular solar irradiance resource data reduces clipping loss errors by more than 90% versus hourly data for high DC:AC scenarios.

“Recent research shows that hourly data can overpredict AC energy by 1.5% – 4% annually, depending on the system design and location,” said Bhat. “High DC:AC ratios, a recent trend for new installations, often lead to errors at the high end of this range.”

Higher-resolution products like SolarAnywhere leverage GOES satellite data that offers 5-minute, 500 meter resolutions. Combined with True Dynamics data to capture large, intra-hourly ramp rates and clear-sky exceedance events, Clean Power Research internal testing demonstrated a 90% improvement in clipping loss errors as compared to hourly data.

“Solar developers should consider using site-specific, sub-hourly solar data to get more realistic and data driven P50/P90 energy estimates,” said Bhat. “As the solar market matures, solar developers increasingly need to design systems that cost effectively deliver firm power regardless of the weather.”

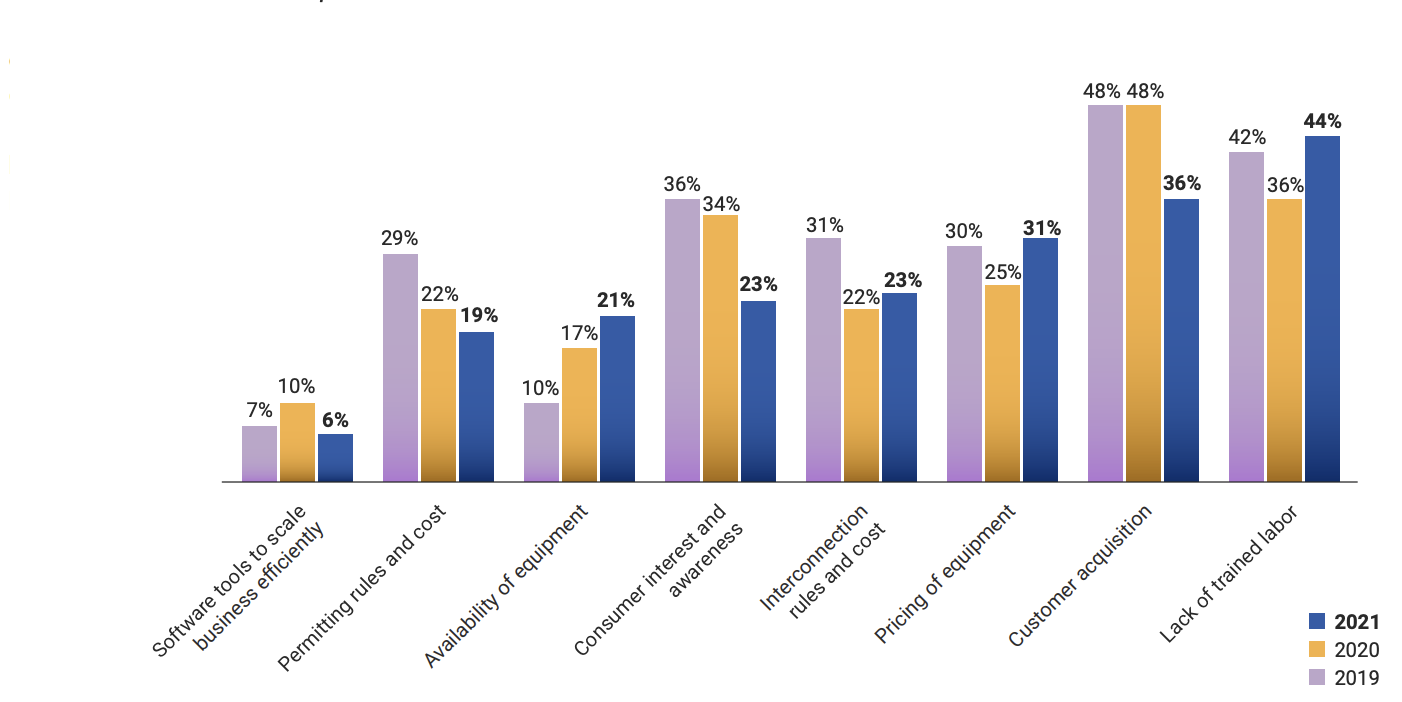

3) 44% of companies noted lack of trained labor as growth bottleneck

In a survey of over 500 solar companies, informational site EnergySage found that 44% of installers reported finding qualified trained labor professionals as a growth bottleneck. Only half as many installers (21%) pointed to the availability of equipment as a barrier to growth.

Solving the labor shortage challenge is not expected to be an easy task, but EnergySage said the Inflation Reduction Act provides a potential roadmap.

“The IRA establishes a precedent that solar companies must play an active role in the training of the next generation of solar installers,” said Spencer Fields, director of insights, EnergySage. “By extending the [Investment Tax Credit] at 30% for another decade (at a minimum), the IRA provides certainty.”

For a third year in a row, installers listed industry experience as their main differentiator from their competitors.

“Those same installers started somewhere: as apprentices or transitioning to solar from adjacent industries. Training – especially certifications and on-the-job training – was paramount to their success in the industry and will be just as important to the success of the next generation of solar contractors as well,” said EnergySage.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.