The U.S. solar industry installed 6.1 GW of capacity in the first quarter of 2023, according to the U.S. Solar Market Insight Q2 2023 report from the Solar Energy Industries Association (SEIA) and Wood Mackenzie.

Several factors contributed to the record first quarter, not the least of which was the surge in demand triggered by the Inflation Reduction Act (IRA) of 2022. But in addition to the surge, projects are beginning to move forward after being delayed due to supply chain challenges that began during the Covid-19 pandemic.

Wood Mackenzie forecasts that the solar market will triple in size over the next five years, amounting to a total installed solar capacity of 378 GW by 2028.

A key component to the IRA is the domestic content adder. In May, the U.S. Department of the Treasury and Internal Revenue Service (IRS) released guidance that provides detailed information about the domestic content bonus under the Inflation Reduction Act. Solar power projects that use domestic content are eligible for the full 30% tax credit can increase their tax credit by an additional 10%, to 40% in total, and 0.3 ¢/kWh for projects that use the Production Tax Credit.

In addition to the tax credits for clean energy developers, the IRA provides incentives for the build out of U.S. manufacturing, and it has effectively stimulated a number of companies to announce the intent to set up domestic manufacturing facilities. The SEIA/Wood Mackenzie report expects that, as a result of the surge in announced manufacturing facilities, domestic module capacity will rise from fewer than 9 GW today to more than 60 GW by 2026. At least 16 GW of module manufacturing facilities are under construction as of the end of Q1 2023.

In addition to the domestic content adder, the IRA specifies adders for energy communities and low-income community projects, intending to drive investments in underserved communities.

“As the Inflation Reduction Act begins to flex its muscle and drive demand, the U.S. solar and storage industry is eagerly awaiting further guidance on some of the most impactful pieces of the law,” said Abigail Ross Hopper, president and CEO of SEIA. “Timely, specific, and workable implementation guidance from the administration will have a major impact on our success in both the near and long-term. This guidance is powerful, and if done correctly, it could unlock new market potential across the country.”

The Q2 Solar Market Insight Report paints a picture of an upward trajectory, but that growth is not without some complexity. First off, navigating the maze of credits within the IRA remains complex and challenging. And secondly, it could take a few years before a full range of U.S.-made solar materials and components are available. The report points to the fact that there currently is no crystalline silicon cell manufacturing in the U.S., although a few manufacturers have announced intentions of doing so, but it will be some time before the facilities are operational.

Michael Parr, executive director of Washington DC-based trade body the Ultra-Low Carbon Solar Alliance, says making polysilicon, wafers, and cells is capital intensive and that is why we are initially seeing so many announcements that are instead about module manufacturing. Any mismatch between U.S. module and cell production capacity would see module makers remain dependent on imported cells for the foreseeable future.

“The U.S. solar industry is slowly starting to see supply chain relief,” said Michelle Davis, head of global solar at Wood Mackenzie and lead author of the report. “At the same time, qualifying for the domestic content adder will be a very complex process for solar project developers. Even once crystalline silicon cell manufacturing is established, many other components will need to be produced domestically before projects can qualify.”

The SEIA/Wood Mackenzie report also notes that the IRA rules leave the residential market without clarity because they don’t specify how adders and credits can be applied. However, the residential market grew 30% over the same quarter last year. The report estimates that the residential segment installed 1.6 GW of solar capacity in Q1 2023, and is on track to add 36 GW of solar over the next five years, growing at an average annual rate of 6%.

Looking at the utility-scale market, it rebounded from a difficult 2022 and installed a record 3.8 GW of capacity. The report points to delayed projects moving forward due to fading supply chain challenges as more module importers were able to satisfy the documentation requirements under the Uyghur Forced Labor Prevention Act (UFLPA).

The commercial market installed a record 391 MW, and is on track for 12% growth in 2023. The only market downturn noted in the report is community solar, which dropped 13%, installing only 212 MW, in large part due to interconnection backlogs.

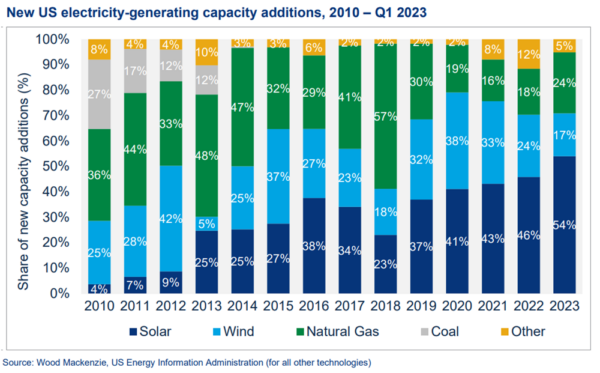

Overall the solar industry accounted for 54% of all new electricity-generating capacity added to the grid in Q1 2023.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.