SunPower, a residential solar development company, added 23,100 customers in the third quarter, while doubling sequential earnings before interest, tax, depreciation and amortization to $33 million.

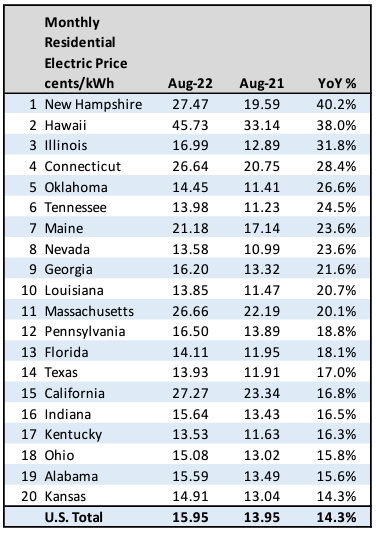

Richmond, California-based SunPower reported on Tuesday a more than 63% year over year increase in financial performance, with Q3 revenue increasing to $470 million from $414 million in Q3 ‘21, while net income increased to $139 million from a $73 million net loss in Q3 ’21. Like other residential solar companies, SunPower continues to see more customers turning to solar as U.S. retail energy prices continue to escalate by 14.3% year over year through August.

For its fiscal year 2022 guidance, SunPower reiterated plans to conclude the year with 73k to 80k customers, while generating $90 million to $110 million in net income.

SunPower highlights

- In September SunPower entered a partnership with IKEA to deliver home solar solutions, starting in Fall 2022 in select markets in California

- In October SunPower signed a collaboration agreement with General Motors to deploy home energy storage systems for residential EV charging that uses bi-directional charging, while SunPower was named GM’s preferred EV charger installer and solar provider.

- In September SunPower made minority investments in Renova Energy and EmPower Solar. As part of its Dealer Accelerator Program, SunPower will provide capital and business support solutions under the two installers’ nationwide dealer network.

- SunPower signed a four-year, nationwide agreement with Dream Finders Homes, a U.S. listed homebuilder, to deploy SPWR PV and storage systems across the homebuilder’s national network, versus an initial agreement that earlier this year started out in Colorado.

With the passage of the Inflation Reduction Act and the solar ITC credit boosted to 30% through 2032, SunPower pointed to the serviceable market for residential solar expanding by 40 to 50 million homes with SEIA and Wood Mackenzie projections citing 7.3 GW of incremental installed capacity to be added on from 2023 to 2027, the equivalent of 900,000 new homes with solar systems.

SunPower cited additional market tailwinds from the IRA, including a 30% new standalone energy storage ITC credit starting in 2023, as well as ITC adders for single-family leases or PPA and multi-family residences, as new sources of customer accretion for the company.

SunPower shares traded at $16.86 today, down from $31.87 a year ago, for a market capitalization of $2.94 billion.

Image: SunPower, EIA data.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Your article failed to mention Sunpower‘s failures in customer service. My power generation is down over 50 % but because Sunpower cannot access its own records prior to 2020 they are not honoring their warranty. Customer service tells me they are doing a database update – – but this has been going on for at least a year, so my electric bill remains high. Their backlog means they can not give adequate service to either new or existing customers. Response to complaints is boilerplate. See better business bureau for example for a list of over 600 complaints.