The Inflation Reduction Act (IRA) may become a transformative document, enabling a grand experiment in energy generation at a national level. A report from Credit Suisse suggests as much. The organization believes that the United States has an opportunity to become a global leader in clean energy, much like it is already in the fossil industry.

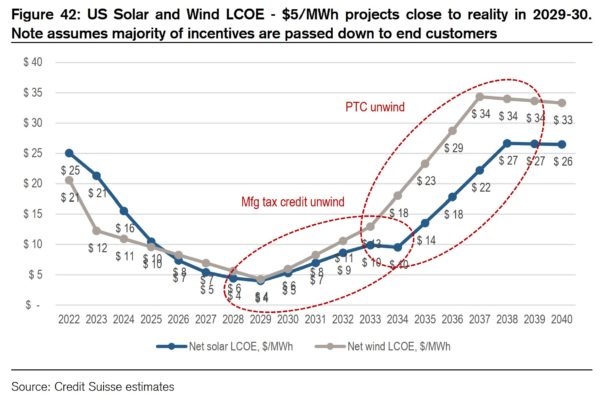

Among the many ideas discussed in the document is a striking prediction – there may be solar power projects whose levelized cost of electricity (LCOE) drops below a penny per kilowatt hour, bottoming around 0.4¢/kWh ($4/MWh) in 2029. We could see these prices as soon as 2025, and they could persist beyond 2030.

If we combine a few data points, we can see how this number is possible – and might even have room to go lower.

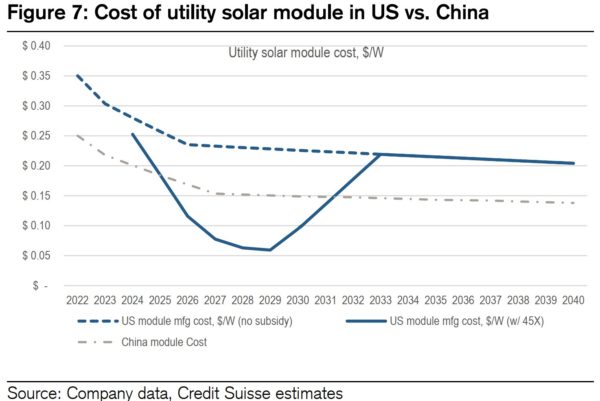

First, the IRA will pay solar panel manufacturers up to 18¢/W when manufacturing modules. Each item along the module supply chain gets a piece – polysilicon, wafers, cells, and modules.

Consider that it has only been a few years since First Solar told Bloomberg that their manufacturing costs were around 20¢/W – with the IRA, they’re on a pathway to a 2¢/W product. Since First Solar has nearly sold out for the upcoming few years, and may not feel enough pressure to reach pricing that low, this author doesn’t expect the most extreme lows to materialize. But according to this report, there are plenty of other solar module manufacturers that could get to an essential cost of 6-10¢/W.

The lowest number could be pushed upward by demand, as some market projections suggest that we could see 100 GW of solar demand by the end of the decade.

The report also suggests that the United States might become a net exporter of solar modules to the global market, while pushing our natural cost of manufacturing modules toward 20¢/W near the end of the 2030s. That is still 33% greater than estimates for China’s estimated costs (per the chart, above).

Second, we have to layer on the Production Tax Credit (PTC). Adjusted for inflation, the PTC is valued at 2.6¢/kWh. For ten years after a project is constructed, the project will receive an inflation adjusted tax credit for every kWh generated. Larger projects tend to take the PTC in lieu of the Investment Tax Credit, mostly due to project scale and capacity factor.

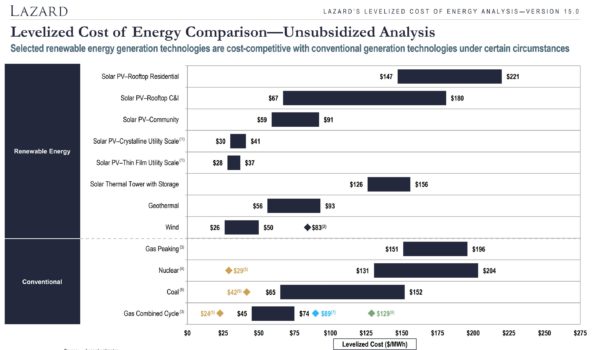

Last year, Lazard suggested that the unsubsidized LCOE of large-scale PV was 3-4.2¢/kWh for crystalline silicon, and 2.8-3.7¢/kWh for thin-film. If subtract out the PTC value, we get an LCOE 0.4-1.6¢/kWh for standard modules, and 0.2-1.1¢/kWh for thin film.

Additionally – we can increase the PTC two times, by about a third (0.87¢/kWh) each time. The first increase will come from modules manufactured with domestic content, and second will come from building solar in energy communities. That hikes the 2.6¢/kWh all the way up to a total of 4.34¢/kWh in PTC for qualifying projects.

When we combine the cheap IRA solar panels with the PTC, we’ll start to see domestic solar power PPAs at 0¢/kWh, sometime in the second half of the decade. PPAs below zero have happened before.

If we take a few minutes to digest that, it becomes clear why Credit Suisse spent over a hundred pages going far beyond just wind and solar in the document. That includes a lot of discussion about cheaply manufactured green hydrogen as well. (Will the hydrogen be produced with $0/kWh solar?) Hydrogen will have its own additional incentive of $3/kg.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

So they’re predicting solar energy to be 0.4¢/KWh in 2029 but then a higher price than right now (2.1¢/KWh) in 2038 (2.7¢/KWh) ? I guess all those prices are already cheaper than fossil fuel energy anyway, even when not considering all the costs due to fossil fuel-created pollution.

But solar is less than 50% of the day, then battery storage is needed for the rest. it takes 300% as much of what a solar array puts out in battery storage, so you need 200% more solar to charge it. Watt per watt, even if solar is $0 after rebates, you still need 300% or more in storage. Solar only puts out power for about 8 hours, so the other 16 hours has to be from stored energy and that requires more solar for storage. Weather it is pumped hydro or battery systems, the infrastructure must be paid for from the tariffs collected from customers. Where a solar panel system may last 25 years, batteries only last 12 years at best so for every solar panel installed, two battery systems will need to be purchased over 25 years. Lithium-Ion batteries cost more watt for watt than solar and wear out twice as fast. Pumped hydro may cost less, but the only extra water would be from de-salination plants and that would take a 5 for 1 ratio of electrical energy to create the fresh water before being pumped on the West Coast. Solar may be 50 cents per watt, but lithium-ion battery storage is $3.50 per watt hour and after the replacement is purchased, it is $7.00 per watt hour over 25 years. Daytime energy may be $0, but nighttime energy will be 15 cents per kilo watt hour, before transmission, for 16 hours a day. This is why natural gas at 5 cents to 7 cents per kilo watt hour is winning.

There is an interesting technology called the Allam Cycle. It can use natural gas and produces a partitioned CO2 stream. They have injected it underground and have seen it deposit over the course of 24 to 48 months. It would be pretty interesting if we can use renewables plus a carbon neutral and potentially carbon negative process for dispatchable production to fill in the gaps.

I’m not sure where you’re getting $3.50/Wh. I built a 14.5KWh lithium (LiFePO4) battery for 17 cents/Wh by buying the cells and BMS and assembling it which by the way, is NOT very hard to do. You can even get pre-built lithium batteries for around 35 cents/Wh. Or you can pay a lot more if you don’t know what you’re doing, just like when buying a lot of things.

Dan, most people cannot build their own system, so, if you use a commercially available systems, pay for permits and have the whole thing installed professionally, including transfer switches and wiring, it is very expensive. Solar installers only use “utility approved” systems that cost 3 to 4 times what one could build a similar system for.

Hi Ed, I agree that paying someone else costs much more but an off-grid system that never sends energy back into the grid doesn’t have to be “utility approved” although it does need to meet whichever version of the NEC your county is using. And even though most people don’t know how to do everything from scratch, there are still a lot of people who can install a kit that comes with instructions and save a good deal that way. There are good kits that come with everything needed so you don’t have to figure anything out yourself. You just supply the labor to install it. I hope you’re enjoying the use of your DIY system. I’m sure enjoying mine. It’s quite cold here now but I haven’t had to run the pellet stove at all – my air heat pump is running totally from solar. I haven’t had to switch over to utility power since I installed the system and it cooled the house during the summer and is now heating it too. I wish my neighbors would do the same because I’m tired of smelling and breathing their wood smoke.

Generation cost is almost immaterial in California where high cost utility PG+E charges 40 cents retail and 49 cents high use for delivered electricity. Union labor and a multitude of subsidy programs paid by consumers makes this energy three to four times as expensive as the national average outside California. Electric cars are not cheaper to operate at these rates.

The IRA/PTCs do NOT lower the cost of producing solar, they merely SHIFT that cost to taxpayers as a whole

There’s no magic free lunch – just taxpayers forced to subsidize the profits of expensive solar products

Fossil fuels are MORE expensive overall. But the true costs are hidden. Fossil fuels are already tax-payer subsidized but should not be, based on the obscene profits of the fossil fuel industry. Fossil fuels will die as clean, renewables take their place. Unfortunately, it will take a lot longer than it should due to the money the fossil fuel industry has to bribe senators and reps every step of the way.