From pv magazine global

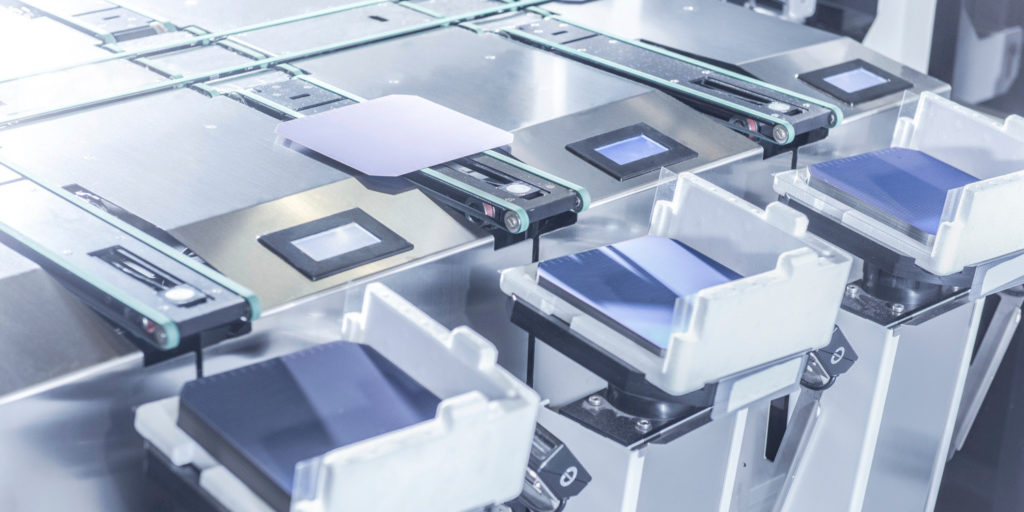

The first fruits of US President Joe Biden‘s Inflation Reduction Act have already been witnessed, with Swiss solar module and production line manufacturer Meyer Burger ramping up its solar panel production plans.

The heterojunction module maker cited the U.S. climate change and health care package as one of the reasons it is accelerating its manufacturing plans, along with a big module order from New York-based developer DE Shaw Renewable Investments. Publishing its first-half results on its website this week, Meyer Burger said the extension of the Investment Tax Credit for solar manufacturing in the United States – which was part of the Inflation Reduction Act – will be worth $0.07 times the nominal power output of each Meyer Burger module produced stateside.

DE Shaw has placed an order for 3.75 GW of the European manufacturer’s panels, to be delivered from 2024 to 2029. It will pay a “substantial annual down payment” to help Meyer Burger fund the production capacity required to meet such delivery requirements.

However, the European company said the U.S. tax incentive and customer deposits will not be sufficient to finance a doubling of its manufacturing capacity to 3 GW per year. The business, headquartered in Gwatt, Switzerland, said it would need a further CHF 250 million ($262.3 million) to add 1.5 GW of production lines at its base in Thalheim, Germany, and 1 GW at its location in Goodyear, Arizona. Details of the fundraising effort will be announced to shareholders “in the next months,” the company said.

Traditionally a solar production equipment supplier, Meyer Burger’s decision to venture into module production has come at a cost to its bottom line as it ramps up its panel-making facilities. First-half revenue leapt from CHF 18 million in the first six months of last year to CHF 56.7 million this time around, with Meyer Burger stating that it was successfully passing on rising input costs to customers.

That led to a widening in net six-month losses, from the CHF 37.2 million shed in January-June 2021 to CHF 41 million. The investment required for module production has seen the company’s cash balance fall from CHF 247 million at the end of last year to CHF 186 million at the end of June. The good news is that DE Shaw has an option to expand its order to up to 5 GW of high-efficiency modules and to extend the length of the supply deal.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It’s a great article. So it really helpful for me.

Thanks for sharing these amazing posts.

Bangladesh national zoo