Since March, the solar industry has reeled from potential tariffs on goods manufactured in Cambodia, Malaysia, Thailand and Vietnam, home to 80% of the nation’s supply of solar panels. Tariff risk on products from the four nations suspected of harboring Chinese goods in alleged violation of anti-circumvention laws exceeded 50% to 250%. It created an untenable level of uncertainty that cascaded into cancelled and delayed projects. The impact was so stark that it led the Solar Energy Industries Association to cut its project deployment forecast in half for the year.

On June 5, the Biden administration announced a 24-month tariff exemption, alleviating some of the near-term supply chain pressures and reopening solar panel supply, for now. Manufactures that halted operations and projects that were considered all but cancelled have now been resumed as a result of the executive order.

Wood Mackenzie said that though this has created clarity for the near-term, tariff implementation is still viewed as “high risk” by tax equity investors despite the two-year pause. The firm said developers should expect to continue to see high costs of capital and high barriers to entry as a result.

The effect of the investigation was exponential, said Wood Mackenize, as weeks of inactivity led to months in delays. Development firms had already begun reallocating machinery and personnel to non-energy projects, leading to a spike in labor shortages for near term projects.

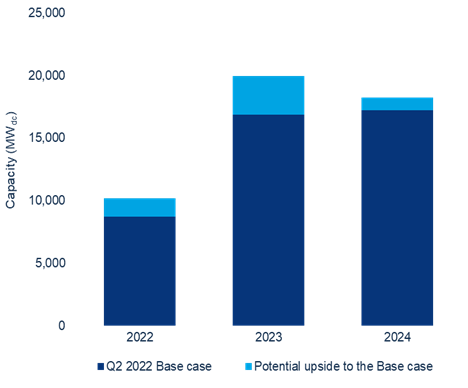

WoodMac said that resuming renegotiations for cancelled and delayed utility-scale solar projects that were pushed to 2023 and 2024 may result in about 30-40% of these projects being installed earlier.

Altogether, the firm offered a modest improvement to its guidance for deployment this year, with an expected 1.5 GW boost, about 17%, to utility-scale solar in 2022, and about a 3 GW increase in deployment projections for 2023.

Image: Wood Mackenzie

Further questions to be answered

There are several questions that remain unanswered for clarity in the near and mid-term for solar deployment. First, there is a possibility that the two-year moratorium on tariffs could come under legal challenges. Recently, a coalition of Republican Senators wrote a letter of concern to the Biden Administration, questioning the use of emergency status to invoke the order.

The senators wrote that the use of an emergency declaration to enact the moratorium was an overreach. They argue that “food, clothing, and medical, surgical, and other supplies for use in emergency relief work,” are the only means for emergency declaration, and that the emergency declaration “translates those words into the language of climate catastrophe.”

However, the summer reliability assessment by the North American Electric Reliability Corporation (NERC) found that vast portions of the Western United States could be subject to widespread blackouts as there is not enough capacity online to serve peak demand, and extreme weather has knocked out numerous centralized transmission wires. NERC described the capacity shortage as “resulting in high risk of energy emergencies.”

It remains to be seen what kind of impact pushback on the two-year moratorium may have.

Another element of uncertainty is the implementation and operation of the Uyghur Forced Labor Prevention Act (UFLPA). WoodMac said the exact mechanisms for implementing the UFLPA will dictate its impact, and much lies in the details of how it is enforced. The UFLPA went into effect on June 21.

To be in compliance with UFLPA, companies must provide a comprehensive supply chain mapping, a complete list of all workers at an entity subject to “rebuttable presumption” that there is a connection to forced labor, and proof that workers were not subject to conditions typical of forced labor practices and are there voluntarily.

Roughly half of the world’s polysilicon supply comes from the Xinjiang region that is under scrutiny for forced labor practices. A list of 20 entities under close attention was released, and several are already under similar scrutiny through Withhold Release Orders (WRO). New entities that were not part of the WRO but are now highlighted in UFLPA include Daqo New Energy and its aliases, Xinjiang East Hope Nonferrous Metals Co., and Heifei Meiling Co.

The Department of Homeland Security’s implementation of the UFLPA will be watched closely to determine what UFLPA may mean for solar panel supply in the near term.

A third element to watch is how the Department of Commerce will rule on the anti-dumping/anticircumvention (AD/CVD) investigation launched by the Auxin Solar petition this August.

WoodMac said developers will want to safe harbor modules without tariffs, but supply is already constrained. The final AD/CVD tariffs will differ by company and change from year to year. This will likely result in higher module pricing to account for these risks.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.