According to the latest edition of Wood Mackenzie’s U.S. energy storage monitor, the country deployed 476 MW of energy storage in Q2, 240% more than was installed in Q2, which just so happened to be the previous quarterly record for installed capacity. That 476 MW mark represents more than 500% year-over-year growth from Q3 2019.

The jump in capacity forced WoodMac to edit the y-axis on it’s deployment graph, producing a pretty funny result:

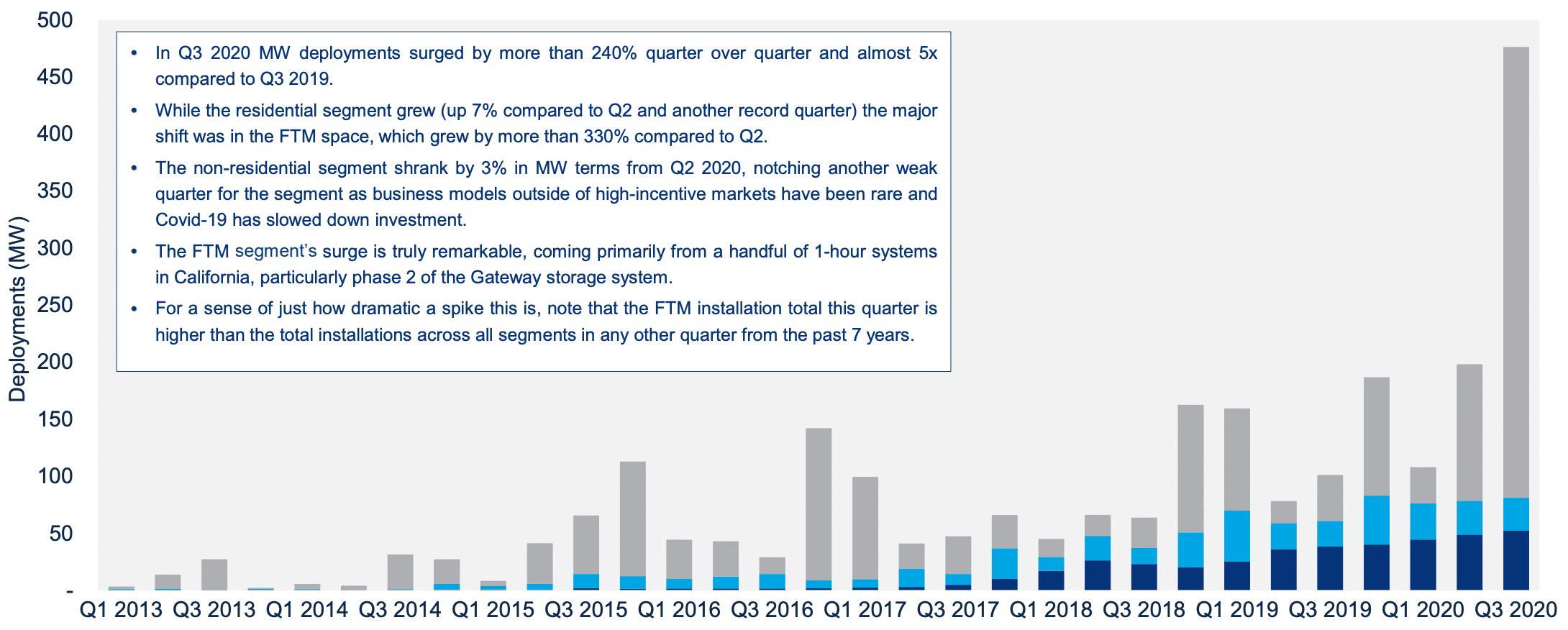

As the graph shows, this exponential capacity increase was driven predominantly by the front-of-the-meter (FTM) market, with that segment alone representing more capacity than the total installations across all segments in any other quarter from the past 7 years.

Beyond MWs

Pure MWs installed, however, are not the main focus of deployed storage, with the other half of the story being told by MWh deployment. What’s interesting here is that, while the 764 MWh deployed in Q3 is a record in its own right, more than doubling the previous record of 378 MWh in Q4 2018, that figure is less than double that of the 476 MW installed, yet most batteries are developed for four-hour charge or discharge.

The answer to this oddity comes from California, where numerous installations were built for only one hour of capacity, though many were also planned or built with the capability to move to four-hours in duration in the future. This phenomenon includes LS Power’s Gateway Energy Storage project, the largest grid battery in the world, clocking in at 230 MW and 230 MWh, with plans to expand to 250 MW/250 MWh.

Just as it was with MW deployed, FTM installations drove this record quarter, with additions growing 475% compared to Q2 and beating the previous FTM record, set in Q1 2017, by nearly 200%.

Outside of the FTM explosion, the residential storage market saw more modest quarter-over-quarter gains of 7% across both MW and MWh deployed, though these gains were still record-setting deployments in their own right.

As has been true with solar, the non-residential storage market has been the hardest hit by the Covid-19 pandemic, shrinking by 3% in MW terms and 10% in MWh terms from Q2 2020.

States and future markets

Potentially the most impressive aspect of Q3’s record deployment figures is that California’s FTM market alone deployed more solar than the entire U.S. has done ins any other quarter in history. In terms of deployment by state, California’s FTM market led the way with 510 MWh, followed by New Jersey at 40 MWh and Arkansas at 10.5 MWh. On the residential side, California led the way again with 39 MWh, followed by Massachusetts at 17 MWh and Hawaii at 11 MWh. For the non-residential segment, surprise, surprise, California topped the rankings at 69 MWh, followed by Hawaii at 20 MWh and Arizona at 3.4 MWh.

According to WoodMac, 2020 is just the start of a tidal wave of storage set to come in the near future. By 2025, the market is set to grow to nearly 7.5 GW in 2025, representing sixfold growth over the projected 1.2 GW set to be installed by the end of 2020.

Alongside this capacity growth, the market is also expected to be a $7.3 billion annual market in 2025, after crossing the $1 billion mark in 2020. It currently sits at $1.4 billion.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.